Decoding the USDINR Chart: Navigating the Indian Rupee’s Journey Towards the Greenback

Associated Articles: Decoding the USDINR Chart: Navigating the Indian Rupee’s Journey Towards the Greenback

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USDINR Chart: Navigating the Indian Rupee’s Journey Towards the Greenback. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the USDINR Chart: Navigating the Indian Rupee’s Journey Towards the Greenback

The Indian Rupee (INR) in opposition to the US Greenback (USD) is a continuously shifting panorama, influenced by a fancy interaction of world and home elements. Understanding the day by day actions depicted on the USDINR chart, significantly on the Nationwide Inventory Change of India (NSE), is essential for buyers, merchants, and anybody with publicity to worldwide markets. This text delves deep into the present dynamics of the USDINR pair, inspecting its current efficiency, the important thing elements driving its fluctuations, and providing insights into potential future tendencies. We’ll keep away from providing particular monetary recommendation, as market predictions are inherently unsure.

Immediately’s USDINR Panorama (Hypothetical, as real-time information adjustments continuously):

Let’s assume, for illustrative functions, that right now’s opening worth for USDINR on the NSE is 82.50. Which means that 1 USD could be exchanged for 82.50 INR. All through the day, this quantity fluctuates primarily based on numerous elements. We would see a excessive of 82.75 and a low of 82.25, reflecting the volatility inherent within the foreign money market. The closing worth, as an instance 82.60, offers a snapshot of the day’s total motion. (Bear in mind, these figures are hypothetical examples; seek the advice of a dwell chart for correct, up-to-the-minute information.)

Components Influencing the USDINR Change Charge:

The USDINR alternate fee is a dynamic indicator reflecting the relative power of the US greenback and the Indian rupee. A number of key elements contribute to its fluctuations:

-

World Financial Situations: World financial development, recessionary fears, and geopolitical instability considerably influence the USDINR fee. A powerful US economic system usually strengthens the greenback, resulting in an appreciation of the USD in opposition to the INR. Conversely, world uncertainty usually drives buyers in the direction of the protection of the US greenback, placing upward strain on the USDINR fee. Latest occasions just like the struggle in Ukraine or world inflation considerably affect this dynamic.

-

US Federal Reserve Coverage: The actions of the US Federal Reserve (the Fed), significantly relating to rate of interest hikes and quantitative easing (QE) packages, play a vital position. Larger rates of interest within the US appeal to overseas funding, growing demand for the greenback and strengthening it in opposition to the INR. Conversely, easing financial coverage can weaken the greenback.

-

Indian Financial Indicators: Home financial elements, equivalent to India’s GDP development fee, inflation, present account deficit (CAD), and overseas alternate reserves, considerably affect the rupee’s worth. Robust financial development and decrease inflation usually strengthen the INR, whereas a widening CAD or depleting foreign exchange reserves can weaken it.

-

Authorities Insurance policies: Authorities insurance policies impacting commerce, overseas funding, and capital controls may affect the USDINR fee. Modifications in import-export rules or tax insurance policies can have an effect on the demand and provide of overseas foreign money, influencing the alternate fee.

-

Hypothesis and Market Sentiment: Market sentiment and hypothesis play a big position in short-term fluctuations. Information stories, analyst predictions, and dealer conduct could cause momentary spikes or dips within the USDINR fee, even within the absence of considerable elementary adjustments.

-

Crude Oil Costs: India is a big importer of crude oil. Larger world crude oil costs enhance India’s import invoice, placing downward strain on the rupee as extra rupees are wanted to buy the identical quantity of oil.

-

Overseas Institutional Investor (FII) Flows: FII investments in Indian markets considerably influence the USDINR fee. Massive inflows of overseas capital strengthen the rupee, whereas outflows weaken it. These flows are sometimes influenced by world market situations and investor sentiment in the direction of the Indian economic system.

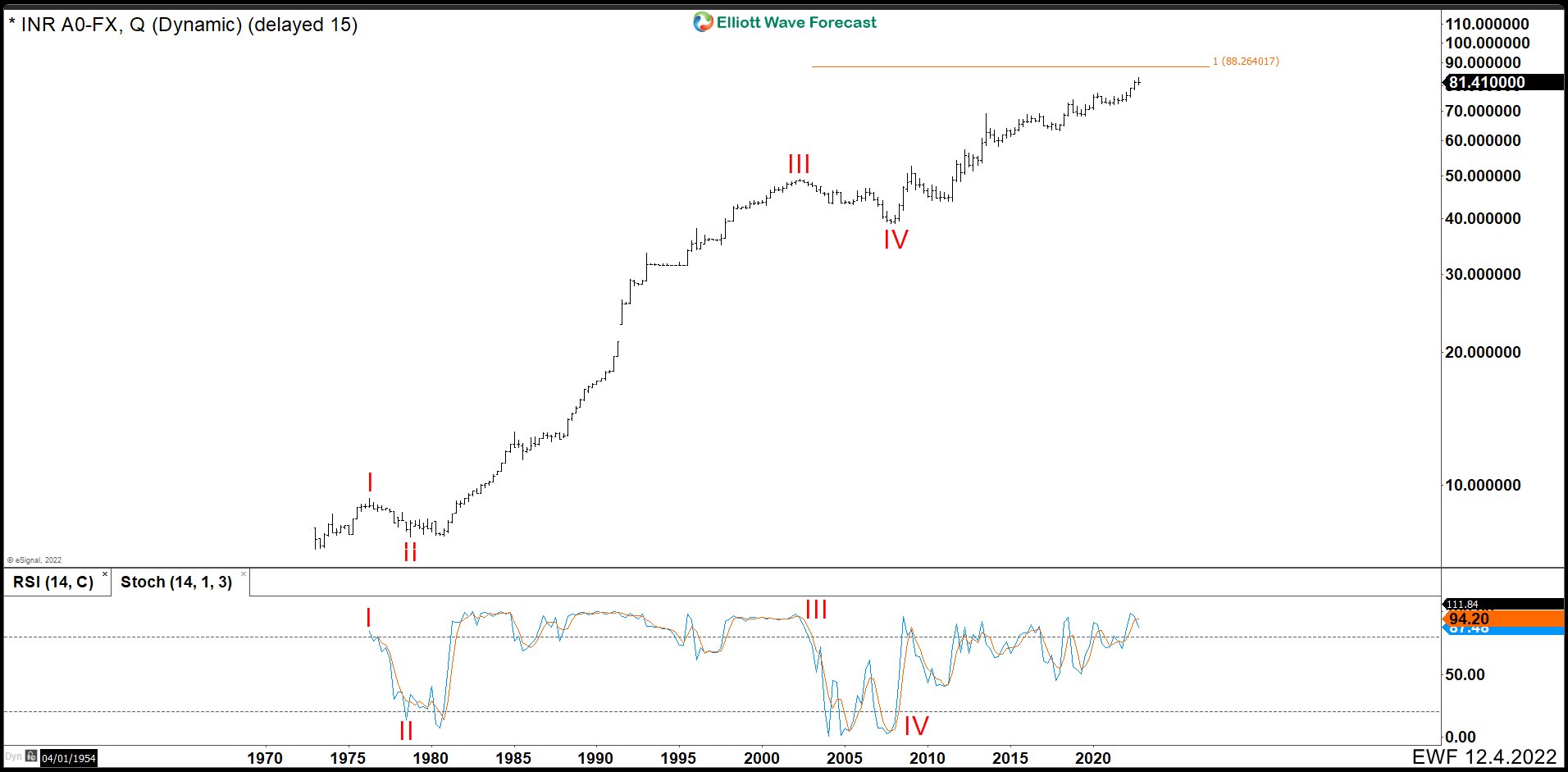

Analyzing the USDINR Chart: Technical and Elementary Evaluation:

Merchants and buyers use numerous methods to research the USDINR chart and predict future actions.

-

Technical Evaluation: This method focuses on historic worth and quantity information to establish patterns and tendencies. Technical analysts use indicators like shifting averages, relative power index (RSI), and candlestick patterns to foretell future worth actions. Help and resistance ranges are essential in figuring out potential turning factors.

-

Elementary Evaluation: This method focuses on macroeconomic elements, inspecting the underlying financial situations of each the US and India. Analysts assess elements like rates of interest, inflation, GDP development, and present account deficits to gauge the relative power of the 2 currencies.

Threat Administration in USDINR Buying and selling:

Buying and selling the USDINR pair includes vital danger. The foreign money market is very unstable, and sudden worth swings can result in substantial losses. Efficient danger administration methods are essential:

-

Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout totally different asset lessons to scale back total danger.

-

Place Sizing: Solely commerce with capital you’ll be able to afford to lose. Keep away from over-leveraging your positions.

-

Cease-Loss Orders: Use stop-loss orders to restrict potential losses. These orders robotically promote your place when the worth reaches a predetermined stage.

-

Hedging: Contemplate hedging methods to mitigate danger, particularly you probably have vital publicity to the USDINR pair.

Conclusion:

The USDINR alternate fee is a fancy and dynamic indicator influenced by a large number of things. Understanding these elements and using efficient analytical and danger administration methods is essential for anybody navigating the Indian foreign money market. Whereas this text offers insights into the dynamics of the USDINR pair, do not forget that predicting future actions with certainty is unattainable. All the time conduct thorough analysis, seek the advice of with monetary professionals, and make knowledgeable selections primarily based in your particular person danger tolerance and funding objectives. The data introduced right here is for academic functions solely and shouldn’t be thought-about monetary recommendation. All the time seek the advice of with a certified monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the USDINR Chart: Navigating the Indian Rupee’s Journey Towards the Greenback. We admire your consideration to our article. See you in our subsequent article!