Decoding At present’s 30-12 months Mortgage Charge Chart: A Complete Evaluation

Associated Articles: Decoding At present’s 30-12 months Mortgage Charge Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding At present’s 30-12 months Mortgage Charge Chart: A Complete Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding At present’s 30-12 months Mortgage Charge Chart: A Complete Evaluation

The 30-year fixed-rate mortgage is the cornerstone of the American dream of homeownership. Its predictability and comparatively lengthy compensation interval make it a preferred alternative for a lot of debtors. Nonetheless, understanding the present panorama of 30-year mortgage charges requires navigating a fancy interaction of financial elements. This text delves deep into at present’s 30-year mortgage price chart, inspecting its present state, the forces shaping it, and what it means for potential homebuyers and owners alike. We can even discover historic context, providing a perspective on the place present charges stand relative to the previous.

(Notice: Because of the dynamic nature of rates of interest, any particular numerical information introduced on this article is topic to alter. Readers ought to seek the advice of up-to-date monetary assets for essentially the most present info.)

At present’s 30-12 months Mortgage Charge Panorama: A Snapshot

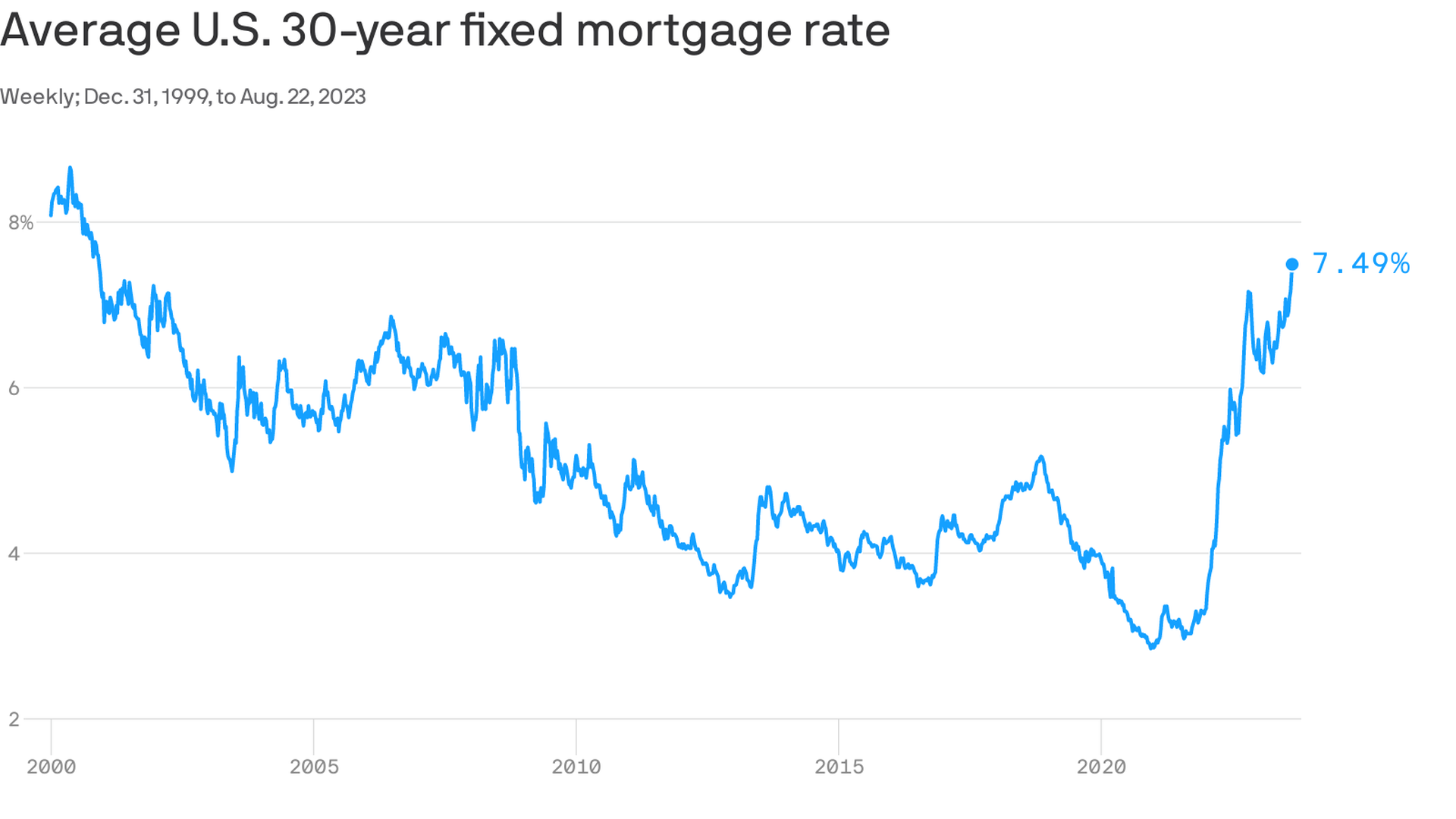

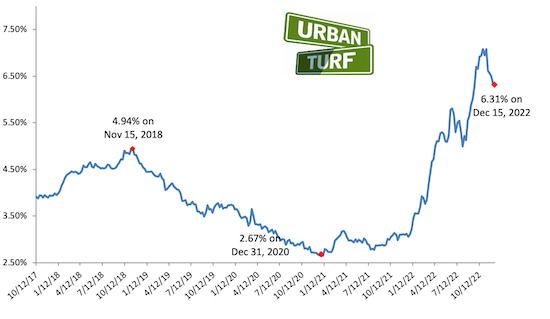

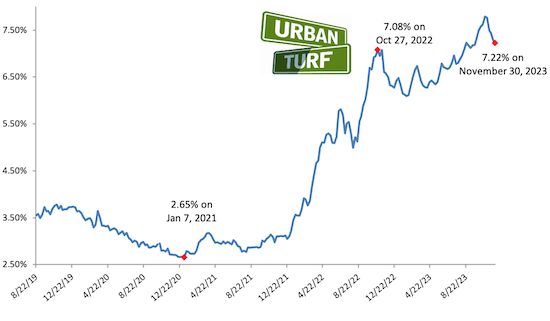

A visible illustration of present 30-year mortgage charges, ideally a chart, can be included right here. This chart would present the speed fluctuations over a selected interval, maybe the final month, three months, or perhaps a yr. The chart ought to clearly label the axes (date and rate of interest share) and embody any related annotations, similar to important financial occasions that will have impacted charges.

The chart would visually exhibit the volatility inherent in mortgage charges. Even small modifications in share factors can considerably impression the general price of a mortgage over its 30-year lifespan. As an illustration, a seemingly small distinction of 0.5% can translate into hundreds of {dollars} in further curiosity paid over the lifetime of the mortgage.

Elements Influencing 30-12 months Mortgage Charges:

A number of interconnected elements affect the day by day fluctuations noticed within the 30-year mortgage price chart. Understanding these elements is essential for making knowledgeable choices about dwelling financing:

-

Federal Reserve Coverage: The Federal Reserve (the Fed) performs a pivotal position in setting rates of interest. By way of its financial coverage instruments, primarily the federal funds price (the goal price banks cost one another for in a single day loans), the Fed influences the general price of borrowing. When the Fed raises the federal funds price, borrowing turns into costlier, resulting in greater mortgage charges. Conversely, reducing the federal funds price usually ends in decrease mortgage charges. The Fed’s actions are sometimes influenced by inflation, unemployment, and total financial development.

-

Inflation: Inflation, the speed at which the final stage of costs for items and companies is rising, is a big issue. Excessive inflation erodes the buying energy of cash, prompting the Fed to boost rates of interest to chill down the economic system and curb inflation. This, in flip, results in greater mortgage charges. Conversely, low inflation permits for decrease rates of interest.

-

Financial Development: A powerful economic system typically results in elevated demand for loans, together with mortgages. This elevated demand can push mortgage charges greater. Conversely, a weak economic system can result in decrease demand and doubtlessly decrease charges.

-

Authorities Bond Yields: The yields on authorities bonds, significantly Treasury bonds, function a benchmark for different rates of interest, together with mortgages. When Treasury yields rise, mortgage charges are inclined to comply with swimsuit. It is because lenders typically base their mortgage charges on the yields they’ll get hold of from investing in authorities bonds.

-

Investor Sentiment and Market Circumstances: Investor confidence and total market circumstances play a big position. Uncertainty available in the market, for instance, stemming from geopolitical occasions or financial downturns, can result in greater mortgage charges as lenders demand greater returns to compensate for elevated threat.

-

Provide and Demand of Mortgages: The supply of mortgages and the extent of demand additionally affect charges. A excessive demand for mortgages with a restricted provide can push charges greater.

Historic Context: A Look Again at 30-12 months Mortgage Charges

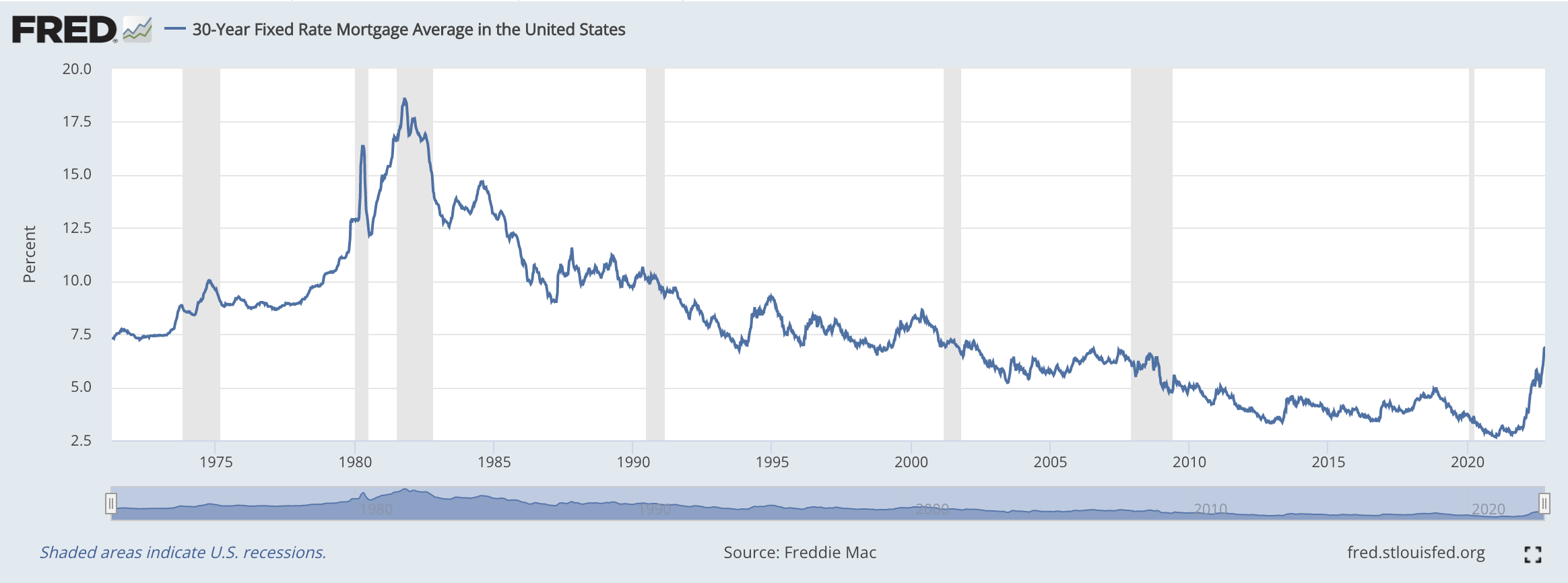

Analyzing historic 30-year mortgage price charts gives worthwhile context for understanding present charges. By inspecting previous traits, we will acquire a greater appreciation for the present price’s place inside a broader historic perspective. A historic chart would ideally illustrate the numerous peaks and troughs in mortgage charges over the previous a number of a long time, highlighting intervals of financial growth and contraction.

For instance, the chart would present the comparatively low charges seen within the early 2000s, adopted by the numerous spike in the course of the 2008 monetary disaster. The next interval would exhibit the gradual decline and subsequent rise in charges resulting in the present setting. This historic perspective permits for a extra nuanced understanding of present market circumstances and helps to keep away from being overly influenced by short-term fluctuations.

Implications for Homebuyers and Owners:

Understanding at present’s 30-year mortgage price chart has important implications for each potential homebuyers and current owners:

-

Homebuyers: Present mortgage charges straight impression affordability. Larger charges imply greater month-to-month funds and a bigger total price of homeownership. Potential homebuyers must fastidiously assess their monetary scenario and affordability earlier than making a purchase order resolution. They need to additionally take into account elements like down fee measurement and mortgage time period to reduce their total price.

-

Owners: For current owners with adjustable-rate mortgages (ARMs), understanding present charges is essential. Modifications within the benchmark rate of interest can straight have an effect on their month-to-month funds. Owners might take into account refinancing their mortgage if present charges are considerably decrease than their current price, doubtlessly saving cash over the remaining mortgage time period. Nonetheless, refinancing includes prices, and it is important to weigh the potential financial savings in opposition to these prices.

Navigating the Complexity: Recommendation for Shoppers

The complexity of the 30-year mortgage price chart will be daunting for the typical client. To make knowledgeable choices, potential homebuyers and owners ought to:

-

Seek the advice of with a Monetary Advisor: A professional monetary advisor can present personalised steering primarily based on particular person monetary circumstances and targets.

-

Store Round for Mortgages: Evaluating charges and phrases from a number of lenders is essential to securing the very best deal.

-

Perceive Mortgage Phrases and Charges: Rigorously overview all mortgage paperwork and perceive all related charges and prices.

-

Monitor Market Tendencies: Staying knowledgeable about financial developments and their impression on mortgage charges can help make well timed choices.

Conclusion:

The 30-year mortgage price chart is a dynamic reflection of the broader financial panorama. Understanding the elements that affect these charges, together with their historic context, is essential for making knowledgeable choices about homeownership. By fastidiously contemplating particular person monetary circumstances, market traits, and searching for skilled recommendation, potential homebuyers and owners can navigate the complexities of mortgage financing and make decisions that align with their long-term monetary targets. Keep in mind, the knowledge offered right here is for common data and shouldn’t be thought-about monetary recommendation. All the time seek the advice of with certified professionals earlier than making any important monetary choices.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding At present’s 30-12 months Mortgage Charge Chart: A Complete Evaluation. We hope you discover this text informative and helpful. See you in our subsequent article!