Decoding Your HDFC Dwelling Mortgage Amortization Chart: A Complete Information

Associated Articles: Decoding Your HDFC Dwelling Mortgage Amortization Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding Your HDFC Dwelling Mortgage Amortization Chart: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding Your HDFC Dwelling Mortgage Amortization Chart: A Complete Information

Securing a house mortgage is a major monetary dedication, and understanding its compensation schedule is essential for efficient monetary planning. HDFC, considered one of India’s main residence mortgage suppliers, supplies debtors with an amortization chart, an in depth breakdown of their mortgage compensation. This chart, usually ignored, is a strong instrument that empowers debtors to trace their progress, anticipate future funds, and make knowledgeable monetary selections. This text will comprehensively clarify HDFC residence mortgage amortization charts, their parts, learn how to interpret them, and their significance in managing your private home mortgage successfully.

What’s an Amortization Chart?

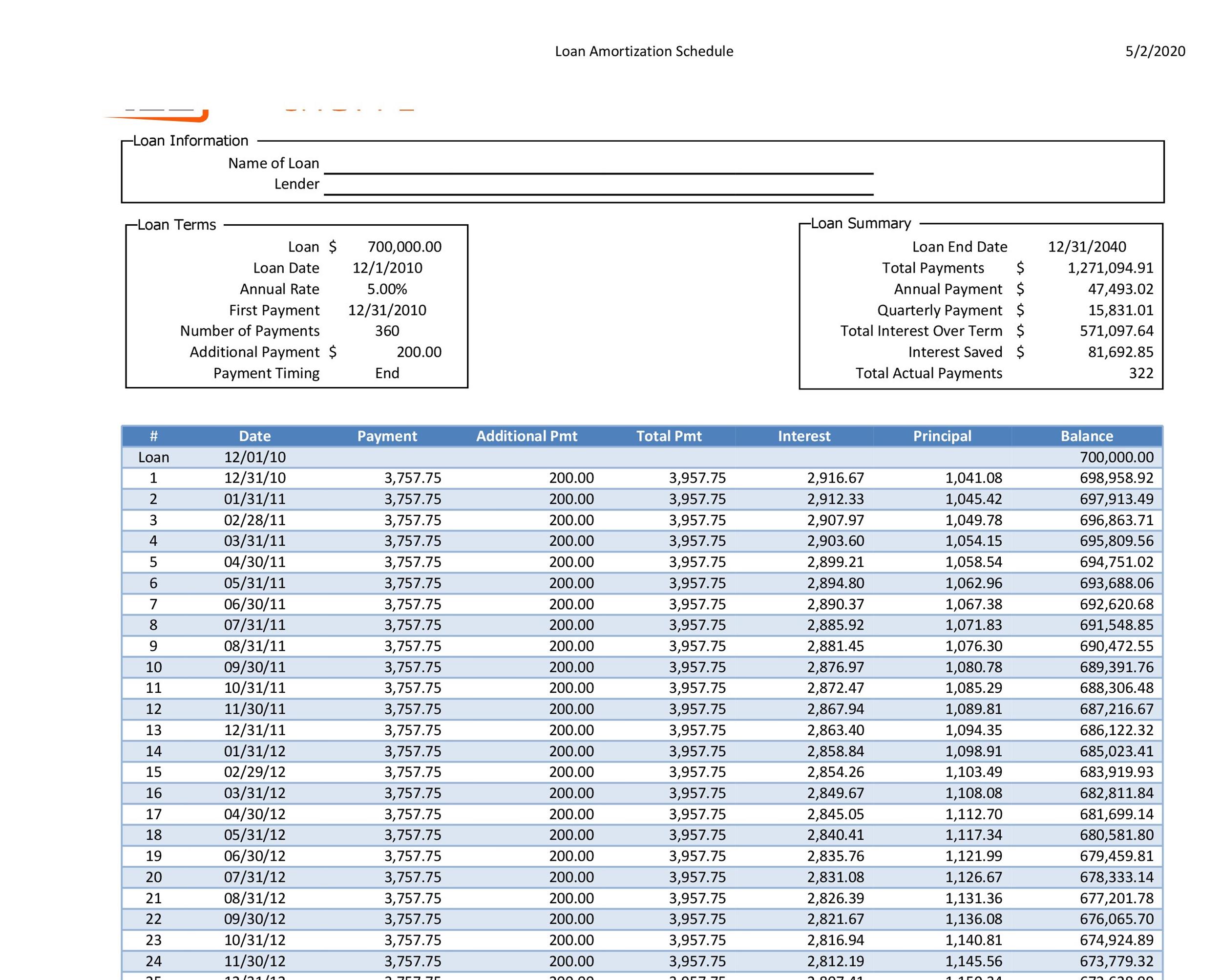

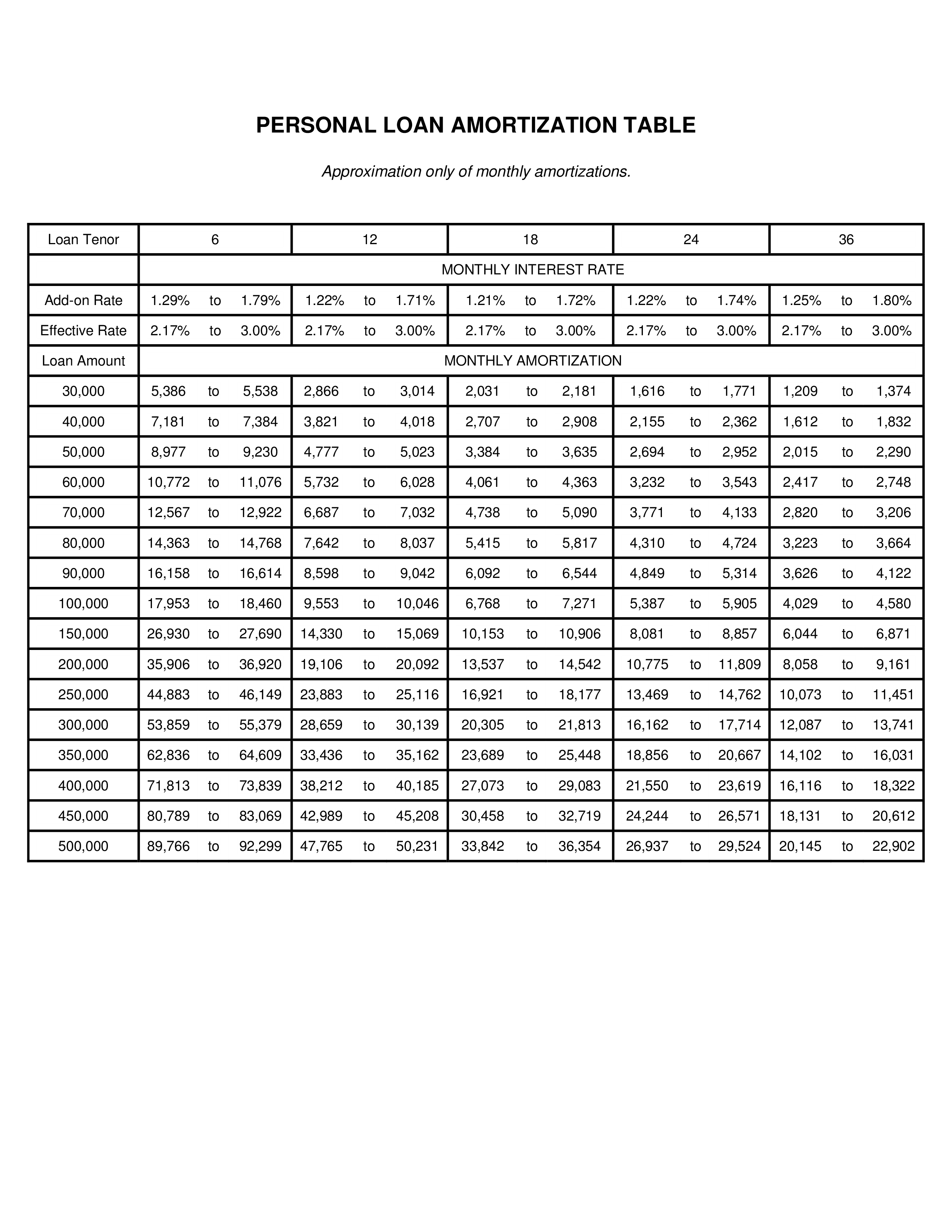

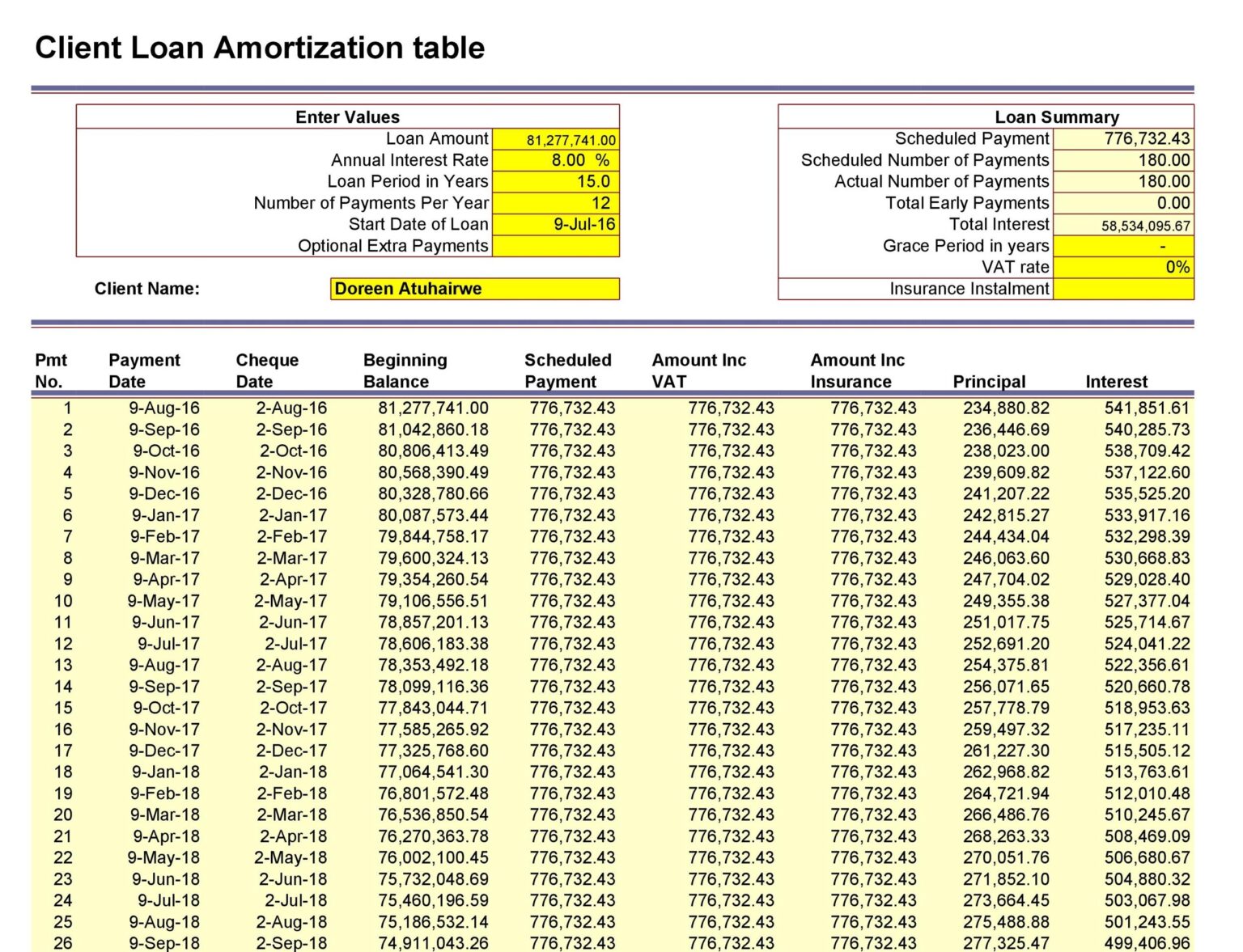

An amortization chart, also called a mortgage amortization schedule, is a desk that itemizes every cost of a mortgage over its complete time period. For an HDFC residence mortgage, this chart exhibits the breakdown of every month-to-month installment (EMI) into principal and curiosity parts. It illustrates how the proportion of principal and curiosity adjustments over time. Within the preliminary levels, a bigger portion of the EMI goes in direction of curiosity cost, whereas the principal compensation progressively will increase because the mortgage tenure progresses.

Key Parts of an HDFC Dwelling Mortgage Amortization Chart:

A typical HDFC residence mortgage amortization chart contains the next key components:

- Mortgage Quantity (Principal): The preliminary quantity borrowed from HDFC.

- Mortgage Tenure: The entire period (in months or years) for which the mortgage is sanctioned.

- Curiosity Charge: The annual rate of interest utilized to the excellent mortgage steadiness. This price will be mounted or floating, relying on the mortgage sort chosen.

- EMI Quantity: The mounted month-to-month installment payable to HDFC. This stays fixed all through the mortgage tenure.

- Cost Quantity: Sequential numbering of every month-to-month cost.

- Starting Steadiness: The excellent mortgage quantity initially of every month.

- Cost in direction of Principal: The portion of the EMI allotted in direction of lowering the principal mortgage quantity.

- Cost in direction of Curiosity: The portion of the EMI allotted in direction of paying the curiosity accrued on the excellent steadiness.

- Ending Steadiness: The remaining excellent mortgage quantity on the finish of every month.

Decoding Your HDFC Dwelling Mortgage Amortization Chart:

Let’s illustrate with an instance. Suppose you will have a ₹50 lakh HDFC residence mortgage with a 20-year tenure at an 8% annual rate of interest. Your amortization chart would present:

- Preliminary months: A good portion of your EMI will probably be allotted in direction of curiosity cost, with a smaller quantity going in direction of principal discount. It’s because the excellent mortgage quantity is excessive initially.

- Mid-term: Because the mortgage tenure progresses, the proportion of principal compensation will progressively improve, whereas the curiosity element decreases. It’s because the excellent mortgage quantity reduces with every cost.

- Closing months: The vast majority of your EMI will probably be devoted to principal compensation, with a smaller portion going in direction of curiosity. By the tip of the mortgage tenure, the excellent mortgage quantity will probably be zero.

The chart lets you visualize this development clearly. You’ll be able to see precisely how a lot of your EMI goes in direction of lowering your debt and the way a lot is being paid as curiosity.

Significance of the Amortization Chart:

Understanding your HDFC residence mortgage amortization chart affords a number of important advantages:

- Monetary Planning: The chart helps you intend your funds successfully by offering a transparent image of your month-to-month bills and the general compensation schedule. You’ll be able to higher allocate your sources and finances accordingly.

- Debt Discount Monitoring: You’ll be able to monitor your progress in lowering your private home mortgage debt. This supplies a way of accomplishment and motivates you to remain on monitor along with your repayments.

- Prepayment Planning: The chart facilitates knowledgeable selections relating to prepayment methods. By analyzing the curiosity element in numerous levels of the mortgage, you possibly can strategically prepay to reduce the full curiosity paid.

- Monetary Forecasting: The chart lets you forecast your future monetary obligations. That is notably useful if you’re contemplating different important monetary commitments like investments or different loans.

- Dispute Decision: In case of any discrepancies in your mortgage assertion, the amortization chart serves as an important doc for verification and dispute decision.

Acquiring Your HDFC Dwelling Mortgage Amortization Chart:

HDFC sometimes supplies the amortization chart to debtors through the mortgage disbursement course of. You may also entry it on-line by means of your HDFC NetBanking account or cellular app. If you cannot discover it, contact your HDFC mortgage officer or customer support for help.

Components Affecting the Amortization Chart:

A number of components affect the main points offered in your HDFC residence mortgage amortization chart:

- Mortgage Quantity: The next mortgage quantity results in larger EMIs and an extended compensation interval.

- Mortgage Tenure: An extended mortgage tenure leads to decrease EMIs however larger general curiosity funds. A shorter tenure results in larger EMIs however decrease general curiosity funds.

- Curiosity Charge: The next rate of interest will increase the full curiosity paid over the mortgage tenure, impacting the EMI quantity and the proportion of principal and curiosity in every cost.

- Prepayments: Any prepayments made will alter the following entries within the amortization chart, lowering the excellent steadiness and doubtlessly shortening the mortgage tenure.

Past the Fundamentals: Superior Functions of the Amortization Chart:

The amortization chart is not only a static doc; it is a dynamic instrument that can be utilized for superior monetary planning:

- Sensitivity Evaluation: You need to use the chart to carry out a sensitivity evaluation by altering the rate of interest or mortgage tenure to grasp the impression in your EMIs and complete curiosity paid. This helps in making knowledgeable selections about mortgage phrases.

- Comparability Purchasing: In case you are contemplating a number of residence mortgage affords from totally different lenders, evaluating their amortization charts permits for a extra complete understanding of the full price of borrowing and helps in deciding on the best option.

- Funding Planning: Understanding your mortgage compensation schedule permits for higher integration of your private home mortgage compensation with different funding methods. You’ll be able to plan your investments to make sure you have enough funds for EMIs whereas nonetheless reaching your monetary objectives.

Conclusion:

The HDFC residence mortgage amortization chart is a worthwhile instrument for managing your private home mortgage successfully. By understanding its parts and using the data it supplies, you possibly can acquire a clearer image of your monetary obligations, plan your funds effectively, and make knowledgeable selections about your private home mortgage compensation. Do not underestimate the facility of this seemingly easy doc; it is the important thing to unlocking monetary readability and peace of thoughts all through your private home mortgage journey. Take the time to completely perceive your chart and use it to your benefit. Bear in mind to at all times seek the advice of with a monetary advisor for customized steerage.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding Your HDFC Dwelling Mortgage Amortization Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!