Decoding Your House Mortgage EMI Chart: A Complete Information

Associated Articles: Decoding Your House Mortgage EMI Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding Your House Mortgage EMI Chart: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding Your House Mortgage EMI Chart: A Complete Information

Shopping for a house is commonly the most important monetary choice of an individual’s life. Understanding the intricacies of your private home mortgage, notably your equated month-to-month installment (EMI) chart, is essential for accountable homeownership. This detailed information will delve into the elements of an EMI chart, its significance, tips on how to interpret it, and tips on how to use it to plan your funds successfully.

What’s an EMI Chart?

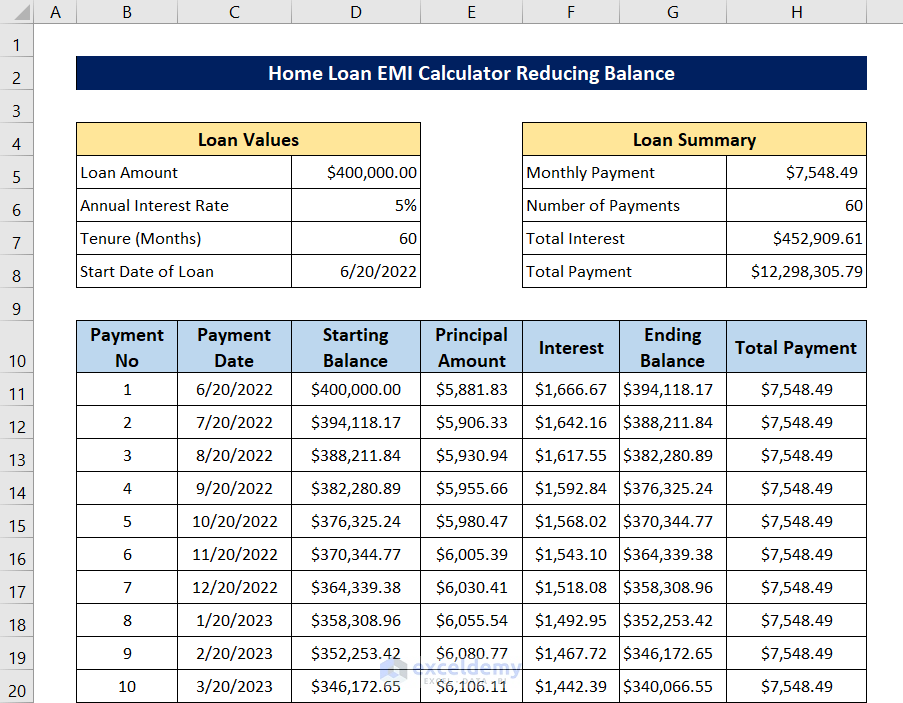

An EMI chart, also referred to as an amortization schedule, is an in depth desk supplied by your lender outlining your month-to-month reimbursement plan in your residence mortgage. It breaks down every month-to-month fee into its principal and curiosity elements, displaying how a lot of your fee goes in the direction of lowering the mortgage’s principal quantity and the way a lot goes in the direction of paying the curiosity accrued on the excellent mortgage stability. The chart sometimes spans the whole mortgage tenure, offering a transparent image of your reimbursement journey.

Key Elements of an EMI Chart:

A typical EMI chart contains the next data for every month of your mortgage tenure:

- Month/Installment Quantity: This means the sequential variety of the installment.

- Starting Stability: The excellent principal mortgage quantity in the beginning of the month.

- EMI Quantity: The fastened month-to-month fee you are obligated to make. This quantity stays fixed all through the mortgage tenure.

- Curiosity Paid: The portion of your EMI allotted to paying the curiosity on the excellent mortgage stability. This part is larger within the preliminary months and step by step decreases over time.

- Principal Paid: The portion of your EMI used to cut back the principal mortgage quantity. This part is decrease within the preliminary months and step by step will increase over time.

- Ending Stability: The remaining principal mortgage quantity on the finish of the month. This represents the excellent mortgage stability after the month-to-month fee.

How is the EMI Calculated?

The EMI calculation includes a system that considers three key elements:

- Mortgage Quantity (P): The whole quantity borrowed from the lender.

- Curiosity Price (r): The annual rate of interest charged on the mortgage, expressed as a month-to-month price (annual price/12).

- Mortgage Tenure (n): The whole reimbursement interval in months.

The system is:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

The place:

- P = Principal Mortgage Quantity

- R = Month-to-month Curiosity Price (Annual Curiosity Price/12/100)

- N = Mortgage Tenure in Months

Whereas the system may appear advanced, most lenders and on-line calculators readily present EMI calculations based mostly in your enter of those three variables.

Decoding Your EMI Chart: A Step-by-Step Information

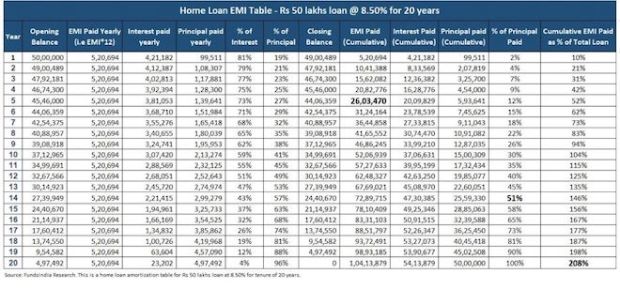

Let’s illustrate with an instance. Suppose you have got a house mortgage of ₹50,00,000 at an annual rate of interest of 8% for a tenure of 20 years (240 months). Your EMI chart would look one thing like this (simplified):

| Month | Starting Stability | EMI (₹) | Curiosity Paid (₹) | Principal Paid (₹) | Ending Stability (₹) |

|---|---|---|---|---|---|

| 1 | 50,00,000 | 41,665 | 33,333 | 8,332 | 49,91,668 |

| 2 | 49,91,668 | 41,665 | 33,278 | 8,387 | 49,83,281 |

| … | … | … | … | … | … |

| 240 | 8,332 | 41,665 | 69 | 41,596 | 0 |

Observations from the Instance:

- Preliminary Months: Discover that within the preliminary months, a bigger portion of your EMI goes in the direction of curiosity fee, and a smaller portion in the direction of principal reimbursement.

- Later Months: Because the mortgage tenure progresses, the proportion of principal reimbursement will increase, whereas the curiosity fee decreases. It’s because the excellent mortgage stability reduces every month.

- Ultimate Month: By the top of the mortgage tenure, the whole principal quantity is repaid, and the ultimate EMI would possibly barely range as a result of rounding off.

The Significance of Understanding Your EMI Chart:

- Monetary Planning: The EMI chart permits you to monitor your progress in the direction of mortgage reimbursement and ensures you stay on price range. You’ll be able to plan your month-to-month bills accordingly, factoring in your EMI dedication.

- Prepayment Technique: Understanding the curiosity and principal elements helps you make knowledgeable selections about prepaying your mortgage. Prepaying strategically can prevent important curiosity prices.

- Debt Administration: The chart gives a transparent overview of your debt trajectory, serving to you handle your general monetary well being.

- Funding Choices: Realizing your EMI obligations permits higher allocation of your monetary sources in the direction of different investments and financial savings targets.

- Budgeting and Emergency Planning: The constant EMI quantity helps you price range precisely and put together for potential monetary emergencies.

Elements Affecting Your EMI Chart:

A number of elements affect your EMI chart and the general mortgage reimbursement:

- Curiosity Charges: Fluctuations in rates of interest can affect your EMI, although sometimes fixed-rate loans keep a relentless EMI. Floating-rate loans, nonetheless, can see EMI modifications based mostly on market rate of interest changes.

- Mortgage Tenure: An extended mortgage tenure ends in decrease EMIs however larger general curiosity funds. A shorter tenure results in larger EMIs however decrease general curiosity prices.

- Mortgage Quantity: A bigger mortgage quantity interprets to larger EMIs, whereas a smaller mortgage quantity ends in decrease EMIs.

- Prepayment: Prepaying your mortgage reduces the excellent principal, resulting in a decrease curiosity burden in subsequent months and doubtlessly shortening the mortgage tenure.

Utilizing Your EMI Chart for Efficient Monetary Planning:

- Monitor your progress: Commonly evaluate your EMI chart to observe your reimbursement schedule and make sure you’re on monitor.

- Plan for contingencies: Consider potential surprising bills and guarantee you have got a buffer to cowl your EMI even throughout monetary setbacks.

- Discover prepayment choices: Take into account prepaying your mortgage strategically, particularly when you have got surplus funds, to cut back your curiosity burden.

- Keep away from delays: Missed or delayed EMI funds can negatively affect your credit score rating and entice penalties.

- Seek the advice of a monetary advisor: When you have questions or considerations about your EMI chart or residence mortgage reimbursement technique, seek the advice of a monetary advisor for customized steerage.

Conclusion:

Your private home mortgage EMI chart is greater than only a desk of numbers; it is a roadmap to your monetary future. Understanding its elements, deciphering its information, and utilizing it strategically can considerably affect your monetary well-being. By fastidiously analyzing your EMI chart and planning your funds accordingly, you’ll be able to efficiently navigate the journey of homeownership and obtain your monetary targets. Keep in mind to at all times keep knowledgeable, plan forward, and search skilled recommendation when wanted to make sure a clean and stress-free residence mortgage reimbursement expertise.

Closure

Thus, we hope this text has supplied priceless insights into Decoding Your House Mortgage EMI Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!