Deconstructing the Invesco QQQ Belief (QQQ) Inventory Value Chart: A 20-12 months Perspective

Associated Articles: Deconstructing the Invesco QQQ Belief (QQQ) Inventory Value Chart: A 20-12 months Perspective

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Deconstructing the Invesco QQQ Belief (QQQ) Inventory Value Chart: A 20-12 months Perspective. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Deconstructing the Invesco QQQ Belief (QQQ) Inventory Value Chart: A 20-12 months Perspective

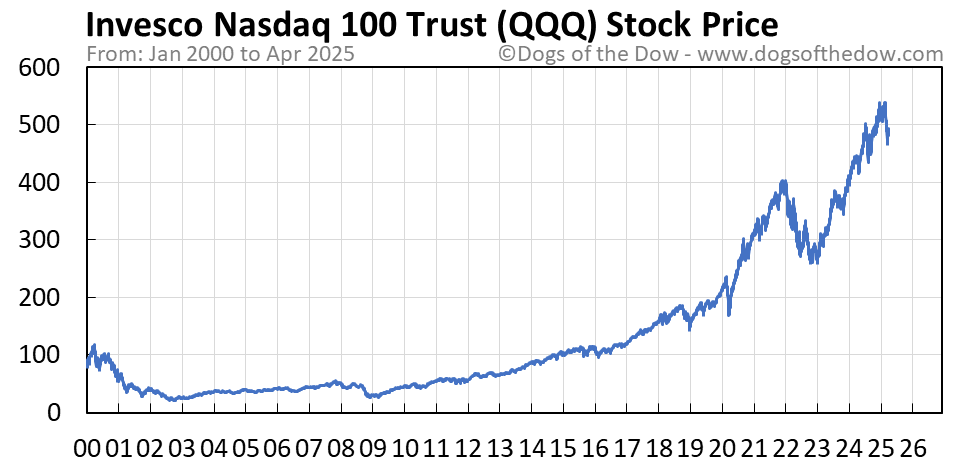

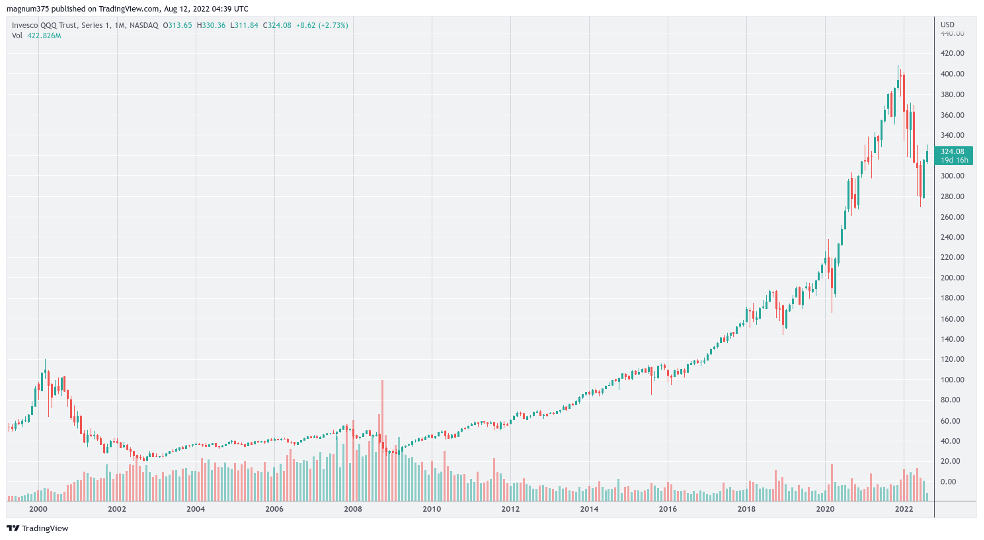

The Invesco QQQ Belief (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index contains 100 of the most important non-financial firms listed on the Nasdaq Inventory Market, making QQQ a preferred proxy for the know-how sector and a big barometer of general market sentiment. Analyzing the QQQ inventory value chart over the previous twenty years reveals fascinating insights into market cycles, technological innovation, and the impression of macroeconomic occasions. This text delves right into a complete evaluation of the QQQ chart, exploring its key developments, important occasions, and implications for buyers.

The Early Years (2003-2007): A Bull Market Fueled by Tech

The early 2000s noticed QQQ emerge from the dot-com bust, albeit tentatively. The chart from 2003 to 2007 exhibits a gradual however constant upward pattern, reflecting the restoration of the know-how sector and the broader market’s optimism. This era witnessed the rise of giants like Google, Apple, and Microsoft, all important parts of the Nasdaq-100. The chart reveals comparatively low volatility in comparison with subsequent durations, punctuated by minor corrections that had been rapidly absorbed by the prevailing bullish sentiment. Buyers who held QQQ throughout this time loved substantial good points, pushed by robust company earnings and technological developments. Nevertheless, the seeds of the 2008 monetary disaster had been already being sown, a reality not readily obvious on the chart on the time.

The 2008 Monetary Disaster and its Aftermath (2007-2010): A Brutal Correction

The 2008 monetary disaster dramatically altered the trajectory of the QQQ chart. The subprime mortgage disaster triggered a world recession, resulting in a pointy and swift decline within the worth of QQQ. The chart vividly illustrates this collapse, with a big drop reflecting the widespread panic and uncertainty within the monetary markets. The know-how sector, regardless of its relative resilience in comparison with another sectors, was not resistant to the contagion. The next restoration was gradual and uneven, marked by durations of consolidation and additional declines earlier than a sustained upward pattern started to emerge. This era highlights the inherent threat related to investing in even seemingly steady property like QQQ, demonstrating the susceptibility of even know-how giants to macroeconomic shocks. The chart throughout this time serves as a stark reminder of the significance of diversification and threat administration in funding portfolios.

The Publish-Disaster Restoration and the Rise of the FAANGs (2010-2020): A Decade of Exponential Progress

The interval from 2010 to 2020 marked a exceptional restoration and sustained development for QQQ. The chart showcases a formidable upward trajectory, pushed largely by the outstanding success of the FAANG shares (Fb, Apple, Amazon, Netflix, and Google). These firms, all main constituents of the Nasdaq-100, benefited from the proliferation of cellular know-how, the rise of e-commerce, and the rising adoption of cloud computing. The chart throughout this era reveals a number of important pullbacks, however every correction proved to be a brief setback within the general upward pattern. This period demonstrates the ability of long-term funding in high-growth firms and the potential for important returns in a positive macroeconomic surroundings. Nevertheless, the comparatively clean upward pattern additionally masked the rising valuations of many tech firms, setting the stage for the following chapter.

The Pandemic and Past (2020-Current): Volatility and Re-evaluation

The COVID-19 pandemic initially despatched shockwaves by the market, inflicting a pointy drop in QQQ’s value. The chart displays this volatility, with a dramatic decline adopted by an much more dramatic and speedy restoration. This restoration was fueled by elevated demand for know-how services and products throughout lockdowns, in addition to unprecedented financial stimulus from central banks. Nevertheless, the next interval has been marked by elevated volatility, pushed by elements reminiscent of inflation, rising rates of interest, and geopolitical uncertainty. The chart displays this uncertainty, with durations of each important good points and losses. This era highlights the significance of understanding and adapting to quickly altering market circumstances. The rising deal with ESG (environmental, social, and governance) elements additionally performs a big position in shaping the QQQ chart, influencing investor sentiment and company methods.

Technical Evaluation of the QQQ Chart:

Analyzing the QQQ chart utilizing technical indicators gives additional insights. Shifting averages (e.g., 50-day, 200-day) may also help determine developments and potential assist and resistance ranges. Relative Power Index (RSI) can gauge momentum and potential overbought or oversold circumstances. Quantity evaluation can present extra context to cost actions. By combining these technical indicators with elementary evaluation of the underlying firms, buyers can develop a extra complete understanding of the QQQ’s value motion and potential future actions. Nevertheless, it is essential to keep in mind that technical evaluation just isn’t foolproof and must be used at the side of different types of market analysis.

Basic Evaluation of QQQ’s Parts:

The efficiency of QQQ is intrinsically linked to the monetary well being and development prospects of its underlying firms. Analyzing the monetary statements, aggressive panorama, and administration groups of those firms is essential for understanding the long-term outlook for QQQ. Elements reminiscent of income development, profitability, innovation, and market share all play a big position in figuring out the longer term trajectory of the ETF. Recurrently reviewing the composition of the Nasdaq-100 index and assessing the efficiency of its particular person constituents is crucial for knowledgeable funding selections.

Conclusion:

The Invesco QQQ Belief (QQQ) inventory value chart gives a captivating case research of market dynamics and the interaction between technological innovation and macroeconomic forces. From the restoration after the dot-com bust to the turbulence of the 2008 monetary disaster and the next rise of the FAANGs, the chart provides worthwhile classes for buyers. Understanding the historic developments, key occasions, and technical indicators related to QQQ can contribute considerably to knowledgeable funding selections. Nevertheless, it is essential to keep in mind that previous efficiency just isn’t indicative of future outcomes, and investing in QQQ, like another asset, carries inherent threat. A complete funding technique that comes with diversification, threat administration, and a radical understanding of each technical and elementary evaluation is crucial for navigating the complexities of the market and maximizing long-term returns. Repeatedly monitoring the QQQ chart, alongside a broader understanding of the know-how sector and the worldwide economic system, is essential for staying forward of the curve and making knowledgeable funding decisions.

Closure

Thus, we hope this text has offered worthwhile insights into Deconstructing the Invesco QQQ Belief (QQQ) Inventory Value Chart: A 20-12 months Perspective. We admire your consideration to our article. See you in our subsequent article!