is the qqq the identical chart because the futures nq

Associated Articles: is the qqq the identical chart because the futures nq

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to is the qqq the identical chart because the futures nq. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

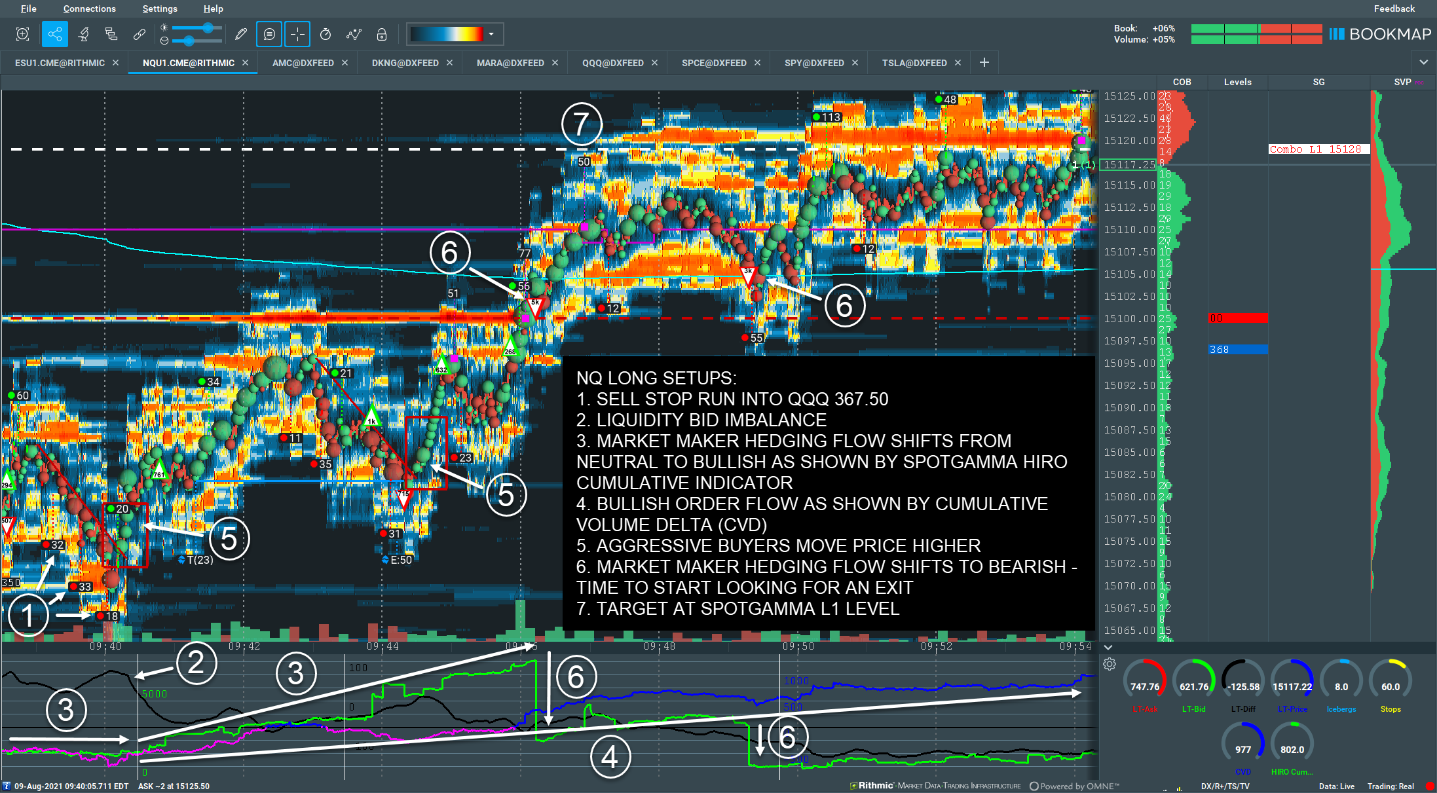

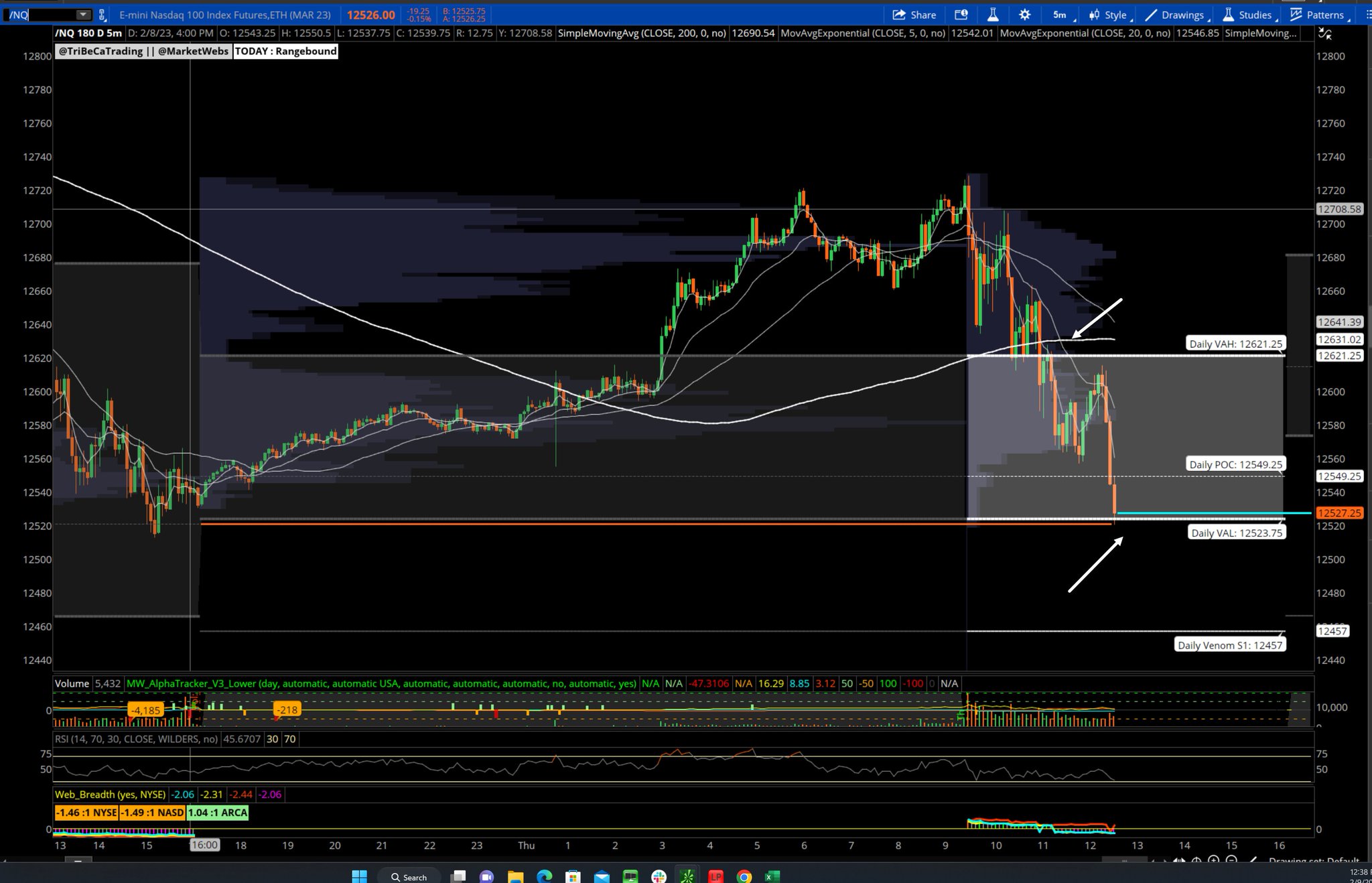

Decoding the Relationship: QQQ vs. NQ Futures – Are They the Identical Chart?

The Invesco QQQ Belief (QQQ) and the Nasdaq-100 E-mini futures contract (NQ) are each broadly used devices for buying and selling the Nasdaq-100 index. Whereas they each monitor the identical underlying index, the refined but vital variations between them make it inaccurate to say they share the precise similar chart. Understanding these variations is essential for traders and merchants to make knowledgeable choices and keep away from potential pitfalls. This text delves deep into the nuances of QQQ and NQ futures, evaluating their traits, value habits, and suitability for various buying and selling methods.

Understanding the Underlying Asset: The Nasdaq-100 Index

Each QQQ and NQ futures derive their worth from the Nasdaq-100 index, a market-capitalization-weighted index comprising 100 of the biggest non-financial firms listed on the Nasdaq Inventory Market. This index is a benchmark for the know-how sector and consists of giants like Apple, Microsoft, Amazon, and Google. The composition of the index is commonly reviewed and adjusted, making certain it displays the present market panorama. This underlying index is the widespread thread that hyperlinks QQQ and NQ, however the way in which every instrument represents it differs considerably.

QQQ: An Trade-Traded Fund (ETF)

QQQ is an exchange-traded fund that goals to trace the efficiency of the Nasdaq-100 index. It is a passively managed fund that invests in the identical shares because the index, proportionally to their weight. Which means if Apple constitutes 10% of the Nasdaq-100, QQQ can even maintain roughly 10% of its property in Apple inventory.

Key Traits of QQQ:

- Buying and selling like a inventory: QQQ trades on exchanges like a daily inventory, with costs decided by provide and demand.

- Steady buying and selling: Buying and selling happens all through the common inventory market hours.

- Dividends: QQQ distributes dividends to its shareholders based mostly on the dividends acquired from its underlying holdings.

- Transaction prices: Shopping for and promoting QQQ entails brokerage commissions and doubtlessly slippage (the distinction between the anticipated value and the precise execution value).

- Liquidity: Typically extremely liquid, making it simple to purchase and promote massive portions.

- Worth discovery: Worth is set by the market’s collective evaluation of the underlying property.

- Regulatory oversight: Topic to SEC rules for ETFs.

NQ Futures: A Spinoff Contract

NQ futures are spinoff contracts that obligate the customer to buy (or the vendor to promote) a specified variety of Nasdaq-100 index models at a predetermined value on a future date. Not like QQQ, which instantly owns the underlying property, NQ futures characterize a contract to purchase or promote the index at a future level.

Key Traits of NQ Futures:

- Margin buying and selling: Futures buying and selling requires a margin deposit, a fraction of the contract’s complete worth. This enables for leveraged buying and selling, amplifying each income and losses.

- Leverage: Using margin considerably magnifies returns but additionally will increase danger.

- Expiration dates: NQ futures contracts have particular expiration dates, sometimes month-to-month, quarterly, and yearly. This implies the contract have to be settled (both by supply or money settlement) on the expiration date.

- Every day value limits: To stop extreme value volatility, exchanges usually impose each day value limits on futures contracts. If the value reaches the restrict, buying and selling could also be halted briefly.

- Transaction prices: Futures buying and selling entails commissions and charges, however they are often decrease than inventory buying and selling charges relying on the dealer.

- Liquidity: Extremely liquid, particularly close to expiration dates.

- Worth discovery: Worth is influenced by elements past the underlying index, together with hypothesis and hedging actions.

- Regulatory oversight: Topic to the Commodity Futures Buying and selling Fee (CFTC) rules.

Why Aren’t Their Charts An identical?

Whereas each devices monitor the Nasdaq-100, their charts will not be similar attributable to a number of elements:

- Leverage: The inherent leverage in NQ futures contracts considerably amplifies value actions in comparison with QQQ. A small proportion change within the Nasdaq-100 can result in a a lot bigger proportion change within the NQ futures value.

- Expiration dates: The worth of NQ futures contracts converges in direction of the spot value of the Nasdaq-100 because the expiration date approaches. This "convergence" creates a novel value dynamic not current in QQQ.

- Margin calls: In futures buying and selling, margin calls can pressure merchants to deposit extra funds to take care of their positions. This could result in compelled liquidations, impacting value actions.

- Hypothesis and hedging: Futures markets entice a big variety of speculators and hedgers, influencing costs past the underlying index’s efficiency.

- Completely different buying and selling hours: Futures markets usually have prolonged buying and selling hours in comparison with the common inventory market hours for QQQ.

- Contract specs: The contract measurement and minimal value fluctuation (tick measurement) of NQ futures additionally contribute to variations in value motion in comparison with QQQ.

Which Instrument is Proper for You?

The selection between QQQ and NQ futures relies upon closely in your funding objectives, danger tolerance, and buying and selling type:

- QQQ is appropriate for: Lengthy-term traders looking for publicity to the Nasdaq-100 with decrease danger and fewer complexity. It is simpler to know and handle than futures.

- NQ futures are appropriate for: Energetic merchants and complex traders looking for leverage, the power to brief the market, and the potential for larger returns (and losses). They require a deeper understanding of futures markets and danger administration.

Conclusion:

Whereas each QQQ and NQ futures monitor the Nasdaq-100, their charts will not be similar. The variations stem from leverage, expiration dates, margin necessities, hypothesis, and the inherent nature of ETFs versus futures contracts. Understanding these variations is crucial for making knowledgeable choices. Buyers ought to fastidiously think about their danger tolerance, buying and selling type, and funding objectives earlier than selecting between QQQ and NQ futures. The seemingly minor variations can have a big affect in your total buying and selling expertise and portfolio efficiency. At all times conduct thorough analysis and seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied worthwhile insights into is the qqq the identical chart because the futures nq. We thanks for taking the time to learn this text. See you in our subsequent article!