Mastering Bitcoin Chart TradingView: A Complete Information

Associated Articles: Mastering Bitcoin Chart TradingView: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Mastering Bitcoin Chart TradingView: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Mastering Bitcoin Chart TradingView: A Complete Information

Bitcoin, the pioneering cryptocurrency, has captivated the world with its volatility and potential for substantial positive factors. For merchants, understanding its worth actions is paramount, and TradingView has emerged as a number one platform for analyzing Bitcoin charts and making knowledgeable buying and selling choices. This text dives deep into using TradingView for Bitcoin chart evaluation, masking every thing from primary chart navigation to superior technical indicators and methods.

I. Navigating the TradingView Bitcoin Chart Interface:

Earlier than delving into complicated analyses, it is essential to know the TradingView interface. Upon accessing the platform and trying to find "BTCUSD" (Bitcoin/US Greenback), you may be offered with a complete chart. Key options embrace:

-

Chart Sorts: TradingView gives varied chart varieties, together with candlestick, bar, line, Heikin Ashi, and space charts. Candlestick charts are the most well-liked for his or her visible illustration of worth motion over a selected interval. Every candlestick shows the open, excessive, low, and shutting costs.

-

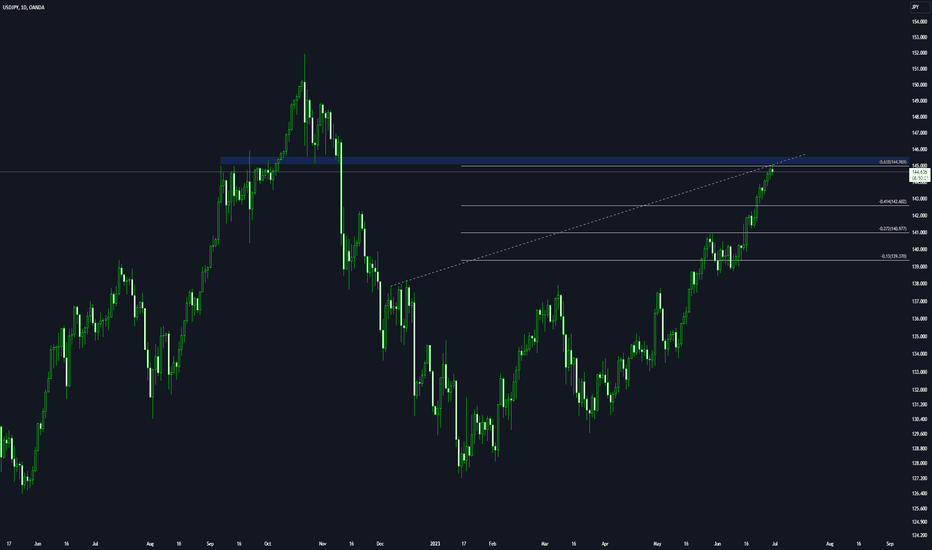

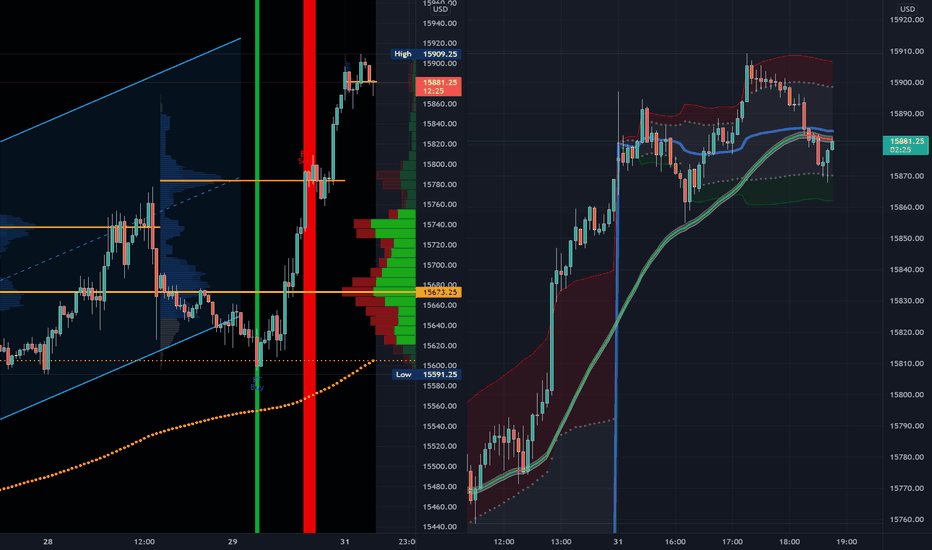

Timeframes: Adjusting the timeframe is essential for various evaluation views. Choices vary from intraday (1-minute, 5-minute, 15-minute, hourly, 4-hour) to each day, weekly, and month-to-month charts. Longer timeframes reveal long-term developments, whereas shorter timeframes spotlight short-term worth fluctuations.

-

Drawing Instruments: TradingView gives a wealthy set of drawing instruments, together with pattern traces, Fibonacci retracements, help/resistance ranges, channels, and Elliott Wave patterns. These instruments assist establish potential worth targets, entry/exit factors, and general market path.

-

Indicators: The center of technical evaluation on TradingView lies in its huge library of indicators. These mathematical calculations are overlaid on the chart to offer insights into momentum, pattern power, and potential reversals. Standard indicators embrace:

-

Transferring Averages (MA): Clean out worth fluctuations, revealing underlying developments. Widespread varieties embrace Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA).

-

Relative Power Index (RSI): Measures the magnitude of current worth modifications to judge overbought and oversold circumstances. Values above 70 usually recommend overbought circumstances, whereas values beneath 30 point out oversold circumstances.

-

Transferring Common Convergence Divergence (MACD): Identifies momentum modifications by evaluating two transferring averages. Crossovers of the MACD traces can sign potential pattern modifications.

-

Bollinger Bands: Present worth volatility and potential reversals. When costs contact the higher band, it might probably sign overbought circumstances, and touching the decrease band can point out oversold circumstances.

-

Quantity Indicators: Analyze buying and selling quantity alongside worth motion. Excessive quantity confirms worth actions, whereas low quantity suggests weak developments.

-

II. Technical Evaluation Methods utilizing TradingView for Bitcoin:

Combining totally different indicators and drawing instruments on TradingView permits for the event of sturdy buying and selling methods. Listed below are a couple of examples:

-

Development Following: Determine the prevailing pattern (uptrend or downtrend) utilizing transferring averages, pattern traces, and different indicators. Enter lengthy positions throughout uptrends and brief positions throughout downtrends. Affirm the pattern utilizing quantity evaluation. Think about using trailing stop-loss orders to guard earnings.

-

Imply Reversion: Determine overbought and oversold circumstances utilizing RSI, Bollinger Bands, or different oscillators. Enter brief positions when the worth is overbought and lengthy positions when it is oversold, anticipating a reversion to the imply.

-

Assist and Resistance Buying and selling: Determine key help and resistance ranges utilizing horizontal traces, Fibonacci retracements, or earlier worth highs/lows. Purchase close to help ranges and promote close to resistance ranges, anticipating a bounce or breakout.

-

Breakout Buying and selling: Determine potential breakouts from established ranges or patterns. Enter lengthy positions after a breakout above resistance and brief positions after a breakout beneath help. Affirm breakouts with elevated quantity.

-

Mixture Methods: Many profitable merchants mix a number of indicators and methods. For instance, they may use transferring averages to establish the pattern, RSI to establish overbought/oversold circumstances, and Bollinger Bands to gauge volatility.

III. Superior Methods and Issues:

-

Backtesting: TradingView permits for backtesting methods utilizing historic knowledge. This helps consider the efficiency of a method earlier than risking actual capital. Nevertheless, keep in mind that previous efficiency would not assure future outcomes.

-

Alerting System: Arrange alerts based mostly on particular worth ranges, indicator crossovers, or different circumstances. This enables for well timed entry and exit indicators, even when not actively monitoring the chart.

-

A number of Timeframe Evaluation: Analyzing Bitcoin on a number of timeframes concurrently gives a extra complete perspective. As an example, figuring out a long-term uptrend on a weekly chart would possibly inform short-term buying and selling choices on a each day or hourly chart.

-

Danger Administration: By no means danger extra capital than you possibly can afford to lose. Use stop-loss orders to restrict potential losses and take-profit orders to safe earnings. Correct place sizing is essential for long-term success.

-

Elementary Evaluation: Whereas TradingView focuses on technical evaluation, incorporating elementary evaluation can improve buying and selling choices. Think about information occasions, regulatory modifications, and Bitcoin adoption charges when assessing the general market sentiment.

-

Understanding Bitcoin’s Distinctive Traits: Bitcoin’s volatility is considerably increased than conventional property. This requires a distinct buying and selling strategy, usually involving smaller place sizes and tighter stop-loss orders. The 24/7 buying and selling nature additionally requires fixed vigilance or automated methods.

-

Paper Buying and selling: Earlier than risking actual cash, observe your methods utilizing a paper buying and selling account. This lets you achieve expertise and refine your strategy with out incurring monetary losses.

IV. Conclusion:

TradingView gives a strong platform for analyzing Bitcoin charts and growing refined buying and selling methods. By mastering the interface, understanding varied indicators and drawing instruments, and using sound danger administration ideas, merchants can considerably enhance their possibilities of success within the risky Bitcoin market. Nevertheless, it is essential to keep in mind that cryptocurrency buying and selling entails vital danger, and no technique ensures earnings. Steady studying, adaptation, and disciplined execution are important for navigating this dynamic market successfully. All the time conduct thorough analysis and take into account searching for recommendation from certified monetary professionals earlier than making any buying and selling choices. The data supplied on this article is for academic functions solely and shouldn’t be construed as monetary recommendation.

Closure

Thus, we hope this text has supplied useful insights into Mastering Bitcoin Chart TradingView: A Complete Information. We hope you discover this text informative and useful. See you in our subsequent article!