Mastering Chart Reside TradingView: A Complete Information for Merchants

Associated Articles: Mastering Chart Reside TradingView: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Mastering Chart Reside TradingView: A Complete Information for Merchants. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Mastering Chart Reside TradingView: A Complete Information for Merchants

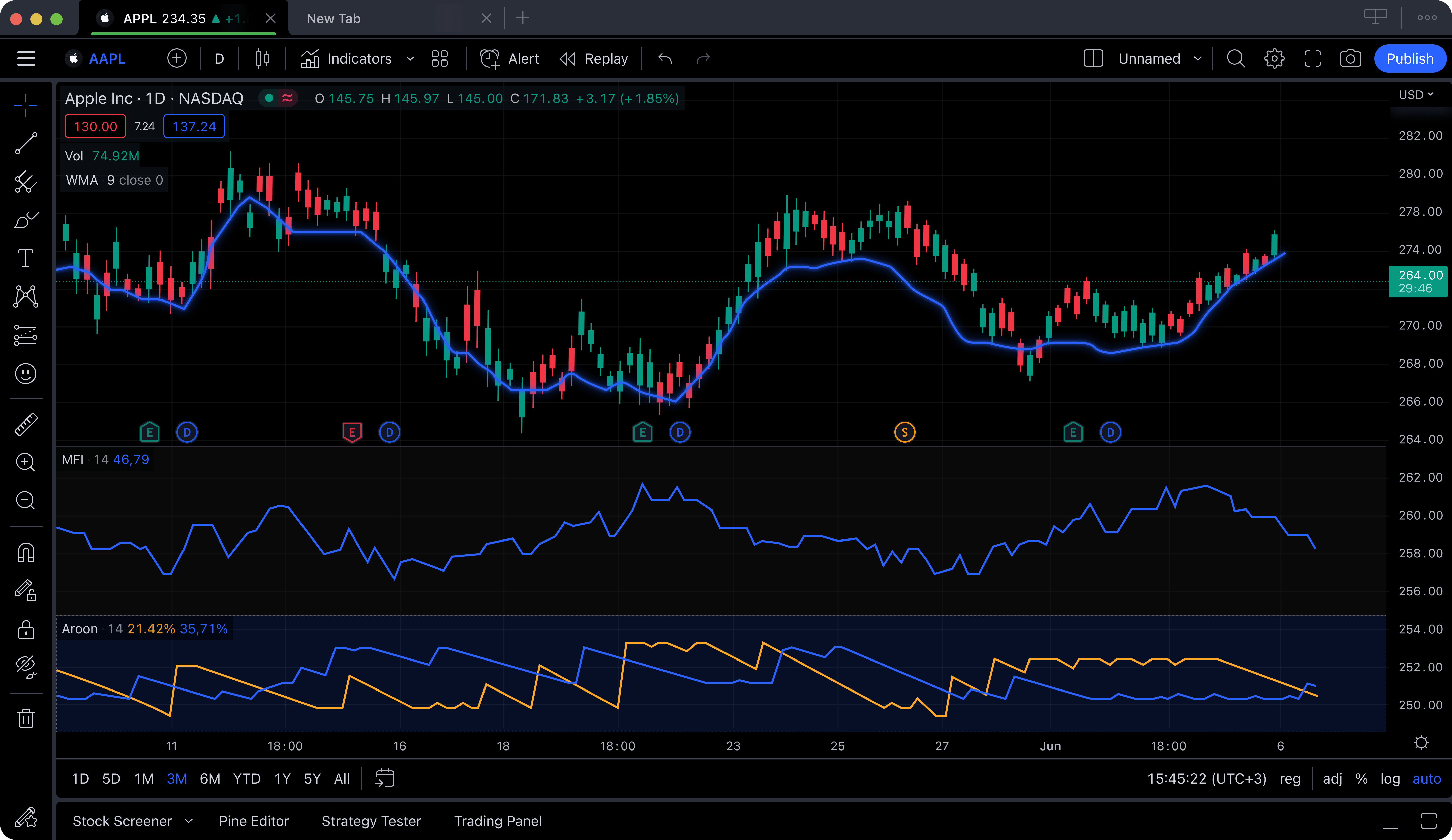

TradingView has quickly grow to be the go-to platform for tens of millions of merchants worldwide, and its core energy lies in its highly effective and versatile charting capabilities. This text delves deep into the intricacies of utilizing TradingView’s dwell charts, equipping you with the information to leverage their full potential for knowledgeable buying and selling choices. We’ll cowl all the pieces from primary navigation and indicator software to superior methods like drawing instruments and script customization, in the end serving to you remodel uncooked market information into actionable insights.

I. Navigating the TradingView Chart Interface:

Step one to mastering dwell buying and selling on TradingView is knowing its interface. Whereas seemingly advanced at first look, the format is intuitive when you grasp the important thing elements:

-

Chart Space: That is the central hub, displaying the value chart of your chosen asset. You’ll be able to zoom out and in utilizing the mouse wheel, pan left and proper with the mouse drag, and navigate by means of time utilizing the timeline on the backside.

-

Toolbar: Situated on the high, the toolbar gives fast entry to important features: including indicators, drawing instruments, altering chart sorts (candlestick, line, bar, and many others.), and accessing settings.

-

Indicator Panel: This panel, normally positioned to the left, lists all obtainable indicators, permitting you to look, filter, and add them to your chart. TradingView boasts an enormous library of built-in and community-created indicators.

-

Drawing Instruments Panel: Just like the indicator panel, this part homes numerous drawing instruments for technical evaluation, together with development strains, Fibonacci retracements, assist/resistance ranges, and extra.

-

Properties Panel: This panel, usually showing when an indicator or drawing instrument is chosen, means that you can customise their settings, parameters, and look.

-

Timeline: On the backside of the chart, the timeline lets you choose particular timeframes (e.g., 1-minute, 5-minute, every day, weekly) and navigate by means of the historic value information.

II. Using Indicators for Reside Buying and selling:

Indicators are mathematical calculations utilized to cost information, offering insights into developments, momentum, and volatility. TradingView affords a plethora of indicators, categorized for ease of use:

-

Development Indicators: These assist establish the general course of the market. In style examples embrace Shifting Averages (MA), Exponential Shifting Averages (EMA), MACD, and Common Directional Index (ADX). Understanding how totally different MAs work together (e.g., a shorter-term MA crossing above a longer-term MA signaling a bullish crossover) is essential.

-

Momentum Indicators: These measure the pace and energy of value actions. Examples embrace Relative Energy Index (RSI), Stochastic Oscillator, and Fee of Change (ROC). Overbought and oversold ranges present potential entry and exit alerts.

-

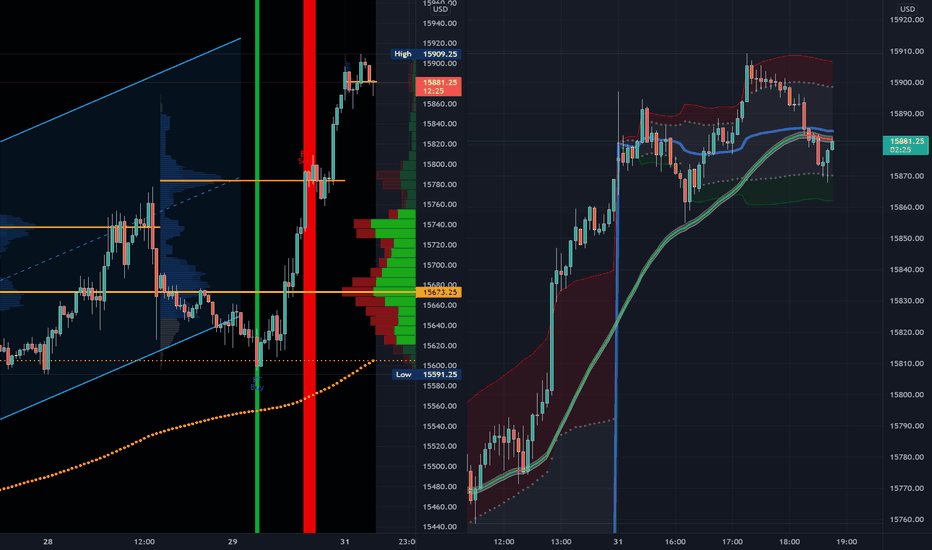

Volatility Indicators: These gauge the diploma of value fluctuations. Bollinger Bands, Common True Vary (ATR), and Keltner Channels are widespread examples. Wider bands counsel elevated volatility, whereas narrower bands point out decrease volatility.

-

Quantity Indicators: These analyze buying and selling quantity alongside value motion, offering affirmation of developments and potential reversals. On-Steadiness Quantity (OBV) and Chaikin Cash Circulation are standard decisions.

III. Mastering Drawing Instruments for Technical Evaluation:

Drawing instruments are important for visually decoding value charts and figuring out potential buying and selling alternatives. Proficient use of those instruments enhances your skill to:

-

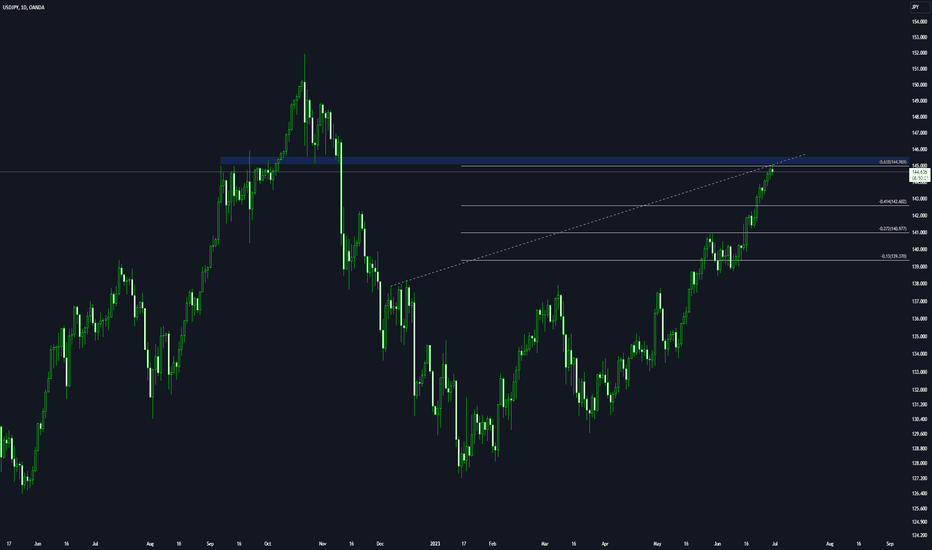

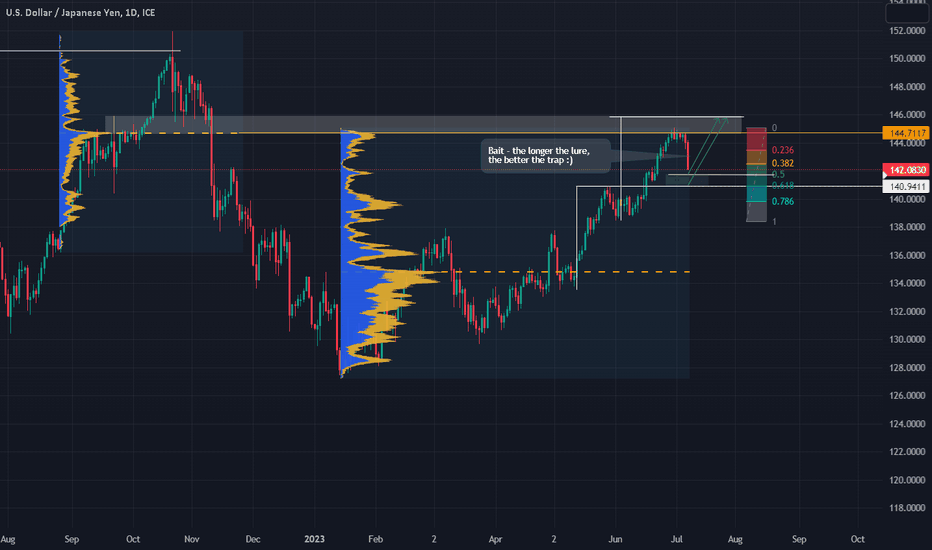

Establish Assist and Resistance Ranges: Horizontal strains drawn at vital value ranges the place the value has beforehand bounced or reversed.

-

Draw Development Traces: Traces connecting consecutive value highs (uptrend) or lows (downtrend), indicating the general market course.

-

Make the most of Fibonacci Retracements: Based mostly on the Fibonacci sequence, these instruments establish potential assist and resistance ranges inside a development.

-

Apply Gann Traces: Based mostly on Gann’s theories, these strains are used to establish potential value targets and reversal factors.

-

Use Andrews Pitchfork: This instrument helps establish potential assist and resistance ranges primarily based on value channels.

IV. Superior Strategies and Customization:

TradingView’s energy extends past primary charting and indicator software. Superior options allow subtle evaluation and personalised buying and selling workflows:

-

Pine Scripting: TradingView’s proprietary scripting language, Pine Script, means that you can create customized indicators, methods, and alerts. This opens a world of potentialities for tailoring your evaluation to particular market circumstances and buying and selling types. Studying Pine Script is a big funding, nevertheless it unlocks unparalleled customization.

-

Alert Creation: Arrange custom-made alerts primarily based on value ranges, indicator alerts, or different standards. These alerts can notify you by way of e mail, cellular push notifications, or browser pop-ups, guaranteeing you do not miss essential buying and selling alternatives.

-

A number of Timeframe Evaluation: Concurrently analyzing totally different timeframes (e.g., 5-minute chart alongside a every day chart) gives a holistic perspective, serving to you establish potential confluences of alerts and scale back the danger of false alerts.

-

Backtesting: Whereas circuitously dwell buying and selling, backtesting methods utilizing historic information inside TradingView is essential for evaluating the effectiveness of your buying and selling plans earlier than risking actual capital.

-

Neighborhood Engagement: TradingView boasts a vibrant neighborhood of merchants. Discover public charts created by different customers, be taught from their methods, and contribute your personal insights.

V. Danger Administration and Accountable Buying and selling:

No matter your technical evaluation expertise, accountable danger administration is paramount. Bear in mind:

-

Outline your danger tolerance: Decide the utmost quantity you are keen to lose on any single commerce.

-

Use stop-loss orders: These routinely exit a commerce if the value strikes in opposition to you, limiting potential losses.

-

Diversify your portfolio: Do not put all of your eggs in a single basket. Unfold your investments throughout totally different property to scale back total danger.

-

By no means commerce with borrowed cash: Keep away from utilizing leverage until you absolutely perceive the dangers concerned.

-

Repeatedly be taught and adapt: The markets are dynamic. Keep up to date on market developments, refine your methods, and repeatedly be taught out of your successes and failures.

VI. Conclusion:

TradingView’s dwell charting capabilities are a strong instrument for merchants of all ranges. By mastering the interface, using indicators and drawing instruments successfully, and exploring superior options like Pine Script and alert creation, you’ll be able to considerably improve your buying and selling efficiency. Nevertheless, do not forget that technical evaluation is only one piece of the puzzle. Profitable buying and selling requires self-discipline, danger administration, and a steady dedication to studying and adapting to the ever-changing market dynamics. Mix your technical expertise with sound danger administration practices, and you will be well-equipped to navigate the complexities of the monetary markets and obtain your buying and selling objectives. Bear in mind to all the time apply accountable buying and selling and by no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has offered invaluable insights into Mastering Chart Reside TradingView: A Complete Information for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!