Mastering the Xero Chart of Accounts: A Complete Information

Associated Articles: Mastering the Xero Chart of Accounts: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering the Xero Chart of Accounts: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Mastering the Xero Chart of Accounts: A Complete Information

Xero’s chart of accounts is the spine of your monetary record-keeping. It is a meticulously organized record of all your online business’s accounts, categorizing each transaction for correct reporting and monetary evaluation. Understanding and successfully managing your Xero chart of accounts is essential for sustaining clear, dependable monetary information and making knowledgeable enterprise choices. This complete information delves into the intricacies of Xero’s chart of accounts, exploring its construction, finest practices, and tips on how to optimize it to your particular enterprise wants.

Understanding the Construction of Xero’s Chart of Accounts:

Xero’s chart of accounts follows a hierarchical construction, permitting for detailed categorization of transactions. This construction usually consists of:

-

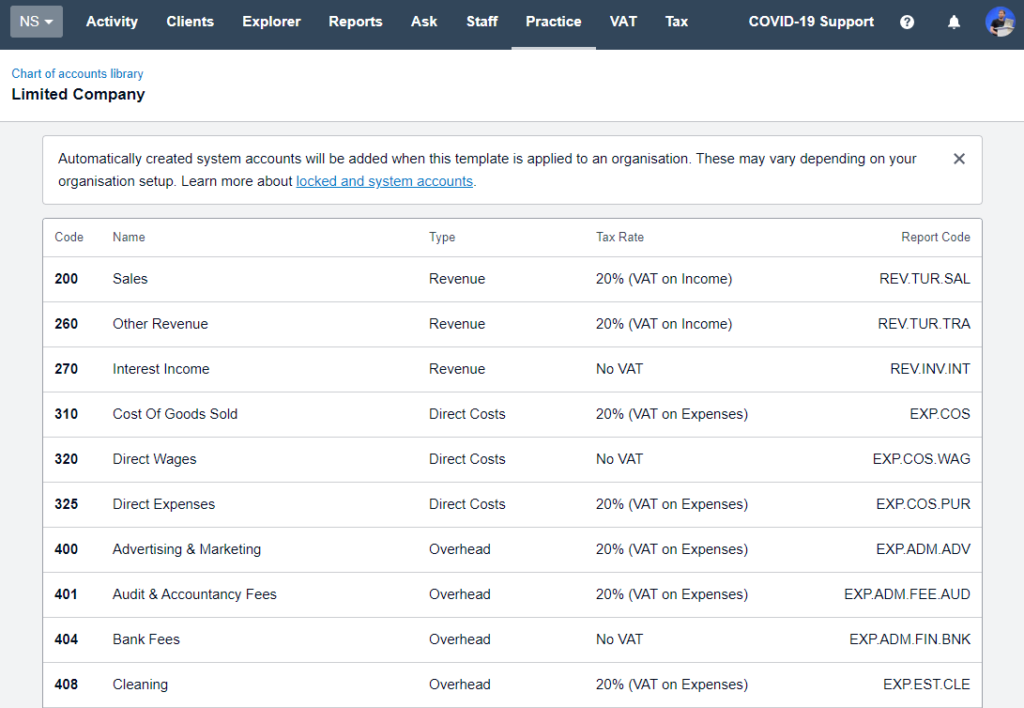

Account Varieties: Xero pre-populates a number of account sorts, together with Property, Liabilities, Fairness, Income, and Bills. Every transaction is assigned to one in all these most important classes, offering a high-level overview of your monetary place.

-

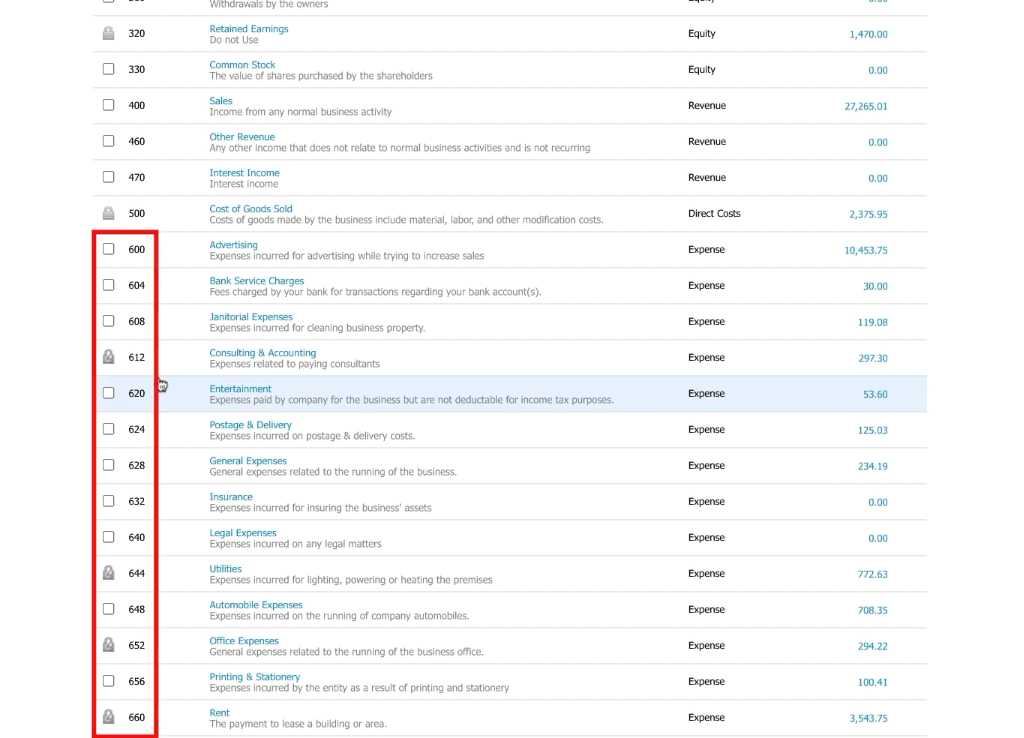

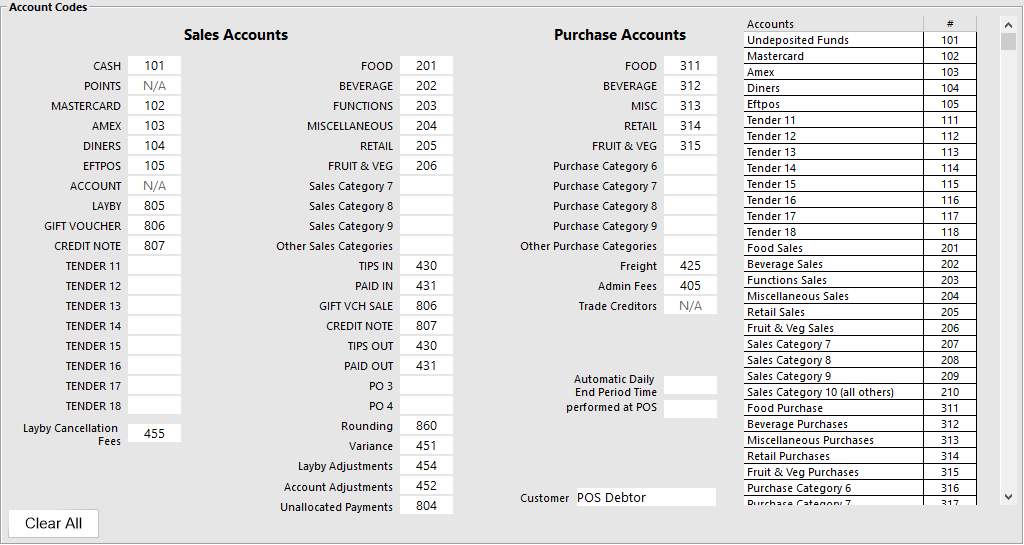

Account Codes: Every account inside a kind is assigned a singular code. This code typically follows a numbering system (e.g., 1000-1999 for Property, 2000-2999 for Liabilities) for straightforward identification and sorting. Whereas Xero permits for personalized numbering, sustaining a logical construction is essential for environment friendly reporting.

-

Account Names: These are descriptive names assigned to every account (e.g., "Money at Financial institution," "Accounts Receivable," "Gross sales Income"). Clear and concise naming is important for understanding the aim of every account.

-

Account Sub-types (elective): Inside every account kind, you’ll be able to create sub-accounts for higher element. For instance, beneath "Property," you may need sub-accounts for "Financial institution," "Petty Money," and "Accounts Receivable." This layered strategy gives a granular view of your monetary information.

Establishing Your Xero Chart of Accounts:

Establishing your chart of accounts appropriately is a crucial first step in utilizing Xero successfully. Here is a step-by-step information:

-

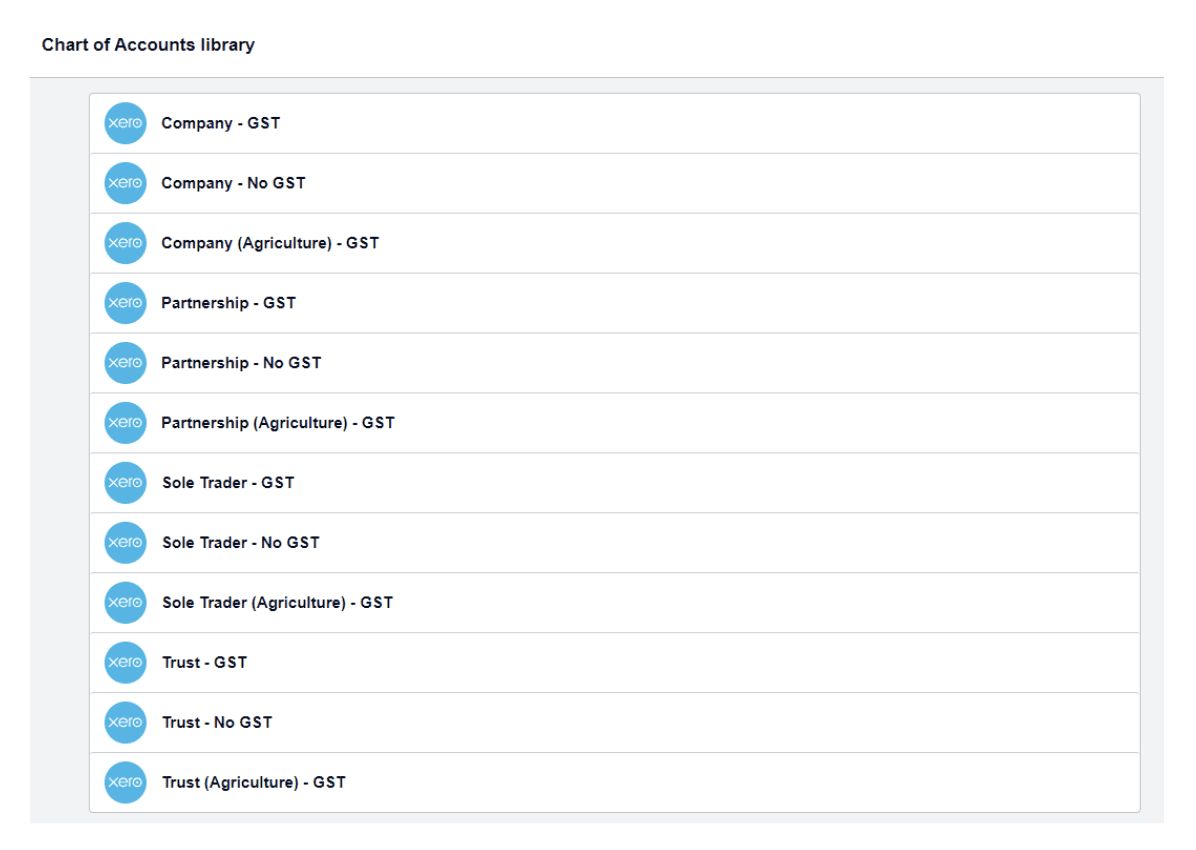

Select a Chart of Accounts Template: Xero gives pre-built templates tailor-made to totally different industries. Deciding on a related template gives a strong basis, saving you time and guaranteeing a structured strategy.

-

Customise Your Chart of Accounts: Whereas templates are useful, you may seemingly must customise your chart to replicate your particular enterprise operations. This may contain including new accounts, modifying current ones, or deleting irrelevant accounts. Keep in mind to keep up a constant numbering system and descriptive naming conventions.

-

Take into account Your Enterprise Wants: The extent of element in your chart of accounts ought to align together with your reporting necessities. A small enterprise may require a less complicated construction, whereas a bigger enterprise may want a extra advanced and granular system.

-

Use Account Monitoring Classes (elective): Xero’s monitoring classes mean you can additional section your monetary information primarily based on initiatives, departments, or different related standards. This provides one other layer of study past the fundamental account construction.

-

Often Evaluation and Replace: Your small business will evolve, and your chart of accounts ought to adapt accordingly. Often evaluate your account construction to make sure it stays correct and related to your present operations. Including new accounts for brand new services or products, or archiving previous ones, is important for sustaining information integrity.

Greatest Practices for Managing Your Xero Chart of Accounts:

-

Consistency is Key: Keep constant naming conventions and a logical numbering system all through your chart of accounts. This ensures readability and simplifies reporting.

-

Use Descriptive Account Names: Keep away from abbreviations or jargon. Use clear, concise names that precisely replicate the aim of every account.

-

Hold it Easy, however Complete: Attempt for a steadiness between simplicity and comprehensiveness. Keep away from pointless accounts, however guarantee you’ve enough element to generate correct studies.

-

Often Reconcile Your Accounts: Often reconcile your financial institution and bank card accounts together with your Xero information to make sure accuracy and establish any discrepancies.

-

Make the most of Monitoring Classes Successfully: Leverage monitoring classes to achieve deeper insights into your online business efficiency. Section your information by mission, division, or some other related standards.

-

Doc Your Chart of Accounts: Keep clear documentation of your chart of accounts, together with the aim of every account and any particular naming conventions used. That is notably useful for brand new crew members or throughout audits.

-

Take into account Skilled Recommendation: In case you’re uncertain about one of the best ways to construction your chart of accounts, contemplate looking for recommendation from an accountant or bookkeeper. They will help you create a system that meets your particular wants and complies with accounting requirements.

Frequent Account Varieties and Examples:

Here is a breakdown of frequent account sorts and examples inside Xero’s chart of accounts:

-

Property: These signify what your online business owns.

- Present Property: Money at Financial institution, Accounts Receivable, Stock, Pay as you go Bills.

- Non-Present Property: Property, Plant, and Tools (PP&E), Intangible Property (e.g., goodwill, logos).

-

Liabilities: These signify what your online business owes to others.

- Present Liabilities: Accounts Payable, Brief-Time period Loans, Unearned Income.

- Non-Present Liabilities: Lengthy-Time period Loans, Mortgages.

-

Fairness: This represents the proprietor’s funding within the enterprise.

- Capital: Preliminary funding, retained earnings.

-

Income: This represents earnings generated from your online business operations.

- Gross sales Income: Revenue from gross sales of products or companies.

- Different Income: Curiosity earnings, rental earnings.

-

Bills: These signify prices incurred in operating your online business.

- Value of Items Offered (COGS): Direct prices related to producing items.

- Working Bills: Lease, salaries, utilities, advertising bills.

Troubleshooting Frequent Chart of Accounts Points:

-

Duplicate Accounts: Keep away from creating duplicate accounts. This results in inaccurate reporting and makes reconciliation troublesome.

-

Inconsistent Naming: Keep constant naming conventions to make sure readability and keep away from confusion.

-

Incorrect Account Assignments: Precisely assign transactions to the proper accounts. Incorrect assignments result in inaccurate monetary statements.

-

Lack of Element: Guarantee your chart of accounts gives enough element to generate significant studies.

-

Outdated Accounts: Often evaluate and replace your chart of accounts to replicate modifications in your online business operations.

Conclusion:

A well-structured and meticulously maintained chart of accounts is prime to the success of any enterprise utilizing Xero. By understanding the rules outlined on this information and implementing finest practices, you’ll be able to guarantee your monetary information is correct, dependable, and gives useful insights for knowledgeable decision-making. Keep in mind that looking for skilled recommendation when wanted can stop pricey errors and guarantee your chart of accounts successfully helps your online business’s progress and monetary well being. Common evaluate and adaptation are key to sustaining a sturdy and related chart of accounts that evolves with your online business.

Closure

Thus, we hope this text has offered useful insights into Mastering the Xero Chart of Accounts: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!