Mastering Your Funds: A Complete Information to Chart of Accounts Templates in Excel

Associated Articles: Mastering Your Funds: A Complete Information to Chart of Accounts Templates in Excel

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering Your Funds: A Complete Information to Chart of Accounts Templates in Excel. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Mastering Your Funds: A Complete Information to Chart of Accounts Templates in Excel

A well-organized Chart of Accounts (COA) is the spine of any profitable monetary administration system, whether or not you are working a small enterprise, a non-profit, or managing private funds. It is a structured listing of all of the accounts utilized by a company to file its monetary transactions. Whereas accounting software program provides refined COA administration, Excel stays a robust and accessible instrument for creating and sustaining your personal, particularly for smaller entities or these beginning out. This text offers a complete information to creating and using efficient Chart of Accounts templates in Excel, protecting every little thing from fundamental setup to superior options and finest practices.

Understanding the Significance of a Chart of Accounts

Earlier than diving into Excel templates, let’s perceive why a COA is essential:

- Organized Monetary Knowledge: A COA ensures all transactions are categorized constantly, making monetary reporting and evaluation considerably simpler. With out it, knowledge turns into fragmented and troublesome to interpret.

- Correct Monetary Statements: A correctly structured COA is important for producing correct and dependable monetary statements just like the stability sheet, revenue assertion, and money circulate assertion.

- Improved Budgeting and Forecasting: An in depth COA permits for extra exact budgeting and forecasting by offering a transparent framework for monitoring revenue and bills.

- Streamlined Auditing: A well-maintained COA simplifies the auditing course of, making it simpler to determine discrepancies and guarantee compliance with accounting requirements.

- Higher Resolution-Making: Correct and available monetary data, facilitated by a strong COA, empowers knowledgeable decision-making relating to enterprise operations, investments, and strategic planning.

Making a Chart of Accounts Template in Excel: A Step-by-Step Information

Whilst you can obtain pre-made templates, constructing your personal provides larger customization. Right here’s create a fundamental COA template in Excel:

1. Establishing the Worksheet:

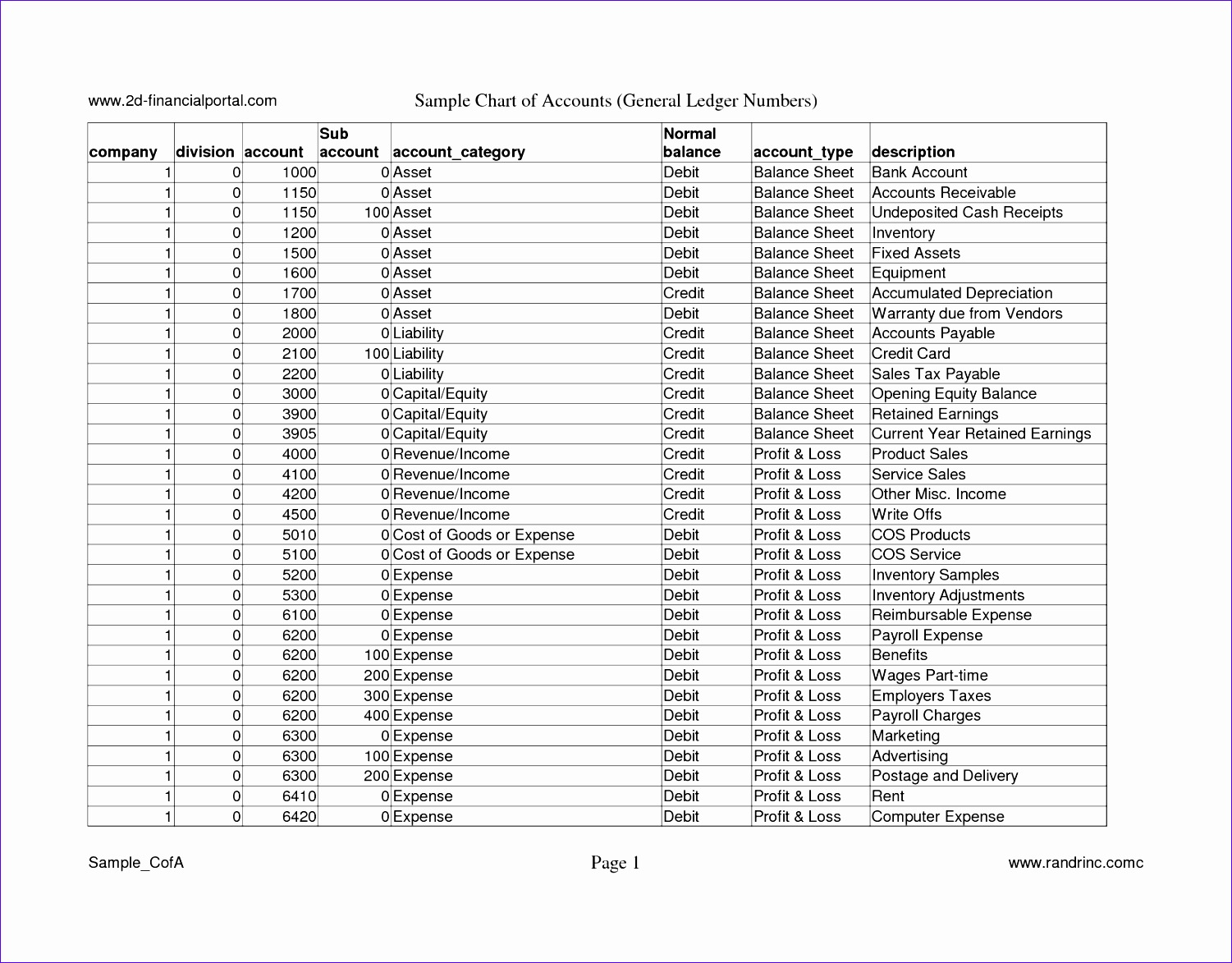

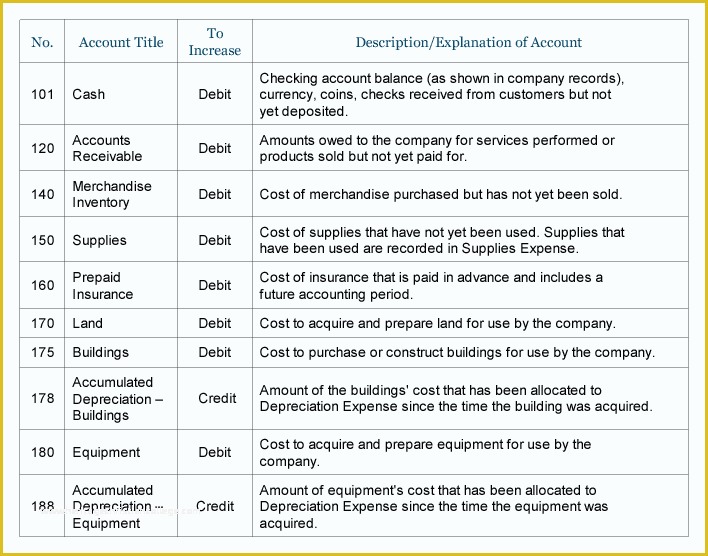

- Column Headers: Create the next columns: Account Quantity, Account Title, Account Kind, Description, Regular Steadiness (Debit/Credit score). You may add extra columns later relying in your wants (e.g., Sub-account, Finances Quantity, Yr-to-Date).

-

Account Numbering System: Select a constant numbering system. A typical method is to make use of a hierarchical system, reminiscent of:

- 1000-1999: Property

- 2000-2999: Liabilities

- 3000-3999: Fairness

- 4000-4999: Income

- 5000-5999: Bills

- Account Varieties: Outline clear account varieties inside every main class. For instance, underneath Property, you might need Money, Accounts Receivable, Stock, and so on.

2. Populating the Template:

- Property: Checklist all of your property, together with money, accounts receivable (cash owed to you), stock, gear, and property.

- Liabilities: Checklist all of your liabilities, together with accounts payable (cash you owe), loans payable, and accrued bills.

- Fairness: Embody proprietor’s fairness (for sole proprietorships and partnerships) or shareholder’s fairness (for companies).

- Income: Checklist all of your revenue sources, reminiscent of gross sales income, service income, and curiosity revenue.

- Bills: Checklist all of your bills, together with price of products bought, salaries, lease, utilities, advertising and marketing, and depreciation.

3. Defining Regular Balances:

- Property, Bills, and Dividends: These accounts usually have debit balances.

- Liabilities, Fairness, and Income: These accounts usually have credit score balances. Understanding regular balances is essential for correct bookkeeping.

4. Including Formulation (Elective):

- Operating Totals: You need to use SUM formulation to calculate working totals for every account sort or class.

- Finances vs. Precise: For those who embody a funds column, you should utilize formulation to check budgeted quantities to precise spending.

Instance of a Simplified COA in Excel:

| Account Quantity | Account Title | Account Kind | Description | Regular Steadiness |

|---|---|---|---|---|

| 1000 | Money | Asset | Money available and in financial institution accounts | Debit |

| 1100 | Accounts Receivable | Asset | Cash owed to the enterprise | Debit |

| 2000 | Accounts Payable | Legal responsibility | Cash owed by the enterprise | Credit score |

| 3000 | Proprietor’s Fairness | Fairness | Proprietor’s funding within the enterprise | Credit score |

| 4000 | Gross sales Income | Income | Income from gross sales of products or companies | Credit score |

| 5000 | Value of Items Offered | Expense | Direct prices of manufacturing items or companies | Debit |

| 5100 | Salaries Expense | Expense | Salaries paid to staff | Debit |

Superior Options and Issues:

- Sub-accounts: For extra detailed monitoring, use sub-accounts inside main accounts. For instance, underneath "Bills," you might need sub-accounts for "Lease," "Utilities," and "Advertising." This may be achieved utilizing a extra granular account numbering system (e.g., 5100.1 for Lease, 5100.2 for Utilities).

- Knowledge Validation: Use Excel’s knowledge validation function to make sure knowledge consistency. For instance, you’ll be able to limit account varieties to a predefined listing.

- Charts and Graphs: Visualize your monetary knowledge utilizing charts and graphs to determine traits and patterns.

- Pivot Tables: Use pivot tables to summarize and analyze your monetary knowledge from completely different views.

- Linking to Different Worksheets: Hyperlink your COA to different worksheets containing transaction knowledge for automated reporting.

- Defending Your Worksheet: Shield your worksheet to stop unintentional modifications to your COA construction.

Selecting a Pre-made Template vs. Constructing Your Personal:

Quite a few free and paid COA templates can be found on-line. Pre-made templates provide comfort, however they could not completely align along with your particular wants. Constructing your personal permits for full customization however requires extra effort and time. Think about your accounting information, the complexity of your corporation, and your time constraints when making this resolution.

Greatest Practices for Sustaining Your Chart of Accounts:

- Common Evaluate: Usually overview and replace your COA to mirror modifications in your corporation operations.

- Consistency: Preserve consistency in your account naming and numbering conventions.

- Documentation: Doc your COA completely, together with explanations of every account and its function.

- Model Management: Preserve observe of various variations of your COA to take care of historic data.

- Safety: Shield your COA from unauthorized entry and modification.

Conclusion:

A well-designed Chart of Accounts is a cornerstone of efficient monetary administration. Whereas accounting software program offers sturdy options, Excel stays a beneficial instrument for creating and sustaining a COA, notably for smaller companies or people. By following the steps and finest practices outlined on this article, you’ll be able to leverage the facility of Excel to create a personalized COA template that may assist you to set up your monetary knowledge, generate correct reviews, and make knowledgeable enterprise choices. Keep in mind to decide on the method—pre-made template or custom-built—that most closely fits your wants and technical expertise, guaranteeing your COA stays a beneficial asset for years to return.

Closure

Thus, we hope this text has supplied beneficial insights into Mastering Your Funds: A Complete Information to Chart of Accounts Templates in Excel. We hope you discover this text informative and useful. See you in our subsequent article!