Mastering Your QuickBooks Chart of Accounts for E-commerce Success

Associated Articles: Mastering Your QuickBooks Chart of Accounts for E-commerce Success

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering Your QuickBooks Chart of Accounts for E-commerce Success. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Mastering Your QuickBooks Chart of Accounts for E-commerce Success

For e-commerce companies, a well-structured Chart of Accounts (COA) in QuickBooks is not only a bookkeeping necessity; it is the bedrock of monetary readability and strategic decision-making. A meticulously crafted COA means that you can observe income streams, handle bills successfully, and acquire essential insights into your small business’s efficiency. Nonetheless, the complexity of e-commerce, with its numerous earnings sources and operational nuances, requires a extra subtle COA than a standard brick-and-mortar retailer. This text delves into creating and optimizing your QuickBooks Chart of Accounts particularly for the calls for of your e-commerce enterprise.

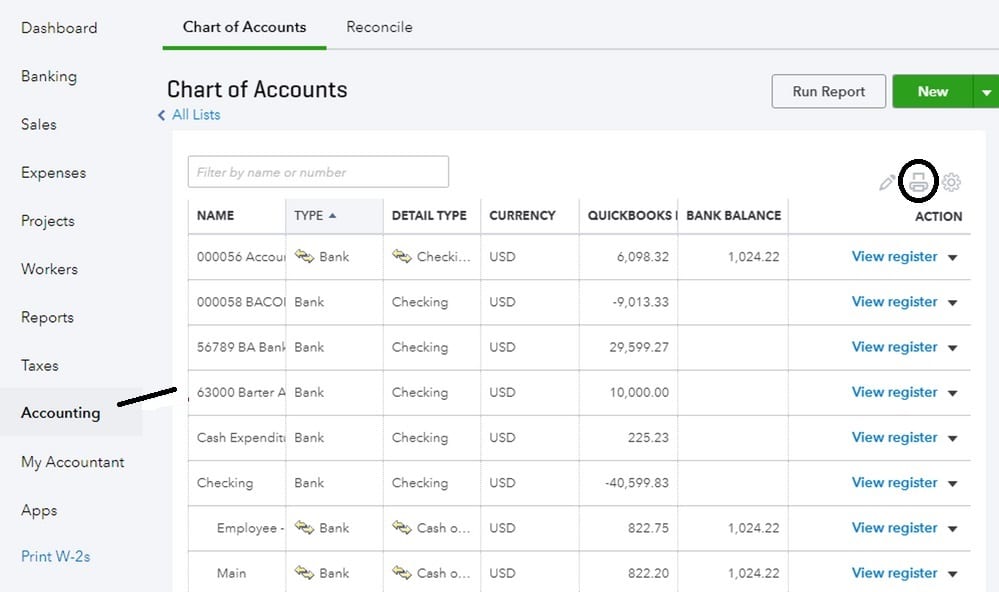

Understanding the Basis: What’s a Chart of Accounts?

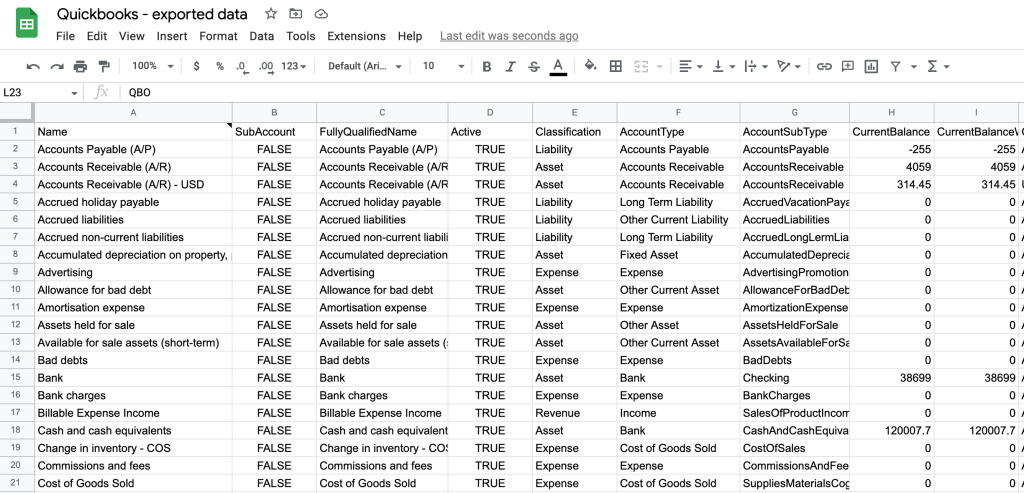

Earlier than diving into e-commerce specifics, let’s set up the basics. Your QuickBooks Chart of Accounts is a complete record of all your small business’s accounts, categorized by sort (belongings, liabilities, fairness, income, and bills). Every account has a novel quantity, permitting for streamlined knowledge group and reporting. Consider it as your small business’s monetary blueprint, guiding the stream of monetary data all through your accounting system. A well-organized COA simplifies:

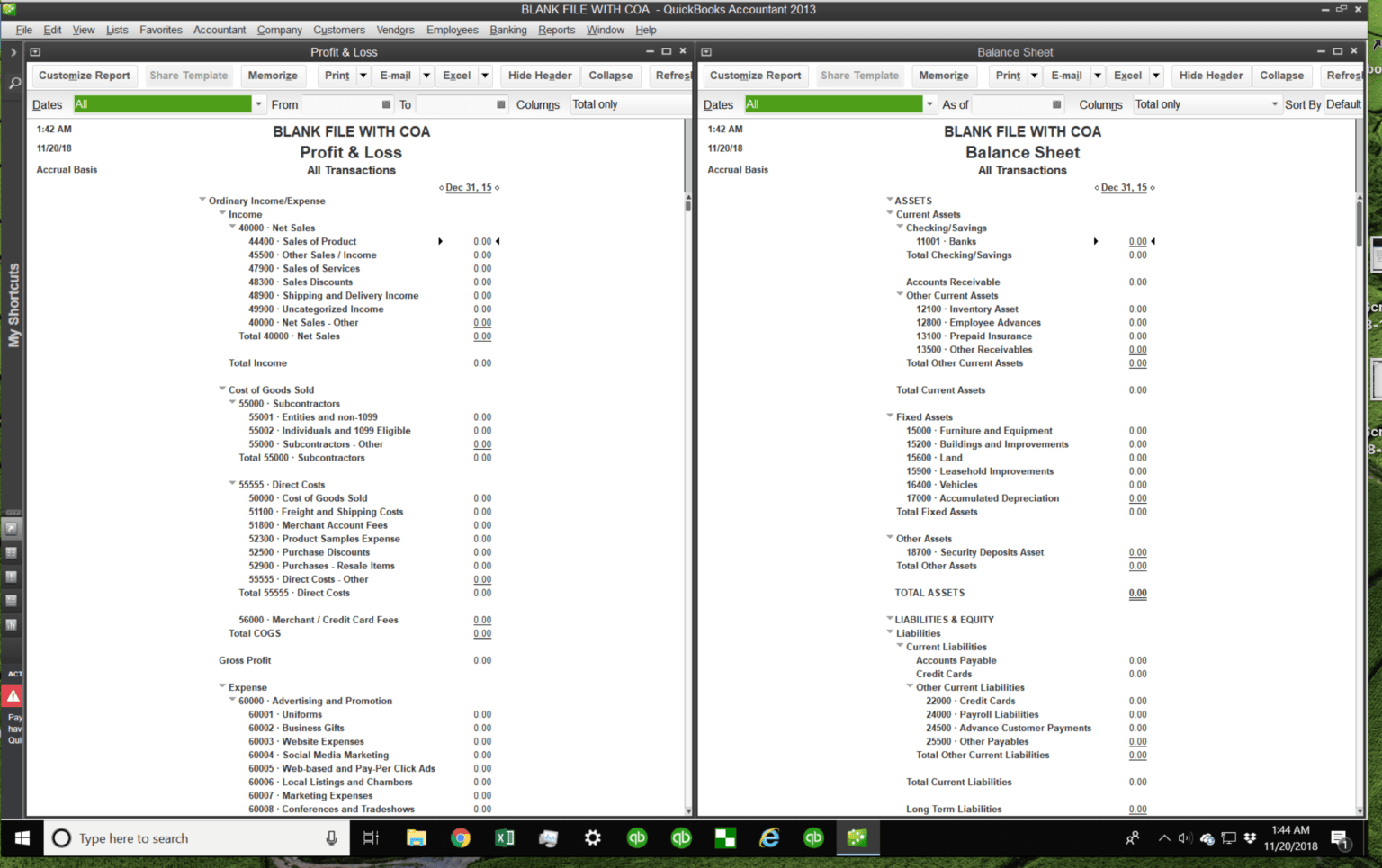

- Monetary Reporting: Producing correct and insightful revenue and loss statements, stability sheets, and money stream statements.

- Tax Preparation: Streamlining the tax submitting course of by offering clearly categorized monetary knowledge.

- Budgeting and Forecasting: Facilitating the creation of correct budgets and monetary projections.

- Choice-Making: Offering the info you might want to make knowledgeable enterprise choices based mostly in your monetary efficiency.

E-commerce Particular Account Issues:

The important thing to a profitable e-commerce COA lies in its means to seize the distinctive points of your small business mannequin. Here is a breakdown of important account classes and sub-accounts tailor-made for on-line companies:

1. Income Accounts:

E-commerce income streams are sometimes extra numerous than conventional companies. Think about these sub-accounts:

-

Gross sales: That is your main income account, monitoring the overall income from product gross sales. You could additional subdivide this based mostly on:

- Product Class: (e.g., Clothes Gross sales, Electronics Gross sales, Equipment Gross sales) This permits for granular evaluation of product efficiency.

- Gross sales Channel: (e.g., Web site Gross sales, Amazon Gross sales, eBay Gross sales) This helps perceive the effectiveness of various advertising and marketing channels.

- Fee Technique: (e.g., Credit score Card Gross sales, PayPal Gross sales, Direct Financial institution Switch Gross sales) This aids in monitoring cost processing charges and figuring out most popular cost strategies.

- Transport Income: Monitor earnings generated from delivery and dealing with expenses individually.

- Subscription Income: In case you supply subscription providers, create separate accounts for every subscription tier.

- Different Income: This class captures miscellaneous earnings sources like internet online affiliate marketing commissions, returns processing charges, or late cost charges.

2. Expense Accounts:

E-commerce companies incur distinctive bills. Cautious categorization is essential for correct price evaluation.

-

Price of Items Offered (COGS): That is arguably essentially the most essential account for e-commerce. It consists of the direct prices related to producing or buying the products you promote, together with:

- Buy of Items: The price of buying stock from suppliers.

- Transport & Dealing with (Inbound): Prices related to receiving stock from suppliers.

- Stock Changes: Account for discrepancies in stock counts.

-

Advertising and marketing & Promoting: It is a important expense for on-line companies. Subdivide this into:

- Paid Promoting (PPC, Social Media): Monitor spending on Google Adverts, Fb Adverts, and so on.

- search engine marketing: Bills associated to search engine marketing efforts.

- E-mail Advertising and marketing: Prices related to e mail advertising and marketing campaigns.

- Content material Advertising and marketing: Bills for weblog posts, movies, and different content material creation.

-

Web site & Know-how: This covers bills associated to your on-line retailer, together with:

- Web site Internet hosting: Prices for internet hosting your web site.

- E-commerce Platform Charges: Charges charged by platforms like Shopify or WooCommerce.

- Web site Growth & Upkeep: Prices related to constructing and sustaining your web site.

- Software program Subscriptions: Bills for CRM, analytics, and different software program.

- Fee Processing Charges: Monitor charges charged by cost gateways like PayPal or Stripe.

- Transport & Dealing with (Outbound): Prices related to delivery merchandise to prospects.

- Buyer Service: Prices associated to offering buyer help.

- Workplace Bills: Conventional workplace bills like lease, utilities, and provides.

- Salaries & Wages: Compensation for workers.

3. Asset Accounts:

These accounts signify what your small business owns. For e-commerce, key belongings embody:

- Money: Your small business’s money stability in varied accounts (checking, financial savings).

- Accounts Receivable: Cash owed to your small business by prospects.

- Stock: The worth of your unsold merchandise. Think about using a perpetual stock system for higher real-time monitoring.

- Pay as you go Bills: Bills paid prematurely, resembling insurance coverage or web site internet hosting.

- Fastened Property: Lengthy-term belongings like computer systems, tools, and furnishings.

4. Legal responsibility Accounts:

These accounts signify what your small business owes to others.

- Accounts Payable: Cash owed to suppliers for bought stock.

- Gross sales Tax Payable: Gross sales tax collected from prospects however not but remitted to the federal government.

- Loans Payable: Excellent mortgage balances.

5. Fairness Accounts:

This part displays the proprietor’s funding within the enterprise.

- Proprietor’s Fairness: Represents the proprietor’s preliminary funding and retained earnings.

Selecting the Proper Chart of Accounts Construction:

QuickBooks gives flexibility in structuring your COA. You should utilize a easy, single-digit numbering system or a extra complicated, multi-digit system with sub-accounts. One of the best strategy is dependent upon your small business’s complexity and your reporting wants. For rising e-commerce companies, a multi-digit system providing detailed sub-accounts is mostly beneficial. This permits for granular evaluation and higher monetary insights.

Instance of a Multi-Digit COA Construction:

- 1000 – Property

- 1100 – Present Property

- 1110 – Money

- 1120 – Accounts Receivable

- 1130 – Stock

- 1200 – Fastened Property

- 1210 – Tools

- 1100 – Present Property

- 2000 – Liabilities

- 2100 – Present Liabilities

- 2110 – Accounts Payable

- 2120 – Gross sales Tax Payable

- 2100 – Present Liabilities

- 3000 – Fairness

- 3100 – Proprietor’s Fairness

- 4000 – Income

- 4100 – Gross sales

- 4110 – Web site Gross sales

- 4120 – Amazon Gross sales

- 4130 – eBay Gross sales

- 4200 – Transport Income

- 4100 – Gross sales

- 5000 – Bills

- 5100 – Price of Items Offered

- 5110 – Buy of Items

- 5120 – Transport & Dealing with (Inbound)

- 5200 – Advertising and marketing & Promoting

- 5210 – Paid Promoting

- 5220 – search engine marketing

- 5300 – Web site & Know-how

- 5400 – Fee Processing Charges

- 5500 – Transport & Dealing with (Outbound)

- 5600 – Buyer Service

- 5700 – Workplace Bills

- 5800 – Salaries & Wages

- 5100 – Price of Items Offered

Common Assessment and Refinement:

Your COA will not be a static doc. As your e-commerce enterprise evolves, so ought to your COA. Frequently evaluation your account construction to make sure it precisely displays your present operations. Add new accounts as wanted to trace rising income streams or bills, and consolidate or eradicate accounts which might be now not related.

Conclusion:

A well-designed Chart of Accounts is an indispensable software for e-commerce success. By rigorously categorizing your income and bills, you may acquire the monetary readability wanted to make knowledgeable choices, optimize your operations, and obtain sustainable progress. Take the time to create a sturdy and tailor-made COA, and you will lay the muse for a financially wholesome and thriving on-line enterprise. Keep in mind to seek the advice of with a professional accountant or bookkeeper to make sure your COA aligns with greatest practices and meets your particular enterprise wants. Investing in a well-structured COA is an funding within the long-term success of your e-commerce enterprise.

Closure

Thus, we hope this text has offered worthwhile insights into Mastering Your QuickBooks Chart of Accounts for E-commerce Success. We hope you discover this text informative and useful. See you in our subsequent article!