Navigating the Nonprofit Chart of Accounts: A Complete Information

Associated Articles: Navigating the Nonprofit Chart of Accounts: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the Nonprofit Chart of Accounts: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the Nonprofit Chart of Accounts: A Complete Information

Nonprofit organizations, whereas devoted to social good, nonetheless require sturdy monetary administration to make sure accountability, transparency, and sustainability. A well-structured chart of accounts is the cornerstone of this monetary administration. It serves as an in depth classification system for all monetary transactions, offering a transparent and arranged image of a company’s monetary well being. Not like for-profit companies, nonprofit charts of accounts should adhere to particular accounting ideas and laws, reflecting their distinctive mission and funding sources. This text will delve into the intricacies of making and sustaining an efficient nonprofit chart of accounts.

Understanding the Objective of a Nonprofit Chart of Accounts

The first goal of a nonprofit chart of accounts is to categorize all monetary transactions, enabling correct monetary reporting and evaluation. This categorization permits for:

- Monitoring Income Sources: Figuring out the origin of funds, whether or not from grants, particular person donations, program charges, or fundraising occasions. That is essential for demonstrating accountability to donors and funders.

- Monitoring Program Bills: Figuring out the price of delivering particular applications and companies. This knowledge is important for evaluating program effectiveness and justifying future funding requests.

- Managing Administrative Bills: Monitoring prices related to operating the group, equivalent to salaries, lease, and utilities. This ensures environment friendly useful resource allocation.

- Producing Correct Monetary Statements: Producing dependable monetary reviews, together with the stability sheet, revenue assertion, and assertion of money flows, that are important for inside decision-making and exterior reporting.

- Assembly Compliance Necessities: Adhering to Typically Accepted Accounting Rules (GAAP) for nonprofits and any particular regulatory necessities, making certain authorized and moral compliance.

- Facilitating Budgeting and Forecasting: Offering a framework for creating sensible budgets and forecasting future monetary wants.

Key Variations between For-Revenue and Nonprofit Charts of Accounts

Whereas each for-profit and nonprofit organizations use chart of accounts, there are vital variations reflecting their distinct targets and funding constructions:

- Income Recognition: Nonprofits typically acknowledge income based mostly on the receipt of funds, whereas for-profits usually acknowledge income when items or companies are delivered.

- Fund Accounting: Nonprofits incessantly use fund accounting to trace restricted and unrestricted funds, making certain that donations are used in response to donor stipulations. That is hardly ever needed for for-profit entities.

- Expense Categorization: Nonprofits typically categorize bills by program, permitting for detailed evaluation of program prices and effectiveness. For-profits could focus extra on purposeful expense classes.

- Web Belongings: As an alternative of retained earnings (utilized by for-profits), nonprofits use the time period "internet property" to signify the distinction between property and liabilities. Web property are additional categorized into unrestricted, briefly restricted, and completely restricted.

Designing Your Nonprofit Chart of Accounts: A Step-by-Step Information

Making a complete and efficient chart of accounts requires cautious planning and consideration. The next steps present a roadmap:

-

Outline Your Group’s Wants: Start by figuring out the precise data your group wants to trace. Think about your applications, funding sources, and operational construction. Contain key employees members on this course of to make sure a complete understanding of the group’s monetary actions.

-

Select a Chart of Accounts Construction: Choose a construction that most closely fits your group’s measurement and complexity. Widespread constructions embrace the numerical system (utilizing sequential numbers) or the alphanumeric system (combining letters and numbers). Think about using a software program answer that robotically generates account numbers and ensures consistency.

-

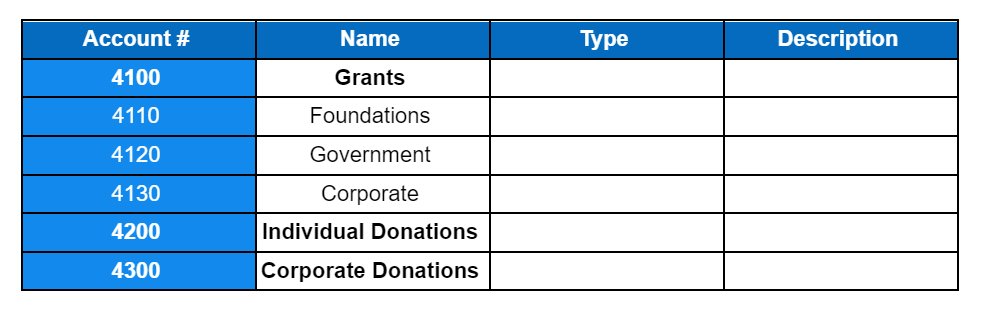

Develop a Chart of Accounts Template: Create a template that features the next data for every account:

- Account Quantity: A novel identifier for every account.

- Account Title: A transparent and concise description of the account.

- Account Kind: Point out whether or not the account is an asset, legal responsibility, fairness, income, or expense account.

- Fund Kind: Specify whether or not the account is related to unrestricted, briefly restricted, or completely restricted funds.

- Program: If relevant, assign the account to a selected program.

-

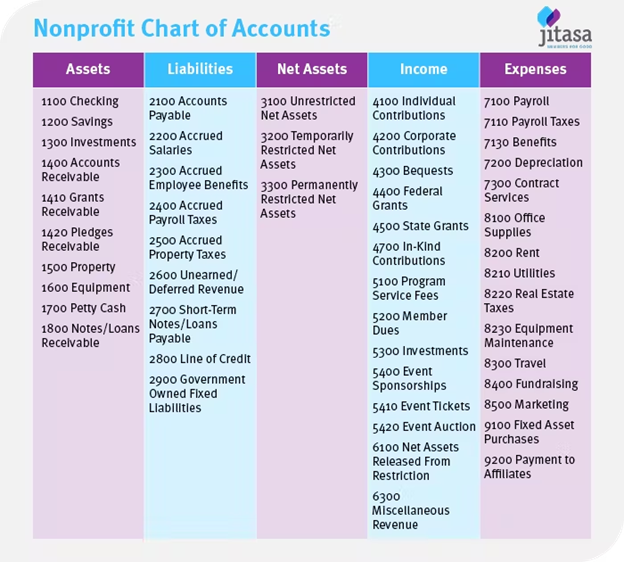

Set up Account Classes: Categorize accounts into significant teams to facilitate reporting and evaluation. Widespread classes embrace:

- Belongings: Money, accounts receivable, investments, property, plant, and tools.

- Liabilities: Accounts payable, salaries payable, deferred income.

- Web Belongings: Unrestricted internet property, briefly restricted internet property, completely restricted internet property.

- Income: Contributions, grants, program charges, funding revenue.

- Bills: Program companies, administration and common, fundraising.

-

Outline Sub-accounts: For better element, create sub-accounts inside every main class. For instance, beneath "Program Providers," you may need sub-accounts for particular applications or initiatives.

-

Common Overview and Updates: Your chart of accounts shouldn’t be static. Overview and replace it periodically to replicate modifications in your group’s applications, funding sources, and operational construction. This ensures that your chart stays related and correct.

Important Accounts for Nonprofit Organizations

Whereas the precise accounts will range relying on the group, some important accounts for many nonprofits embrace:

- Money: Tracks all money available and in financial institution accounts.

- Accounts Receivable: Information quantities owed to the group.

- Grants Receivable: Tracks funds promised however not but obtained.

- Pledges Receivable: Tracks donations promised however not but obtained.

- Investments: Information the worth of investments held by the group.

- Accounts Payable: Information quantities owed by the group.

- Salaries Payable: Information quantities owed to workers.

- Unrestricted Web Belongings: Represents the portion of internet property accessible for any goal.

- Briefly Restricted Web Belongings: Represents funds restricted by donors for particular functions or time durations.

- Completely Restricted Web Belongings: Represents funds restricted by donors for perpetuity.

- Contributions – Unrestricted: Tracks unrestricted donations.

- Contributions – Briefly Restricted: Tracks donations with short-term restrictions.

- Grants – Program Particular: Tracks grants obtained for particular applications.

- Program Service Bills: Tracks bills instantly associated to program supply.

- Administration and Basic Bills: Tracks administrative and operational bills.

- Fundraising Bills: Tracks bills associated to fundraising actions.

Software program Options for Nonprofit Chart of Accounts Administration

A number of software program options can be found to simplify the administration of a nonprofit chart of accounts. These options typically combine accounting, fundraising, and donor administration functionalities, streamlining monetary processes and bettering effectivity. Options to search for embrace:

- Automated Account Numbering: Ensures constant and correct account numbering.

- Customizable Chart of Accounts Templates: Permits for tailoring the chart to the precise wants of the group.

- Reporting and Evaluation Instruments: Gives instruments for producing varied monetary reviews and analyzing monetary knowledge.

- Integration with different methods: Facilitates seamless knowledge alternate with different software program methods utilized by the group.

Conclusion

A well-designed and meticulously maintained chart of accounts is crucial for the monetary well being and success of any nonprofit group. By following the steps outlined on this article and using acceptable software program options, nonprofits can guarantee correct monetary reporting, efficient program administration, and accountable stewardship of donor funds. Common evaluate and updates are important to adapt the chart to the group’s evolving wants and keep its effectiveness in supporting the group’s mission. Keep in mind, a robust chart of accounts is not only a compliance requirement; it is a very important instrument for transparency, accountability, and sustainable progress.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the Nonprofit Chart of Accounts: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!