Nvidia Inventory Worth At present: Dwell Chart Evaluation and Market Outlook

Associated Articles: Nvidia Inventory Worth At present: Dwell Chart Evaluation and Market Outlook

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Nvidia Inventory Worth At present: Dwell Chart Evaluation and Market Outlook. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Nvidia Inventory Worth At present: Dwell Chart Evaluation and Market Outlook

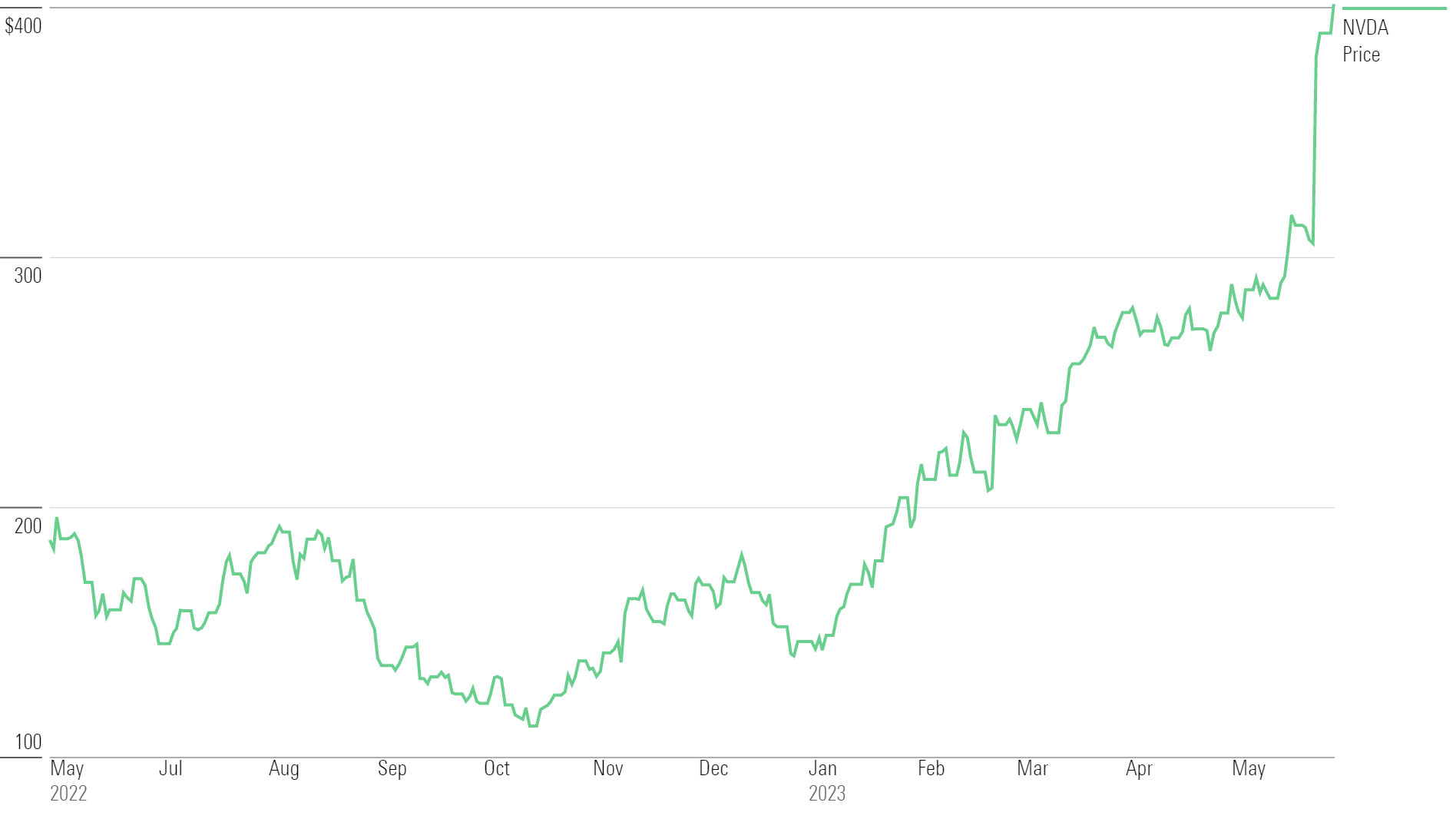

Nvidia (NVDA) has develop into a juggernaut within the expertise sector, its inventory worth a frequent topic of intense hypothesis and evaluation. Its dominance within the GPU market, coupled with its enlargement into AI, knowledge facilities, and automotive applied sciences, has made it a bellwether for the broader tech business. Understanding Nvidia’s present inventory worth, its dwell chart actions, and the components influencing its trajectory is essential for each buyers and market observers. This text will delve right into a complete evaluation, inspecting the present dwell chart knowledge (notice: dwell knowledge is dynamic and modifications continually; the evaluation beneath is predicated on a snapshot in time), key influencing components, and potential future eventualities.

Accessing the Dwell Chart:

Earlier than diving into the evaluation, it is essential to know the place to search out real-time knowledge. A number of respected sources present dwell inventory charts for NVDA, together with:

- Main Monetary Information Web sites: Websites like Yahoo Finance, Google Finance, Bloomberg, and MarketWatch provide interactive charts with numerous timeframes (from intraday to long-term historic knowledge), technical indicators, and quantity info.

- Brokerage Platforms: When you use a web based brokerage account, your platform will doubtless have a built-in charting instrument for monitoring NVDA’s worth in real-time.

- Devoted Monetary Information Suppliers: Firms like Refinitiv and FactSet present complete monetary knowledge, together with high-frequency dwell inventory charts with superior analytical instruments.

By accessing one in all these sources, you’ll be able to observe the dwell chart, together with the present worth, day by day excessive and low, buying and selling quantity, and any important worth actions all through the buying and selling day.

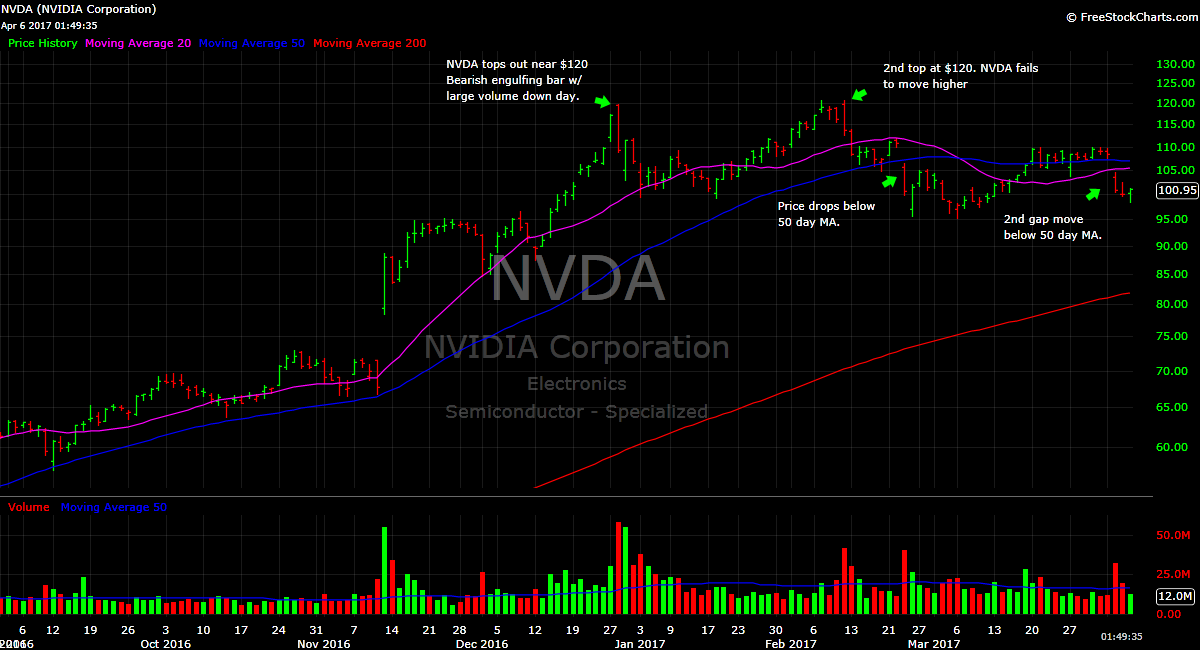

Analyzing the Dwell Chart (Snapshot Evaluation):

(Be aware: This part requires real-time knowledge, which isn’t accessible to this AI. The next is a hypothetical instance for instance the analytical course of.)

Let’s assume the NVDA dwell chart at the moment exhibits the next:

- Present Worth: $450

- Day’s Excessive: $455

- Day’s Low: $445

- Buying and selling Quantity: Above common

- Shifting Averages (e.g., 50-day and 200-day): Worth is above each, suggesting an uptrend.

- Relative Energy Index (RSI): Round 70, indicating the inventory is likely to be overbought.

- Worth Motion: The chart exhibits a latest surge adopted by a slight pullback, suggesting potential consolidation.

Primarily based on this hypothetical snapshot, we are able to draw some preliminary conclusions:

- Constructive Momentum: The worth is above its key shifting averages and buying and selling quantity is excessive, suggesting sturdy shopping for stress.

- Potential Overbought Situation: The excessive RSI suggests the inventory is likely to be due for a correction.

- Consolidation Section: The latest pullback might point out a interval of consolidation earlier than the following leg up.

Elements Influencing Nvidia’s Inventory Worth:

Quite a few components contribute to Nvidia’s risky inventory worth. Understanding these components is essential for knowledgeable funding choices:

- AI Increase: Nvidia’s GPUs are central to the event and deployment of synthetic intelligence, notably in deep studying. The fast development of the AI market considerably impacts NVDA’s efficiency. Any information associated to AI breakthroughs, elevated adoption, or authorities laws within the AI area will immediately have an effect on the inventory worth.

- Information Middle Development: Nvidia’s knowledge heart enterprise is experiencing explosive development, pushed by the rising demand for high-performance computing in cloud computing, massive knowledge analytics, and different purposes. This sector’s efficiency is a key driver of NVDA’s total valuation.

- Automotive Sector: Nvidia’s foray into the automotive business, offering superior driver-assistance methods (ADAS) and autonomous driving platforms, presents a big long-term development alternative. Progress on this sector and partnerships with main automotive producers affect investor sentiment.

- Competitors: Whereas Nvidia enjoys a dominant market share, competitors from AMD, Intel, and different firms is an element to contemplate. Any important aggressive developments or market share losses might influence the inventory worth.

- World Financial Circumstances: Like every expertise inventory, Nvidia is delicate to broader financial developments. Recessions, inflation, rate of interest hikes, and geopolitical instability can negatively have an effect on investor sentiment and result in worth corrections.

- Provide Chain and Manufacturing: Any disruptions to Nvidia’s manufacturing or provide chain, resembling chip shortages or geopolitical occasions, can influence its potential to satisfy demand, affecting its income and inventory worth.

- Monetary Efficiency: Nvidia’s quarterly earnings reviews are intently scrutinized by buyers. Robust earnings, exceeding expectations, usually result in worth will increase, whereas disappointing outcomes can set off sell-offs.

Future Outlook and Funding Issues:

Predicting future inventory costs is inherently speculative, however analyzing the components mentioned above can present insights into potential eventualities. The long-term outlook for Nvidia stays optimistic, pushed by the continued development of AI, knowledge facilities, and the automotive sector. Nevertheless, short-term volatility is more likely to persist because of the components talked about above.

Buyers ought to contemplate the next:

- Danger Tolerance: Nvidia’s inventory is taken into account comparatively high-risk as a result of its growth-oriented nature and susceptibility to market fluctuations. Buyers ought to solely make investments what they will afford to lose.

- Diversification: It is essential to diversify your funding portfolio to mitigate danger. Do not put all of your eggs in a single basket.

- Lengthy-Time period Perspective: Nvidia’s long-term development prospects are sturdy, however short-term worth fluctuations are inevitable. An extended-term funding horizon is mostly beneficial.

- Elementary Evaluation: Along with technical evaluation of the dwell chart, conducting thorough elementary evaluation, inspecting Nvidia’s monetary statements, and understanding its enterprise mannequin is crucial for knowledgeable decision-making.

Conclusion:

Nvidia’s inventory worth is a dynamic reflection of its technological developments and market place. Commonly monitoring the dwell chart, understanding the influencing components, and conducting thorough evaluation are crucial for navigating the complexities of investing on this high-growth, high-volatility inventory. Whereas the long run is unsure, Nvidia’s place on the forefront of technological innovation suggests a promising long-term outlook, though buyers ought to at all times train warning and handle danger successfully. Keep in mind, this evaluation is predicated on a hypothetical snapshot; at all times check with real-time knowledge from dependable sources earlier than making any funding choices.

Closure

Thus, we hope this text has supplied priceless insights into Nvidia Inventory Worth At present: Dwell Chart Evaluation and Market Outlook. We respect your consideration to our article. See you in our subsequent article!