The Bitcoin Halving: A Deep Dive into the Mechanics and Market Affect

Associated Articles: The Bitcoin Halving: A Deep Dive into the Mechanics and Market Affect

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to The Bitcoin Halving: A Deep Dive into the Mechanics and Market Affect. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

The Bitcoin Halving: A Deep Dive into the Mechanics and Market Affect

Bitcoin, the pioneering cryptocurrency, operates on a pre-programmed schedule of occasions that govern its issuance and, consequently, its inflation price. Central to this schedule is the "halving," a programmed discount within the price at which new bitcoins are created and added to the circulating provide. This occasion, occurring roughly each 4 years, has traditionally been related to important worth volatility and market hypothesis, making it an important side of understanding Bitcoin’s long-term trajectory. This text delves into the mechanics of the halving, its historic influence, and the potential implications of future halvings.

Understanding the Halving Mechanism:

Bitcoin’s design incorporates a hard and fast provide restrict of 21 million cash. This shortage is a core tenet of its worth proposition. To attain this restrict, the reward given to Bitcoin miners for validating transactions and including new blocks to the blockchain is halved at common intervals. Initially, the block reward was 50 BTC. After the primary halving in 2012, it dropped to 25 BTC. Subsequent halvings decreased it to 12.5 BTC (2016) after which to six.25 BTC (2020). The subsequent halving is predicted round April 2024, lowering the reward to three.125 BTC. This course of continues till all 21 million bitcoins are mined, which is projected to happen across the 12 months 2140.

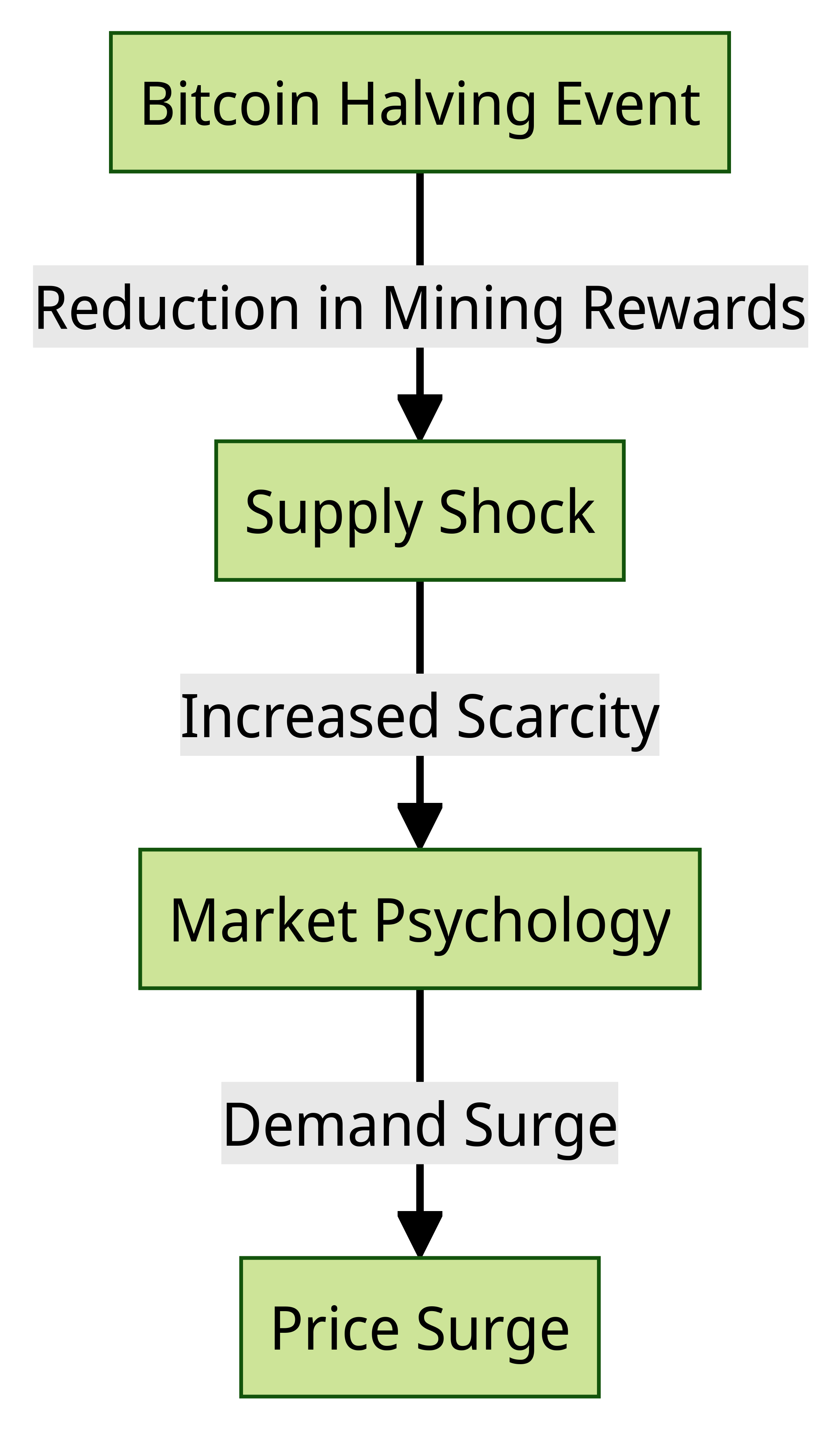

The halving is not a sudden, disruptive occasion; it is a gradual shift within the price of recent Bitcoin creation. Earlier than the halving, miners obtain a sure variety of bitcoins for every block they efficiently mine. After the halving, they obtain half that quantity. This discount within the price of recent Bitcoin issuance inherently reduces the inflation price of the cryptocurrency. This can be a key distinction between Bitcoin and fiat currencies, which might be printed at will by central banks, probably resulting in inflation.

Historic Affect of Halvings:

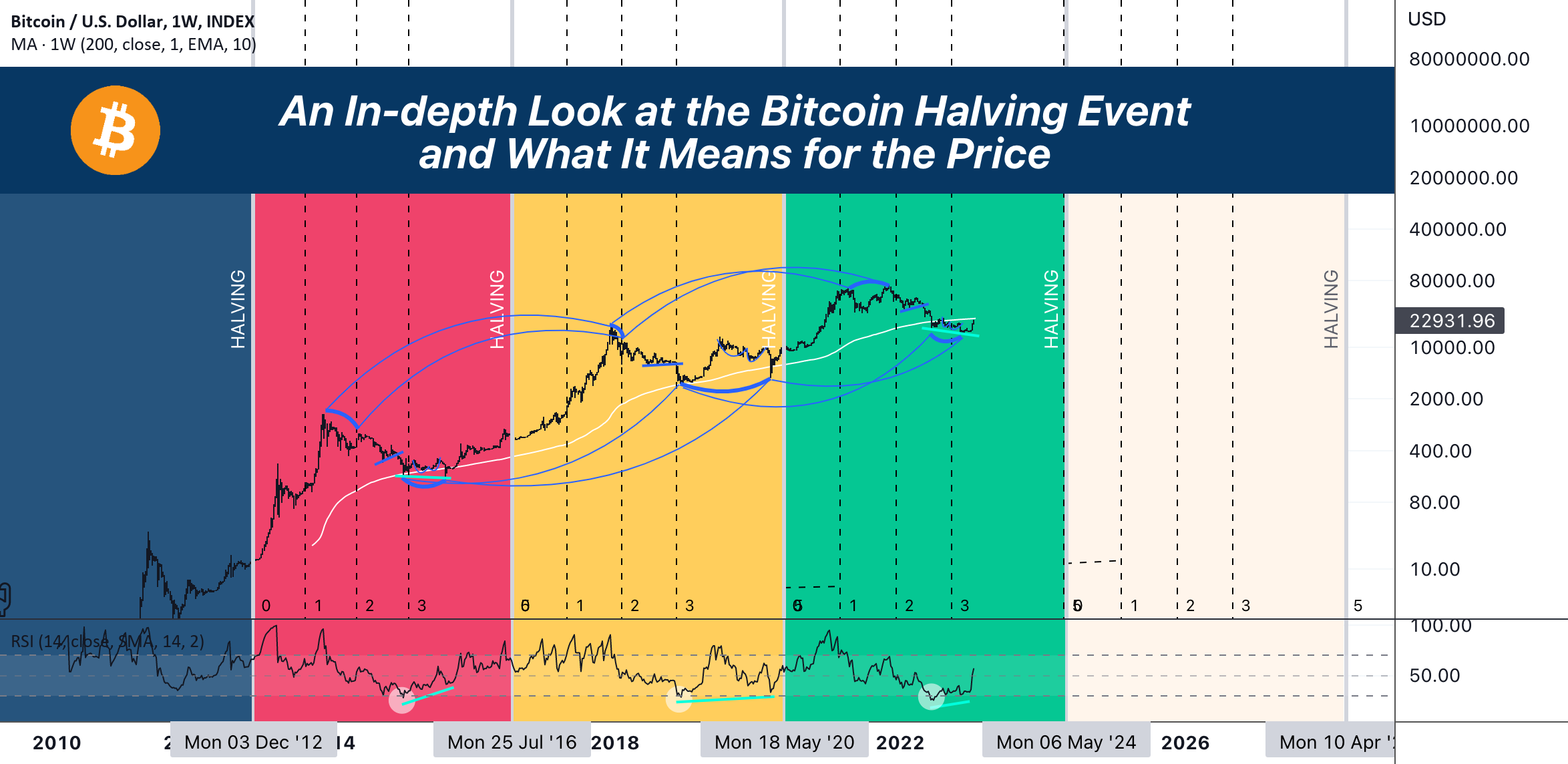

Analyzing the historic influence of earlier halvings offers beneficial insights into potential future situations. Whereas correlation does not equal causation, the info suggests a robust correlation between halvings and subsequent worth will increase.

-

2012 Halving: The primary halving, occurring in November 2012, noticed Bitcoin’s worth buying and selling round $12. Following the halving, the worth skilled a gradual enhance, finally reaching over $1,000 by late 2013. Whereas different elements contributed to this worth surge, the halving undoubtedly performed a job in lowering the availability of recent bitcoins getting into the market.

-

2016 Halving: The second halving in July 2016 occurred when Bitcoin’s worth was round $650. The next interval noticed a major worth appreciation, culminating in a peak of almost $20,000 by late 2017. Once more, numerous market forces contributed to this bull run, however the halving’s influence on lowering inflation and rising shortage is extensively thought of a major issue.

-

2020 Halving: The third halving in Could 2020 befell amidst the COVID-19 pandemic and world financial uncertainty. Bitcoin’s worth was round $9,000 on the time. Following the halving, the worth surged dramatically, reaching an all-time excessive of over $64,000 by April 2021. This bull run was arguably extra pronounced and sustained than earlier ones, additional strengthening the narrative surrounding the halving’s influence.

Components Influencing Publish-Halving Value Actions:

Whereas historic information suggests a optimistic correlation between halvings and worth will increase, it is essential to acknowledge that different elements considerably affect Bitcoin’s worth. These embrace:

-

Market Sentiment and Hypothesis: The anticipation surrounding a halving usually results in elevated hypothesis and shopping for strain, driving up the worth even earlier than the occasion happens. Conversely, unfavourable information or regulatory uncertainty can dampen this impact.

-

Adoption and Community Development: Elevated adoption of Bitcoin by institutional buyers, companies, and governments can positively affect its worth, whatever the halving. A rising community impact, mirrored in elevated transaction quantity and developer exercise, additionally contributes to cost appreciation.

-

Macroeconomic Circumstances: World financial elements, comparable to inflation, rates of interest, and geopolitical occasions, can considerably influence the worth of Bitcoin and different threat belongings. A robust world financial system could not essentially correlate with a excessive Bitcoin worth, and vice versa.

-

Mining Problem Adjustment: The Bitcoin community mechanically adjusts the mining issue to keep up a constant block era time of roughly 10 minutes. After a halving, the decreased block reward would possibly result in a short lived lower in mining profitability. Nevertheless, the issue adjustment mechanism ensures that miners proceed to function effectively.

The 2024 Halving and Past:

The upcoming halving in 2024 is anticipated with appreciable curiosity. The decreased block reward will additional lower Bitcoin’s inflation price, probably rising its shortage and driving up demand. Nevertheless, predicting the exact influence is difficult because of the interaction of assorted elements talked about above.

The market’s response will rely upon the prevailing macroeconomic local weather, the extent of institutional adoption, and the general sentiment in direction of cryptocurrencies. A optimistic confluence of those elements might result in a major worth surge, whereas a unfavourable surroundings might dampen the halving’s impact.

Conclusion:

The Bitcoin halving is a major occasion within the cryptocurrency’s lifecycle. Its programmed nature, lowering the inflation price and rising shortage, has traditionally been related to intervals of worth appreciation. Nevertheless, it is essential to know that the halving is only one issue amongst many who affect Bitcoin’s worth. Market sentiment, adoption charges, macroeconomic situations, and technological developments all play essential roles in figuring out Bitcoin’s future trajectory. Whereas the 2024 halving is predicted to generate important market pleasure, buyers ought to method it with a balanced perspective, contemplating the inherent dangers and uncertainties related to the cryptocurrency market. A radical understanding of the underlying mechanics and the advanced interaction of market forces is important for knowledgeable decision-making. The halving ought to be considered as a long-term structural shift moderately than a short-term worth catalyst, and its true influence will seemingly unfold over an prolonged interval.

Closure

Thus, we hope this text has offered beneficial insights into The Bitcoin Halving: A Deep Dive into the Mechanics and Market Affect. We thanks for taking the time to learn this text. See you in our subsequent article!