The Chart of Accounts Underneath US GAAP: Construction, Performance, and Greatest Practices

Associated Articles: The Chart of Accounts Underneath US GAAP: Construction, Performance, and Greatest Practices

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to The Chart of Accounts Underneath US GAAP: Construction, Performance, and Greatest Practices. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

The Chart of Accounts Underneath US GAAP: Construction, Performance, and Greatest Practices

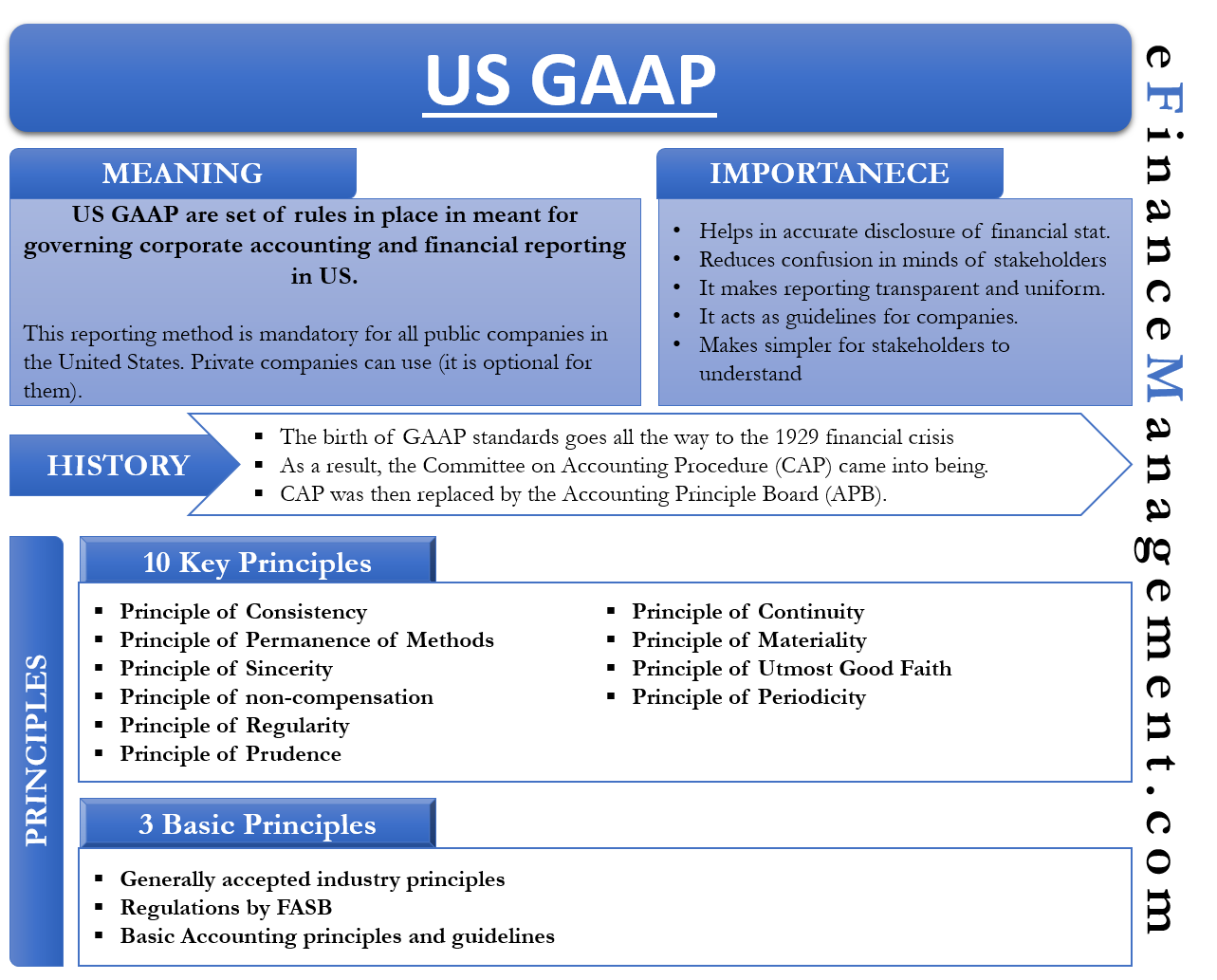

The Chart of Accounts (COA) is the spine of any group’s monetary reporting system. Underneath US Typically Accepted Accounting Ideas (US GAAP), a well-structured and meticulously maintained COA is essential for correct monetary assertion preparation, regulatory compliance, and efficient inner administration. This text delves into the intricacies of the COA below US GAAP, masking its construction, performance, and finest practices for implementation and upkeep.

Understanding the Chart of Accounts:

The COA is a complete record of all accounts utilized by an organization to report its monetary transactions. Every account represents a selected ingredient of the corporate’s monetary actions, categorized to facilitate evaluation and reporting. Consider it as an in depth organizational system for all of the monetary information flowing by a enterprise. It is a hierarchical construction, usually using a numerical coding system to categorise accounts by kind, permitting for environment friendly information aggregation and retrieval.

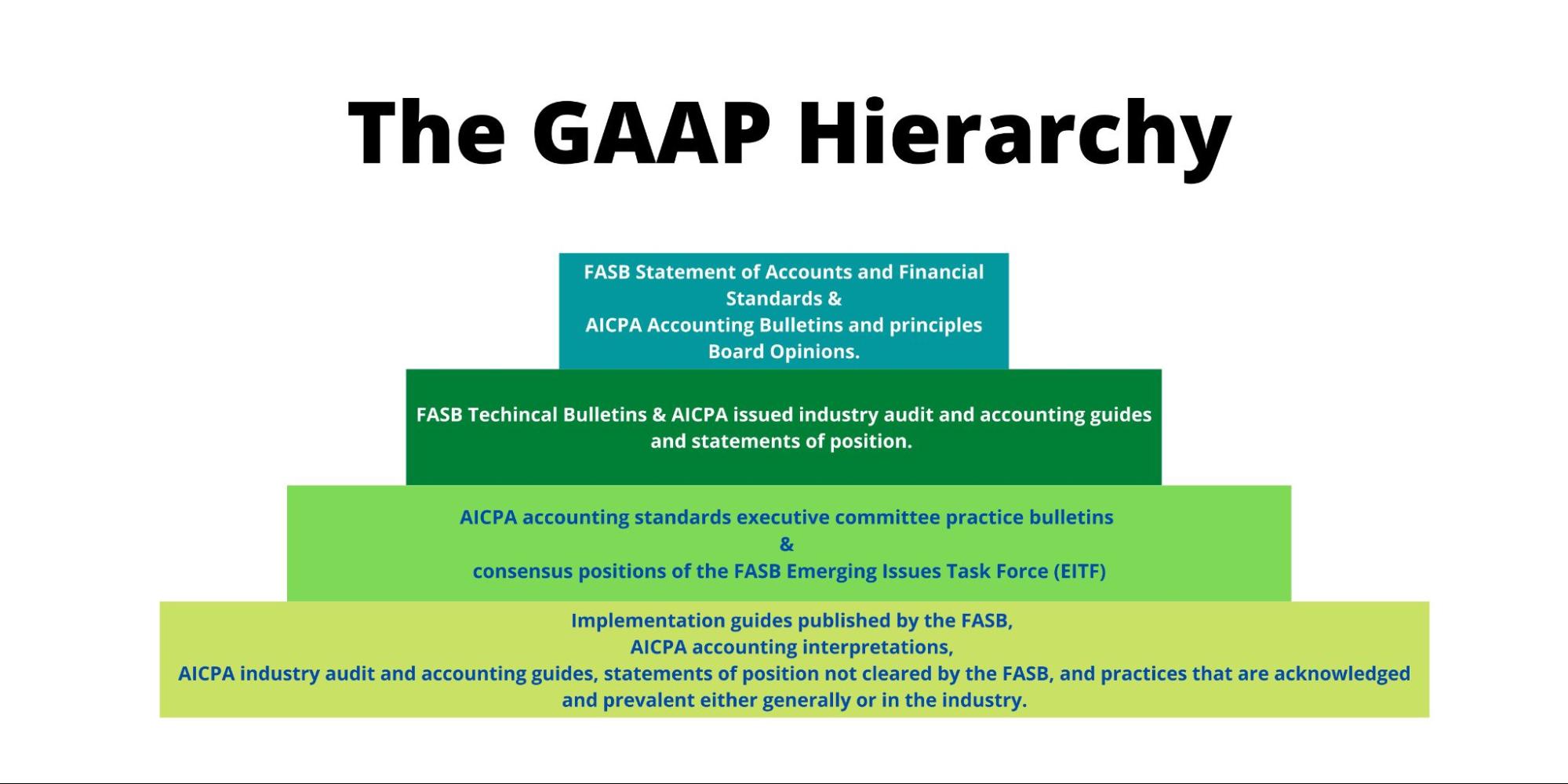

Underneath US GAAP, the COA should adhere to sure elementary rules:

- Compliance with GAAP: The account construction should align with the rules of US GAAP, guaranteeing transactions are recorded and categorized based on established accounting requirements. This consists of adhering to the basic accounting equation (Belongings = Liabilities + Fairness) and correct recognition and measurement of economic objects.

- Materiality: The extent of element within the COA ought to replicate the materiality of data for the group. Whereas a big company would possibly require a extremely detailed COA, a smaller enterprise might have a extra simplified construction.

- Consistency: As soon as established, the COA ought to be maintained constantly over time to make sure comparability of economic information throughout completely different intervals. Modifications ought to be documented and applied fastidiously to keep away from disrupting the integrity of the monetary information.

- Relevance: The COA ought to be designed to offer related and helpful info for each inner administration and exterior stakeholders. This implies the accounts ought to be tailor-made to the precise wants of the enterprise and its reporting necessities.

Construction of a US GAAP Compliant Chart of Accounts:

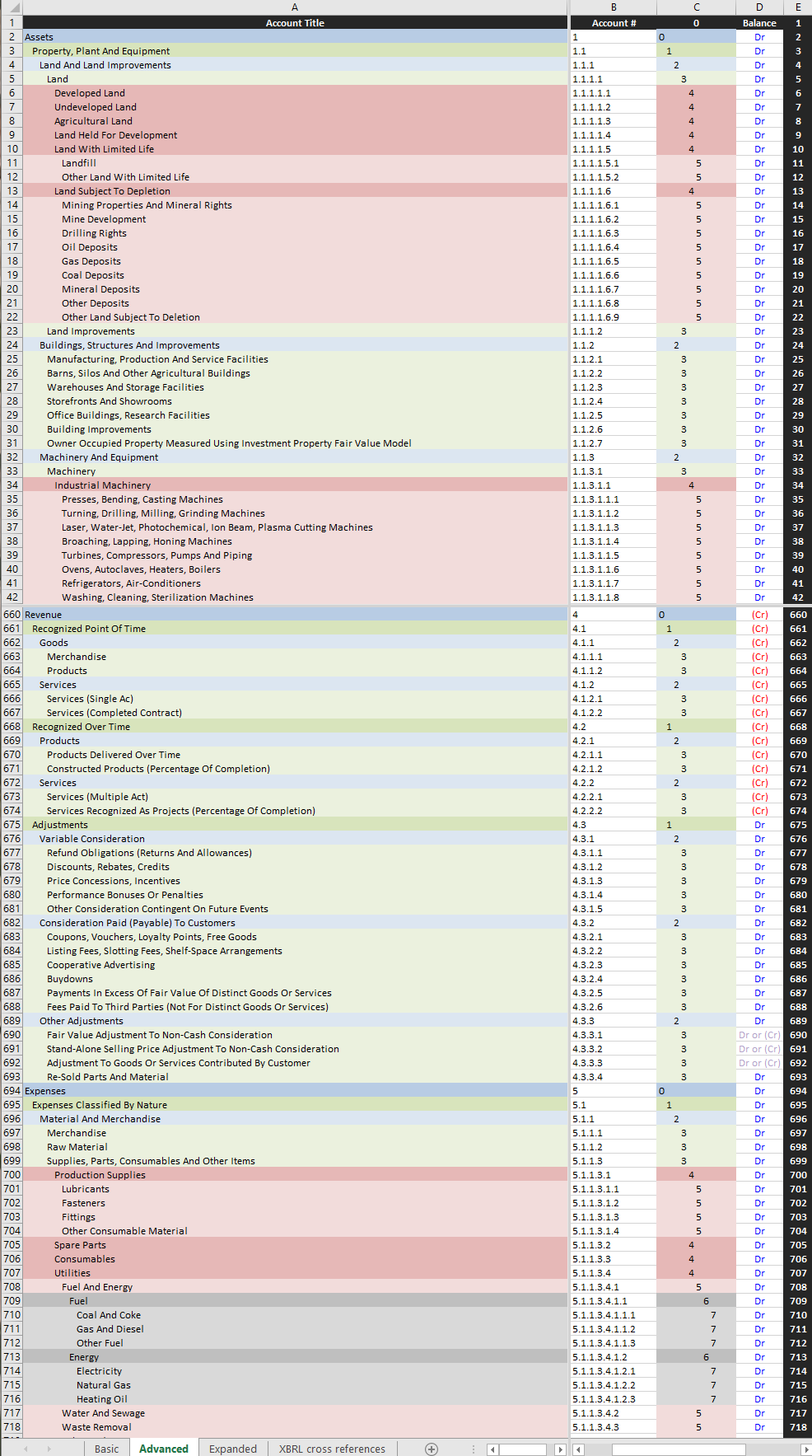

A typical COA below US GAAP follows a hierarchical construction, usually utilizing a numerical coding system. Whereas the precise construction can fluctuate relying on the scale and complexity of the enterprise, a standard framework consists of the next main classes:

-

Belongings: These signify what the corporate owns, together with:

- Present Belongings: Belongings anticipated to be transformed into money or used inside one 12 months, similar to money, accounts receivable, stock, and pay as you go bills.

- Non-Present Belongings: Belongings with a helpful life exceeding one 12 months, together with property, plant, and tools (PP&E), intangible property (patents, copyrights), and long-term investments.

-

Liabilities: These signify what the corporate owes to others, together with:

- Present Liabilities: Obligations due inside one 12 months, similar to accounts payable, salaries payable, short-term loans, and present portion of long-term debt.

- Non-Present Liabilities: Obligations due past one 12 months, similar to long-term loans, bonds payable, and deferred income.

-

Fairness: This represents the house owners’ stake within the firm, together with:

- Contributed Capital: Investments made by shareholders.

- Retained Earnings: Accrued income that haven’t been distributed as dividends.

-

Income: Inflows of property or settlements of liabilities ensuing from the strange actions of the enterprise. Particular income accounts would possibly embrace gross sales income, service income, curiosity income, and so forth.

-

Bills: Outflows of property or incurrences of liabilities ensuing from the strange actions of the enterprise. Bills are categorized by operate (e.g., price of products offered, promoting bills, administrative bills, analysis and improvement bills) or by nature (e.g., salaries, lease, utilities).

Numerical Coding Methods:

A numerical coding system supplies a structured and arranged method to managing the COA. Frequent strategies embrace:

- Sequential Numbering: A easy system the place accounts are assigned consecutive numbers.

- Hierarchical Numbering: A extra advanced system utilizing a collection of digits to signify completely different ranges of element. For instance, 1000-1999 would possibly signify property, with 1100-1199 representing present property, and 1110-1119 representing particular present property like money and accounts receivable.

The selection of coding system is dependent upon the complexity of the enterprise and its reporting wants. A well-designed coding system facilitates information aggregation, evaluation, and reporting.

Greatest Practices for Chart of Accounts Administration:

- Common Overview and Updates: The COA ought to be reviewed and up to date periodically to make sure it stays related and correct. This consists of including new accounts as wanted and eradicating out of date accounts.

- Documentation: Thorough documentation of the COA, together with account descriptions and coding construction, is essential for sustaining consistency and facilitating understanding.

- Inside Controls: Robust inner controls are important to make sure the accuracy and reliability of the information recorded within the COA. This consists of segregation of duties, authorization procedures, and common reconciliation of accounts.

- Software program Integration: Using accounting software program that integrates with the COA simplifies information entry, processing, and reporting.

- Person Coaching: Correct coaching of personnel on the use and upkeep of the COA is important to make sure correct information entry and reporting.

- Consideration of Business Particular Wants: Sure industries have distinctive accounting necessities that must be mirrored within the COA design. For instance, a producing firm would require accounts for work-in-progress and price of products offered {that a} service-based enterprise could not.

- Future Scalability: The COA ought to be designed with future progress in thoughts. It ought to be versatile sufficient to accommodate modifications within the enterprise’s operations and reporting wants.

Affect of a Effectively-Designed Chart of Accounts:

A well-designed and maintained COA gives quite a few advantages:

- Correct Monetary Reporting: Supplies the muse for correct and dependable monetary statements, guaranteeing compliance with US GAAP.

- Improved Choice-Making: Facilitates the evaluation of economic information, enabling higher knowledgeable enterprise choices.

- Enhanced Effectivity: Streamlines monetary processes and reduces the effort and time required for monetary reporting.

- Higher Inside Management: Helps the institution of sturdy inner controls to stop fraud and errors.

- Facilitates Regulatory Compliance: Ensures compliance with related accounting requirements and laws.

Conclusion:

The Chart of Accounts is a elementary part of economic reporting below US GAAP. A well-structured, meticulously maintained COA is important for correct monetary reporting, efficient administration decision-making, and compliance with regulatory necessities. By following finest practices and often reviewing and updating the COA, organizations can make sure that their monetary info is dependable, related, and helpful for all stakeholders. The funding in a sturdy COA is an funding within the long-term monetary well being and stability of the enterprise.

:max_bytes(150000):strip_icc()/chart-of-accounts-984cd9454c364932b0cba045f56a6bb1.jpg)

Closure

Thus, we hope this text has supplied beneficial insights into The Chart of Accounts Underneath US GAAP: Construction, Performance, and Greatest Practices. We respect your consideration to our article. See you in our subsequent article!