The Election Yr Rollercoaster: A Deep Dive into Inventory Market Efficiency Throughout Presidential Elections

Associated Articles: The Election Yr Rollercoaster: A Deep Dive into Inventory Market Efficiency Throughout Presidential Elections

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to The Election Yr Rollercoaster: A Deep Dive into Inventory Market Efficiency Throughout Presidential Elections. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

The Election Yr Rollercoaster: A Deep Dive into Inventory Market Efficiency Throughout Presidential Elections

The quadrennial American presidential election is a spectacle of political maneuvering, passionate debate, and in the end, a choice that shapes the nation’s course for the following 4 years. However past the political rhetoric and marketing campaign guarantees lies one other vital participant affected by the electoral cycle: the inventory market. Whereas no single election definitively dictates market efficiency, historic information reveals intriguing patterns and correlations between election years and inventory market fluctuations. Analyzing these developments can supply beneficial insights for traders navigating the customarily turbulent waters of an election yr.

Historic Tendencies: A Combined Bag of Outcomes

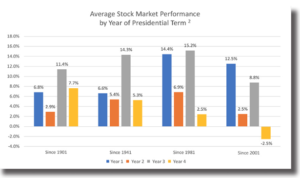

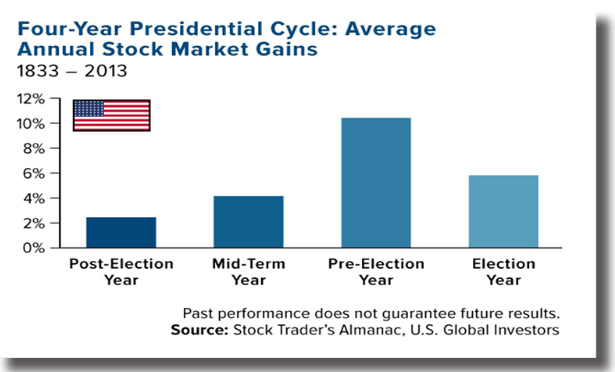

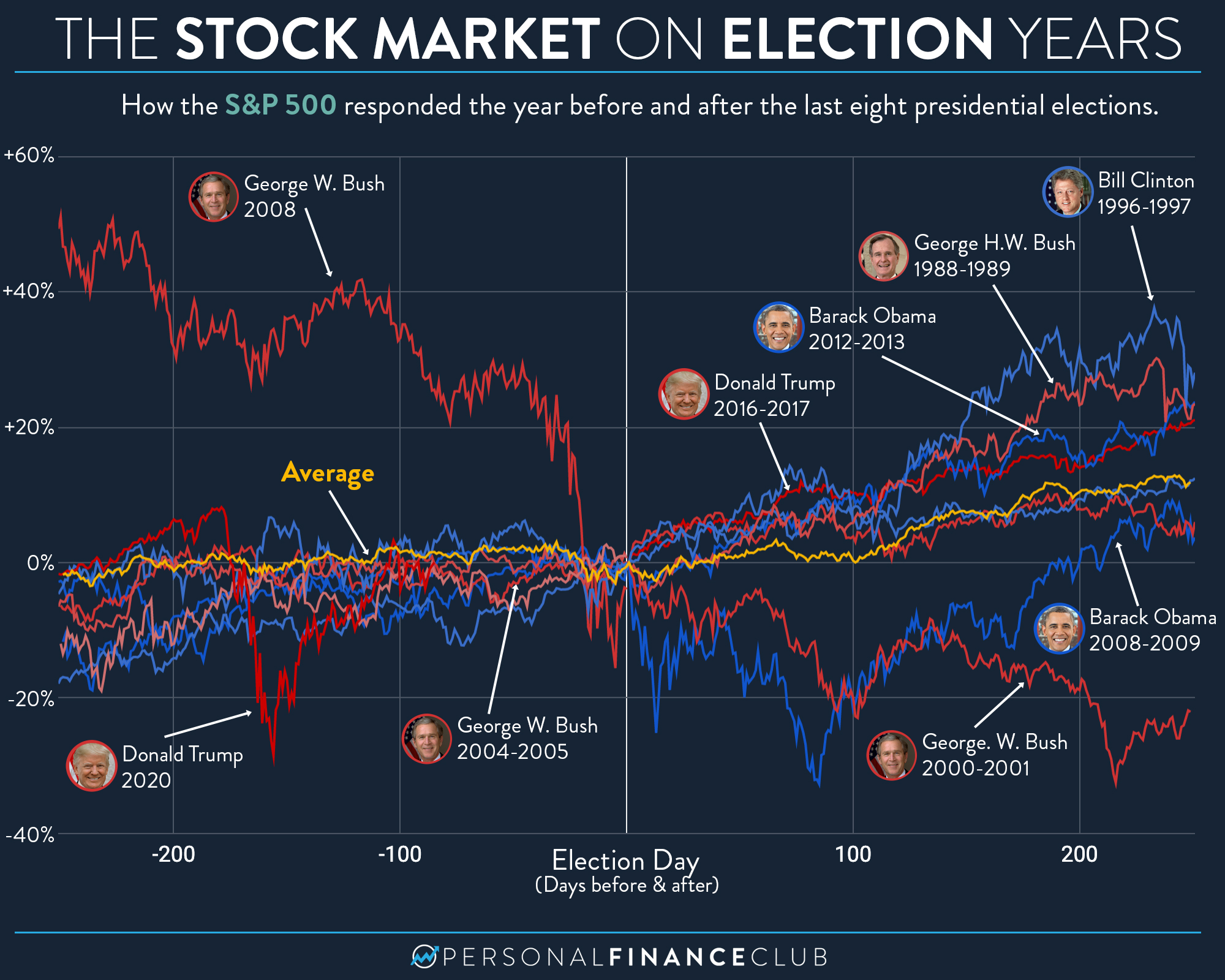

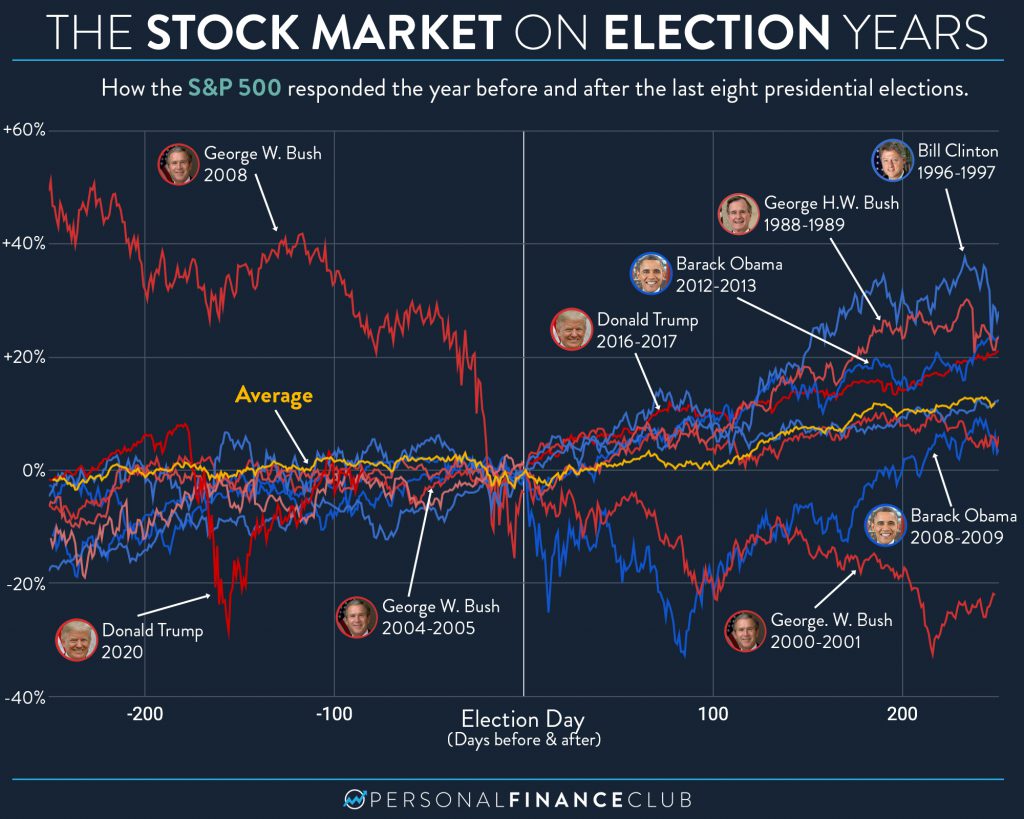

Inspecting inventory market efficiency throughout US presidential election years reveals a posh image, removed from a easy "bull" or "bear" narrative. Whereas some elections have coincided with strong market positive aspects, others have witnessed vital declines. The sheer variety of financial situations, geopolitical occasions, and coverage proposals throughout totally different election cycles makes it troublesome to determine a definitive causal hyperlink between elections themselves and market actions.

As an illustration, the 1980 election, which noticed Ronald Reagan’s victory, marked the start of a big bull market. Equally, the 1992 election, leading to Invoice Clinton’s presidency, additionally witnessed robust market development. Nevertheless, the 2000 election, which noticed a contested consequence between George W. Bush and Al Gore, was adopted by the dot-com bubble burst and subsequent recession. The 2008 election, occurring amidst the worldwide monetary disaster, noticed a dramatic market downturn. These examples spotlight the multifaceted nature of market habits throughout election years, underscoring the affect of things past the electoral course of itself.

The Pre-Election Jitters: Uncertainty and Volatility

One constant statement throughout quite a few election cycles is the elevated volatility main as much as the election. The uncertainty surrounding the potential consequence, coupled with diverging coverage proposals from candidates, usually creates market nervousness. Traders change into hesitant, resulting in elevated buying and selling exercise and worth fluctuations. This heightened volatility can current each alternatives and dangers. Savvy traders may exploit short-term worth swings, whereas extra risk-averse people may favor to undertake a wait-and-see strategy.

The divergence in coverage platforms between candidates considerably contributes to this pre-election volatility. Differing approaches to taxation, regulation, commerce, and social applications can create uncertainty concerning the future financial panorama. For instance, a candidate advocating for vital tax cuts may set off market optimism, whereas a candidate proposing elevated regulation might result in market apprehension. This uncertainty fuels hypothesis and amplifies market reactions to information and occasions.

Publish-Election Reactions: A Interval of Adjustment

The interval instantly following the election usually witnesses a interval of market adjustment. Whatever the victor, the preliminary market response displays the collective evaluation of the end result’s potential affect on the economic system. A decisive victory for a popular candidate may result in a rally, whereas a detailed or surprising consequence might set off elevated uncertainty and volatility.

Nevertheless, the post-election interval is just not merely a mirrored image of the instant consequence. The market’s response can be formed by the transition course of, the composition of the brand new administration, and the following coverage bulletins. The preliminary market optimism or pessimism may be rapidly reversed if the incoming administration’s actions deviate from expectations. This highlights the significance of rigorously analyzing the brand new administration’s coverage agenda and its potential affect on numerous sectors of the economic system.

Sector-Particular Impacts: A Story of Two Industries

The affect of election years on the inventory market is just not uniform throughout all sectors. Sure industries are extra delicate to coverage adjustments than others. As an illustration, the healthcare sector is commonly extremely vulnerable to adjustments in rules and authorities spending. Equally, the power sector is weak to shifts in environmental insurance policies and power rules. The monetary sector is especially delicate to adjustments in monetary rules and financial coverage.

However, sectors like know-how and client staples are likely to exhibit better resilience to political shifts. Know-how firms, significantly these with robust world presence, are sometimes much less affected by home coverage adjustments. Equally, client staples, which characterize important items and companies, keep comparatively constant demand regardless of political outcomes.

Analyzing the 2024 Election Panorama: A Preliminary Look

The 2024 US presidential election is already producing appreciable market hypothesis. The potential candidates and their coverage platforms are being rigorously scrutinized for his or her potential affect on numerous sectors. Traders are analyzing the potential results of proposed tax reforms, commerce insurance policies, and regulatory adjustments. Understanding the potential implications of every candidate’s financial agenda is essential for knowledgeable funding selections.

Elements past the election itself additionally play a big function in shaping the market’s trajectory. International financial situations, inflation charges, rate of interest insurance policies, and geopolitical occasions will all work together with the election cycle to affect market efficiency. Traders should undertake a holistic perspective, contemplating each home and worldwide components when assessing the potential affect of the 2024 election on the inventory market.

Methods for Navigating the Election Yr Market:

Navigating the election yr market requires a multi-faceted strategy. Traders ought to:

- Diversify their portfolios: Spreading investments throughout totally different asset lessons and sectors reduces the affect of any single occasion or coverage change.

- Keep a long-term perspective: Brief-term market fluctuations mustn’t derail a long-term funding technique.

- Keep knowledgeable: Intently comply with information and evaluation associated to the election, the economic system, and related coverage proposals.

- Think about hedging methods: Choices and different hedging devices may also help mitigate potential losses during times of elevated volatility.

- Search skilled recommendation: Consulting with a monetary advisor can present customized steering primarily based on particular person danger tolerance and funding objectives.

Conclusion:

The connection between presidential election years and inventory market efficiency is advanced and multifaceted. Whereas historic information reveals some fascinating developments, it’s essential to keep away from simplistic interpretations. The market’s response to elections is influenced by a large number of things, together with financial situations, geopolitical occasions, and the precise coverage proposals of the candidates. Traders ought to undertake a complete strategy, contemplating all related components and using acceptable danger administration methods to navigate the distinctive challenges and alternatives introduced by an election yr. Finally, profitable investing throughout an election yr requires a mix of knowledgeable evaluation, strategic planning, and a long-term perspective.

Closure

Thus, we hope this text has supplied beneficial insights into The Election Yr Rollercoaster: A Deep Dive into Inventory Market Efficiency Throughout Presidential Elections. We admire your consideration to our article. See you in our subsequent article!