The Steepening Slope: Why Chart Developments Seem Steeper at Excessive Costs Than Low Costs – A Deep Dive into Market Dynamics

Associated Articles: The Steepening Slope: Why Chart Developments Seem Steeper at Excessive Costs Than Low Costs – A Deep Dive into Market Dynamics

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to The Steepening Slope: Why Chart Developments Seem Steeper at Excessive Costs Than Low Costs – A Deep Dive into Market Dynamics. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

The Steepening Slope: Why Chart Developments Seem Steeper at Excessive Costs Than Low Costs – A Deep Dive into Market Dynamics

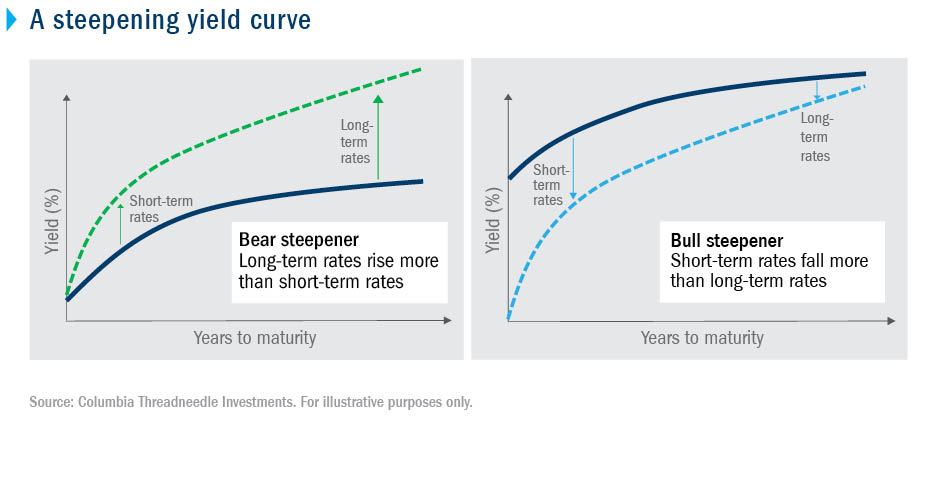

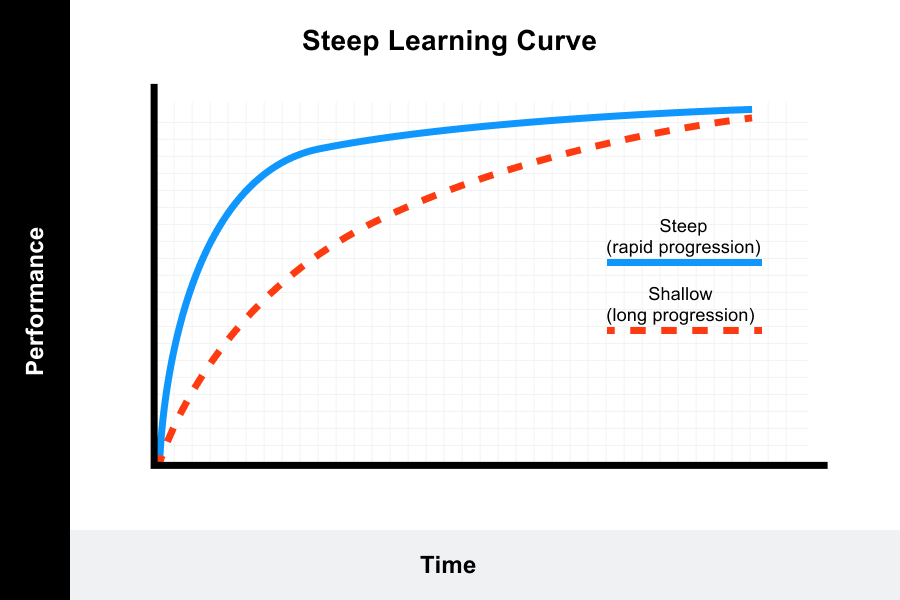

The visible illustration of market traits by charts usually reveals a captivating phenomenon: uptrends seem steeper at increased value ranges, whereas downtrends exhibit a extra pronounced slope at cheaper price ranges. This is not a mere optical phantasm; it is a reflection of advanced market dynamics influenced by elements starting from investor psychology and volatility to the very nature of percentage-based value actions. Understanding this phenomenon is essential for deciphering charts precisely and making knowledgeable buying and selling choices.

The Phantasm of Steepness: A Proportion-Primarily based Perspective

The core motive behind this perceived distinction in slope lies within the share change, somewhat than absolutely the value change. Think about two situations:

- State of affairs 1: A inventory rises from $1 to $2. It is a 100% improve. On a chart, this would seem as a comparatively steep upward motion.

- State of affairs 2: A inventory rises from $100 to $101. It is a 1% improve. On the identical chart, this would seem as a a lot much less steep motion, regardless of representing the identical absolute greenback achieve ($1).

This illustrates the basic precept: a given share change represents a bigger absolute value motion at increased value ranges. Subsequently, a ten% improve from $100 ($10) will seem steeper on a chart than a ten% improve from $10 ($1), though each signify the identical share achieve. This straight interprets to the visible notion of a steeper trendline at increased value factors.

Volatility and its Function in Perceived Steepness

Volatility, the measure of value fluctuations, performs a big function in influencing the perceived steepness of chart traits. Greater value ranges usually correlate with increased volatility. This elevated volatility results in bigger value swings in absolute phrases, contributing to the impression of a steeper upward or downward pattern.

Think about a inventory buying and selling at $10 with low volatility. A $1 improve would possibly take a number of days and even weeks. Nevertheless, the identical inventory at $100 would possibly expertise a $10 improve in a single day on account of increased volatility. This speedy value motion creates the visible impact of a steeper slope, even when the proportion change stays constant.

Conversely, in periods of low volatility at cheaper price ranges, value actions are sometimes smaller and extra gradual, leading to a much less steep look on the chart, whatever the share change.

Investor Psychology and its Affect

Investor psychology considerably impacts the worth motion and, consequently, the perceived steepness of traits. At increased value ranges, investor confidence is commonly increased, resulting in extra aggressive shopping for and promoting. This elevated exercise can exacerbate value swings, contributing to the notion of a steeper pattern.

Concern and uncertainty are extra prevalent at cheaper price ranges. Traders are usually extra cautious, resulting in slower value actions and a much less dramatic visible illustration of the pattern. This hesitancy dampens absolutely the value modifications, making the pattern seem much less steep.

The Influence of Chart Scaling and Timeframes

The scaling of the chart itself performs a vital function in how steep a pattern seems. A chart with a smaller value scale will exaggerate the vertical distance of value actions, making traits seem steeper. Conversely, a bigger value scale will compress the vertical distance, making traits seem much less steep.

Equally, the timeframe used considerably impacts the notion of steepness. A brief-term chart (e.g., hourly or every day) will present extra dramatic value fluctuations, resulting in steeper-looking traits, whereas a long-term chart (e.g., weekly or month-to-month) will clean out these fluctuations, leading to much less steep-appearing traits.

Mathematical Illustration and Logarithmic Scales

The phenomenon of steeper traits at increased costs might be mathematically defined. Whereas linear scales signify absolute value modifications, logarithmic scales signify share modifications. Utilizing a logarithmic scale on a chart successfully mitigates the visible distortion attributable to the disproportionate impression of share modifications at totally different value ranges. A logarithmic scale ensures that equal share modifications are represented by equal vertical distances on the chart, offering a extra correct visible illustration of the pattern’s slope whatever the value stage.

Sensible Implications for Merchants and Traders

Understanding the interaction between share modifications, volatility, investor psychology, and chart scaling is essential for correct chart interpretation. Relying solely on the visible steepness of a trendline might be deceptive. Merchants and traders ought to:

- Think about share modifications: Give attention to share features and losses somewhat than solely on absolute value actions.

- Analyze volatility: Account for volatility when deciphering chart traits. Greater volatility can result in exaggerated perceptions of steepness.

- Use logarithmic scales: Make use of logarithmic scales to acquire a extra correct illustration of share modifications and keep away from visible distortions.

- Analyze a number of timeframes: Look at charts throughout totally different timeframes to achieve a complete understanding of the pattern’s power and sustainability.

- Keep away from emotional biases: Acknowledge and mitigate the affect of emotional biases on chart interpretation.

Conclusion

The perceived distinction within the steepness of chart traits at excessive versus low costs will not be a flaw in chart illustration however somewhat a consequence of the interaction between percentage-based value actions, volatility, investor psychology, and chart scaling. By understanding these underlying dynamics and using acceptable analytical methods, merchants and traders can achieve a extra correct and nuanced understanding of market traits and make better-informed choices. Ignoring this phenomenon can result in misinterpretations and doubtlessly pricey buying and selling errors. The important thing takeaway is to look past the visible impression of steepness and delve deeper into the underlying market forces driving the worth motion.

Closure

Thus, we hope this text has offered priceless insights into The Steepening Slope: Why Chart Developments Seem Steeper at Excessive Costs Than Low Costs – A Deep Dive into Market Dynamics. We hope you discover this text informative and useful. See you in our subsequent article!