The Final Chart Patterns Cheat Sheet: Decoding Market Actions for Worthwhile Buying and selling

Associated Articles: The Final Chart Patterns Cheat Sheet: Decoding Market Actions for Worthwhile Buying and selling

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to The Final Chart Patterns Cheat Sheet: Decoding Market Actions for Worthwhile Buying and selling. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

The Final Chart Patterns Cheat Sheet: Decoding Market Actions for Worthwhile Buying and selling

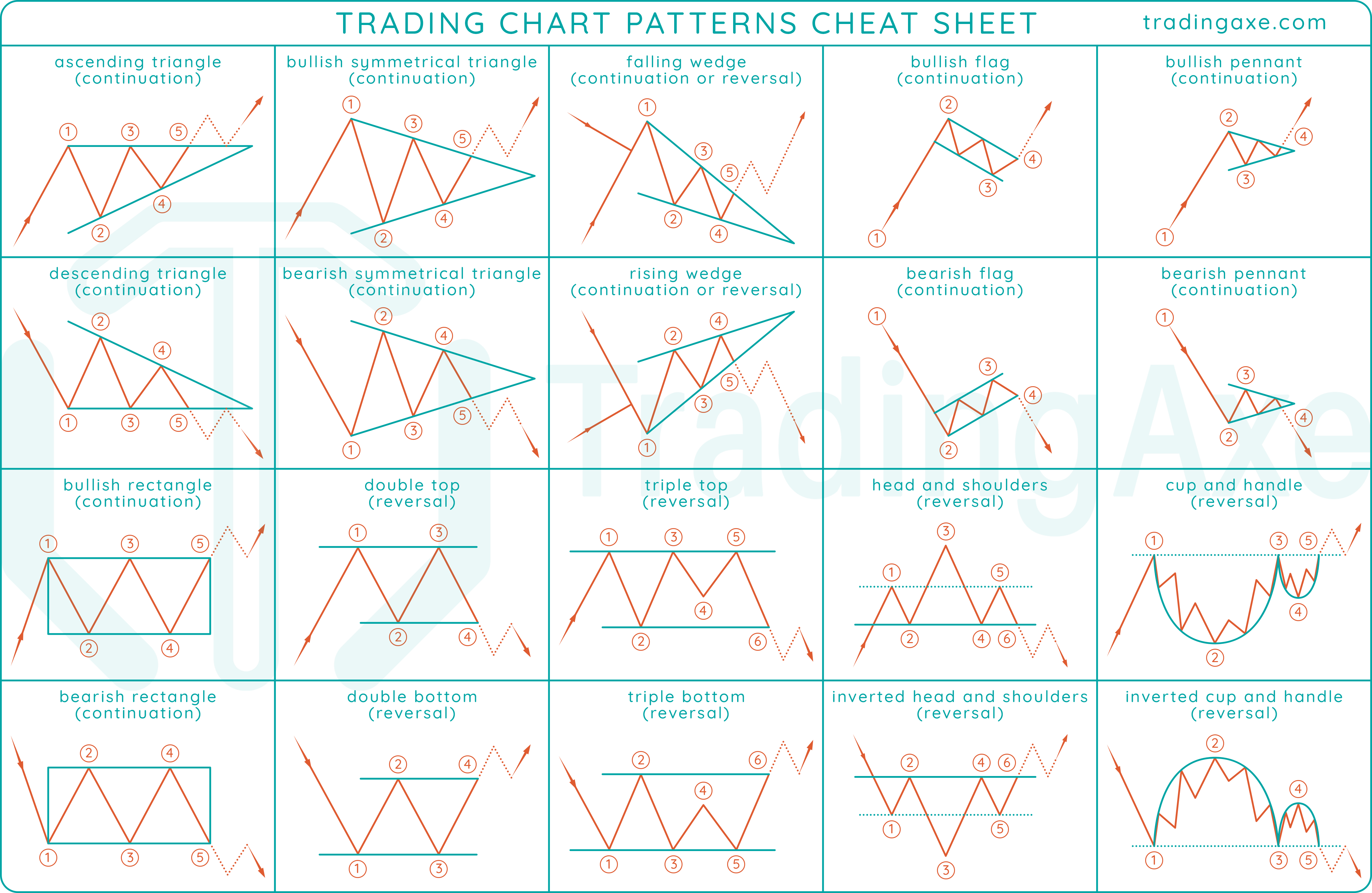

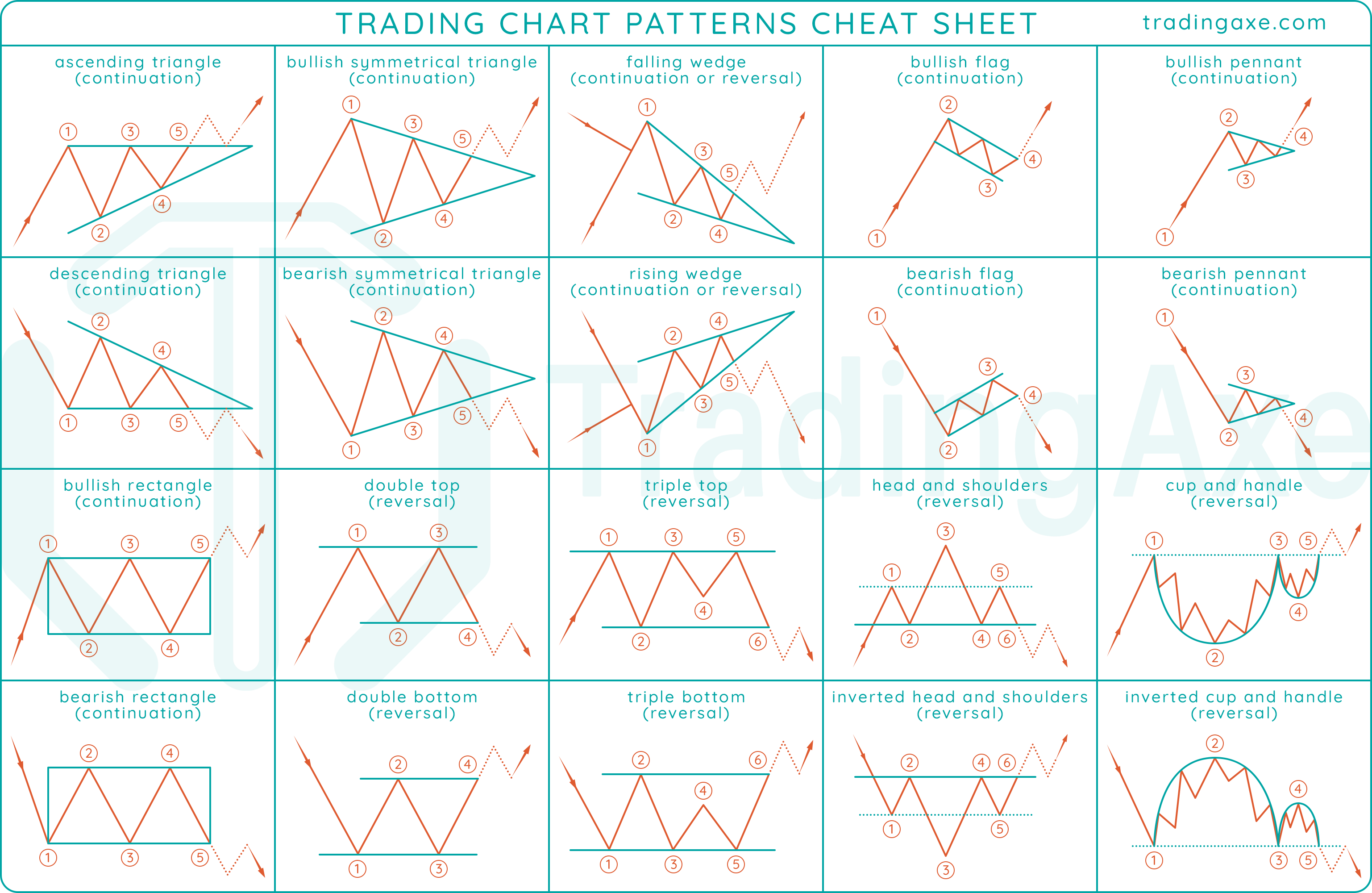

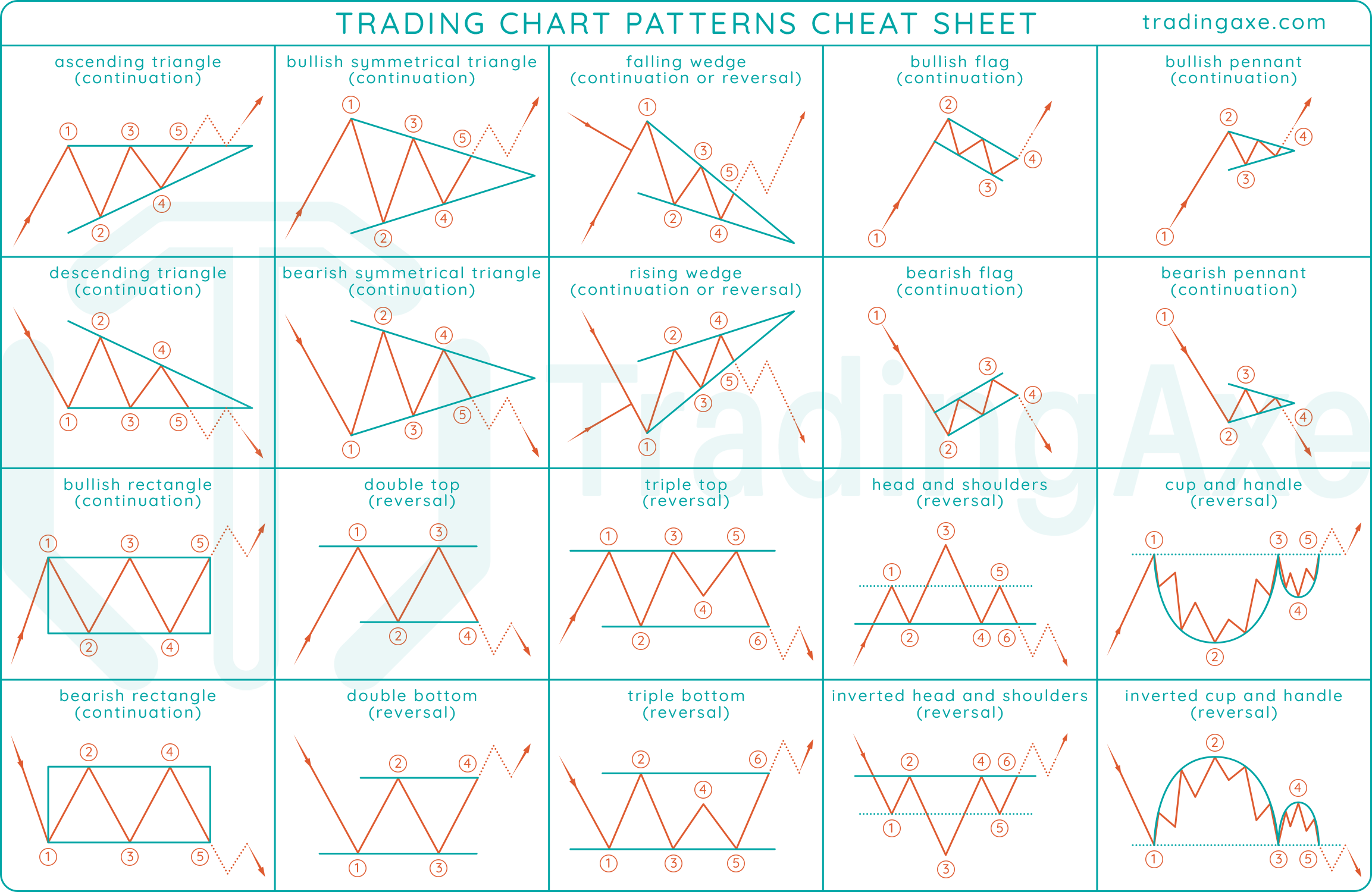

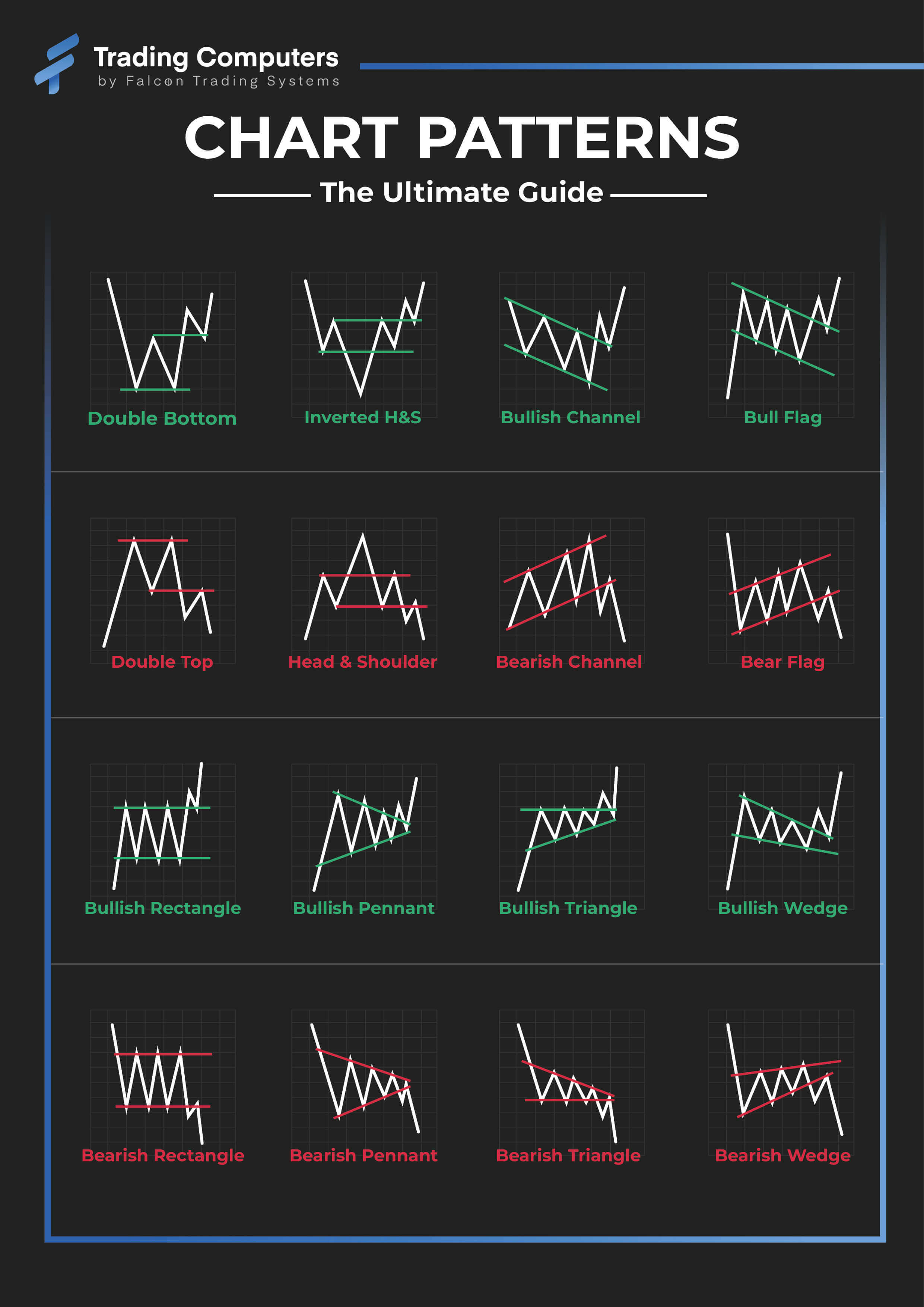

Chart patterns are visible representations of worth motion on a chart, providing helpful insights into potential future worth actions. Whereas not foolproof predictors, mastering the popularity and interpretation of those patterns can considerably improve your buying and selling methods and enhance your probabilities of success. This complete cheat sheet covers a number of the commonest and dependable chart patterns, offering you with the data to confidently navigate the complexities of the market.

I. Understanding Chart Patterns: Key Rules

Earlier than delving into particular patterns, it is essential to know the basic rules behind their formation and interpretation. Chart patterns are shaped by the interaction of provide and demand, reflecting the collective habits of market members. They symbolize short-term pauses within the prevailing development, providing merchants alternatives to enter positions with a better chance of success.

A number of elements affect the accuracy and reliability of chart patterns:

- Quantity: Confirming a sample’s validity typically requires observing corresponding quantity modifications. Increased quantity in the course of the formation of a sample and a breakout typically strengthens the sign. Low quantity breakouts are sometimes weaker and fewer dependable.

- Timeframe: The timeframe chosen considerably impacts the sample’s significance. A sample that is vital on a day by day chart is likely to be insignificant on a 5-minute chart. Think about the sample’s context inside the bigger timeframe.

- Help and Resistance: Patterns typically type round key help and resistance ranges. Breakouts above resistance or under help are essential affirmation alerts.

- Development: The sample’s relationship to the prevailing development is important. A bullish sample in an uptrend is extra dependable than a bullish sample in a downtrend.

II. Bullish Chart Patterns (Anticipating Value Enhance)

These patterns recommend an upward worth motion is prone to observe.

1. Head and Shoulders Backside: This basic reversal sample alerts a possible shift from a downtrend to an uptrend. It is characterised by three troughs (the "head" and two "shoulders") with two peaks connecting them. A breakout above the neckline (a trendline connecting the peaks) confirms the sample and alerts a possible upward worth motion. Quantity affirmation is essential; greater quantity in the course of the breakout strengthens the sign.

2. Inverse Head and Shoulders: That is the mirror picture of the Head and Shoulders Backside, signaling a possible reversal from an uptrend to a downtrend. A breakout under the neckline confirms the sample.

3. Double Backside: This sample options two consecutive lows at roughly the identical worth degree, adopted by a better excessive. A breakout above the neckline (the excessive level connecting the 2 lows) alerts a possible bullish reversal.

4. Triple Backside: Much like a double backside, however with three consecutive lows at roughly the identical worth degree. The breakout above the neckline confirms the sample.

5. Cup and Deal with: This bullish continuation sample resembles a cup with a deal with. The "cup" is a rounded backside, and the "deal with" is a brief, downward consolidation. A breakout above the deal with’s resistance degree confirms the sample and signifies continued upward worth motion.

6. Ascending Triangle: This sample is characterised by a rising trendline connecting greater lows and a horizontal resistance line. The breakout above the resistance line confirms the sample.

7. Bullish Flag: This continuation sample incorporates a temporary interval of consolidation (the "flag") inside a longtime uptrend, adopted by a breakout above the flag’s resistance.

III. Bearish Chart Patterns (Anticipating Value Lower)

These patterns recommend a downward worth motion is prone to observe.

1. Head and Shoulders Prime: The mirror picture of the Head and Shoulders Backside, this sample alerts a possible reversal from an uptrend to a downtrend. A breakout under the neckline confirms the sample.

2. Inverse Head and Shoulders Prime: That is the mirror picture of the Inverse Head and Shoulders Backside, signaling a possible reversal from a downtrend to an uptrend. A breakout above the neckline confirms the sample.

3. Double Prime: This sample options two consecutive highs at roughly the identical worth degree, adopted by a decrease low. A breakout under the neckline (the low level connecting the 2 highs) alerts a possible bearish reversal.

4. Triple Prime: Much like a double high, however with three consecutive highs at roughly the identical worth degree. The breakout under the neckline confirms the sample.

5. Cup and Deal with (Bearish): Whereas sometimes bullish, a cup and deal with may seem in a downtrend. The "cup" is an inverted rounded backside, and the "deal with" is a brief, upward consolidation. A breakout under the deal with’s help degree confirms the sample.

6. Descending Triangle: This sample is characterised by a falling trendline connecting decrease highs and a horizontal help line. The breakout under the help line confirms the sample.

7. Bearish Flag: This continuation sample incorporates a temporary interval of consolidation (the "flag") inside a longtime downtrend, adopted by a breakout under the flag’s help.

IV. Impartial Chart Patterns (Anticipating Consolidation or Sideways Motion)

These patterns do not essentially predict a selected directional motion however fairly point out a interval of consolidation or sideways worth motion.

1. Symmetrical Triangle: This sample is characterised by converging trendlines, with greater lows and decrease highs. The breakout will be both bullish or bearish, relying on which trendline is damaged first.

2. Rectangle: This sample options horizontal help and resistance ranges, with worth motion consolidating between them. Breakouts above the resistance or under the help point out a possible directional transfer.

V. Utilizing Chart Patterns Successfully: Ideas and Issues

- Mix with different indicators: Do not rely solely on chart patterns. Mix them with different technical indicators (like shifting averages, RSI, MACD) and elementary evaluation for higher affirmation and danger administration.

- Establish clear breakouts: Search for decisive breakouts past the sample’s boundaries, accompanied by elevated quantity. Weak breakouts are sometimes false alerts.

- Handle danger: Use stop-loss orders to restrict potential losses. Place your stop-loss order exterior the sample’s boundaries to guard towards false breakouts.

- Observe and Persistence: Mastering chart sample recognition takes time and apply. Do not count on to change into an skilled in a single day. Be affected person and be taught out of your experiences.

- Context is Key: At all times take into account the broader market context, financial information, and company-specific elements when deciphering chart patterns. A sample that is likely to be vital in a bull market is likely to be much less vital in a bear market.

VI. Conclusion:

Chart patterns are a robust software for technical merchants, offering helpful insights into potential market actions. By understanding the formation, interpretation, and limitations of those patterns, you’ll be able to considerably enhance your buying and selling selections and improve your probabilities of success. Do not forget that constant apply, danger administration, and a holistic method combining chart patterns with different indicators are important for worthwhile buying and selling. This cheat sheet serves as a place to begin; steady studying and adaptation are essential for navigating the ever-evolving world of economic markets. At all times conduct thorough analysis and take into account searching for skilled recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into The Final Chart Patterns Cheat Sheet: Decoding Market Actions for Worthwhile Buying and selling. We admire your consideration to our article. See you in our subsequent article!