The Final Inventory Market Chart Patterns Cheat Sheet: Decoding Worth Motion for Revenue

Associated Articles: The Final Inventory Market Chart Patterns Cheat Sheet: Decoding Worth Motion for Revenue

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to The Final Inventory Market Chart Patterns Cheat Sheet: Decoding Worth Motion for Revenue. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

The Final Inventory Market Chart Patterns Cheat Sheet: Decoding Worth Motion for Revenue

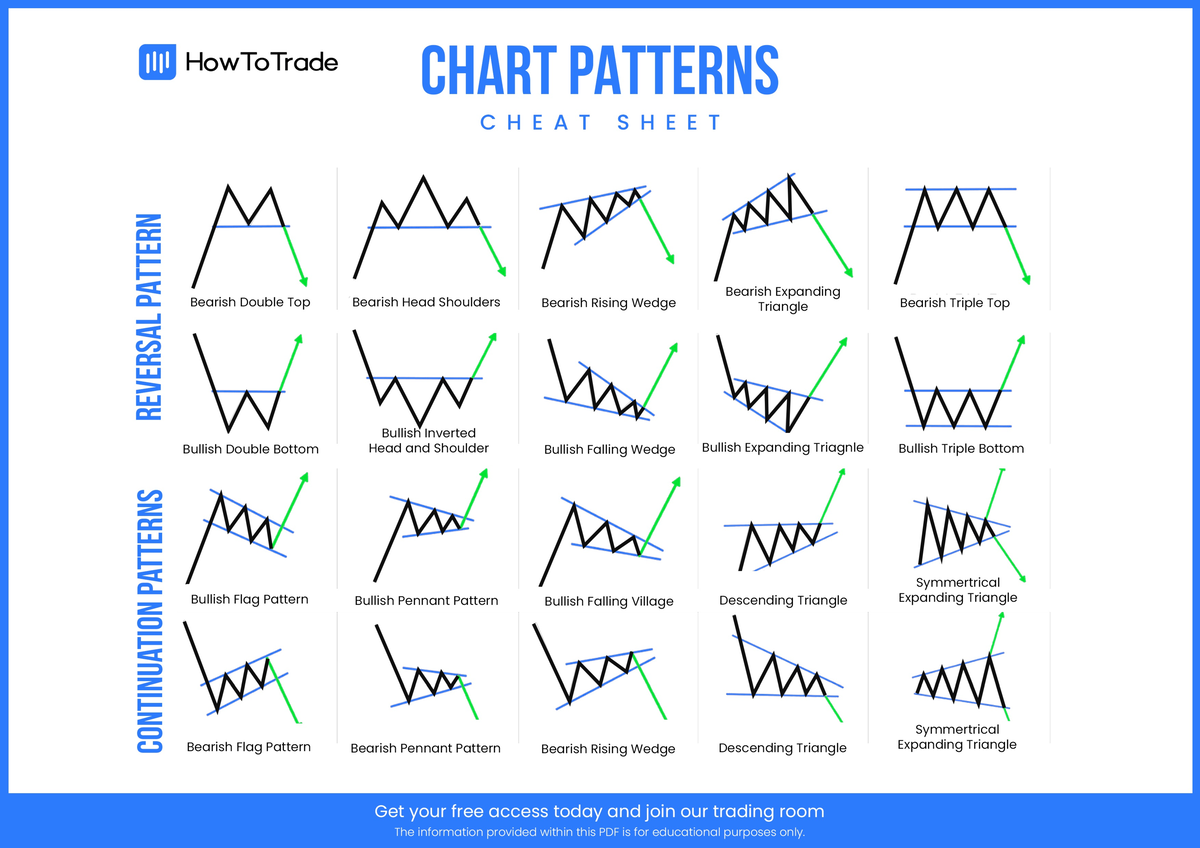

The inventory market, a posh ecosystem of fluctuating costs and unpredictable occasions, can appear formidable to navigate. Nevertheless, beneath the floor chaos lies a predictable rhythm, usually mirrored in recurring value patterns on charts. Understanding these chart patterns can considerably improve your buying and selling technique, offering precious insights into potential value actions. This complete cheat sheet will delve into a number of the most typical and dependable chart patterns, equipping you with the information to interpret value motion and make knowledgeable buying and selling choices.

I. Understanding Chart Patterns: The Fundamentals

Earlier than diving into particular patterns, it is essential to ascertain a foundational understanding. Chart patterns are visible representations of how value and quantity work together over time. They’re shaped by connecting a collection of value highs and lows, revealing potential shifts in momentum and investor sentiment. Whereas no sample ensures future value motion, recognizing these patterns can enhance the chance of profitable trades by figuring out potential assist and resistance ranges, entry and exit factors, and the potential magnitude of value modifications.

Key components to contemplate when analyzing chart patterns embody:

- Help and Resistance Ranges: These are value ranges the place shopping for (assist) or promoting (resistance) strain is powerful sufficient to quickly halt value motion. Breakouts above resistance or beneath assist usually sign vital value modifications.

- Quantity: The amount of shares traded accompanies value actions. Excessive quantity confirms value motion, suggesting stronger conviction behind the transfer. Low quantity suggests weaker conviction and potential for reversal.

- Development: Chart patterns are sometimes categorized as bullish (uptrend), bearish (downtrend), or impartial. Understanding the prevailing development is essential for deciphering sample significance.

- Timeframe: The timeframe of the chart (e.g., day by day, weekly, month-to-month) influences the sample’s significance and potential impression. A sample on a day by day chart would possibly symbolize a short-term buying and selling alternative, whereas a sample on a month-to-month chart may sign a longer-term development.

II. Bullish Chart Patterns (Suggesting Worth Improve)

These patterns sign potential upward value actions. They’re characterised by a interval of consolidation adopted by a breakout to the upside.

-

Head and Shoulders Backside: This traditional reversal sample is shaped by three distinct lows: a decrease low (the "head") flanked by two larger lows (the "shoulders"). A breakout above the neckline (a trendline connecting the 2 shoulders) confirms the sample and alerts a possible bullish development. The goal value is commonly estimated by measuring the space from the top to the neckline and projecting it upwards from the breakout level.

-

Double Backside: This sample consists of two consecutive lows at roughly the identical value stage, adopted by a major upward value motion. A breakout above the neckline (the road connecting the 2 lows) signifies a bullish reversal. The goal value is commonly estimated by measuring the space from the neckline to the low and projecting it upwards from the breakout level.

-

Inverse Head and Shoulders: The mirror picture of the Head and Shoulders Backside, this sample is bullish and characterised by three distinct peaks: a decrease peak (the "head") flanked by two larger peaks (the "shoulders"). A breakout above the neckline alerts a possible upward development. The goal value is calculated equally to the Head and Shoulders Backside.

-

Cup and Deal with: This sample resembles a cup with a deal with. The cup represents a interval of consolidation, adopted by a gradual upward development forming the deal with. A breakout above the deal with’s resistance stage alerts a bullish continuation.

-

Bullish Flag: This sample consists of a pointy upward transfer adopted by a interval of consolidation inside a descending channel (the flag). A breakout above the flag’s resistance stage suggests a continuation of the uptrend.

-

Bullish Pennant: Much like a bullish flag, however the consolidation interval types a symmetrical triangle. A breakout above the pennant’s resistance stage alerts a continuation of the uptrend.

III. Bearish Chart Patterns (Suggesting Worth Lower)

These patterns point out potential downward value actions. They’re usually characterised by a interval of consolidation adopted by a breakout to the draw back.

-

Head and Shoulders High: That is the bearish counterpart to the Head and Shoulders Backside. It consists of three distinct highs: the next excessive (the "head") flanked by two decrease highs (the "shoulders"). A breakout beneath the neckline alerts a possible bearish development. The goal value is estimated by measuring the space from the top to the neckline and projecting it downwards from the breakout level.

-

Double High: Much like the Double Backside however in a bearish context. Two consecutive highs at roughly the identical value stage are adopted by a major downward value motion. A breakout beneath the neckline (the road connecting the 2 highs) signifies a bearish reversal. The goal value is estimated by measuring the space from the neckline to the excessive and projecting it downwards from the breakout level.

-

Triple High: Much like a double prime however with three consecutive highs at roughly the identical value stage, indicating stronger bearish strain.

-

Bearish Flag: This sample mirrors the bullish flag, however the consolidation happens inside an ascending channel. A breakout beneath the flag’s assist stage suggests a continuation of the downtrend.

-

Bearish Pennant: Much like a bearish flag, however the consolidation interval types a symmetrical triangle. A breakout beneath the pennant’s assist stage alerts a continuation of the downtrend.

-

Rounding High: This sample signifies a gradual reversal of an uptrend. The value types a rounded form earlier than declining.

IV. Impartial Chart Patterns (Suggesting Consolidation or Sideways Motion)

These patterns recommend a interval of indecision available in the market, with neither a transparent bullish nor bearish bias.

-

Triangles: These patterns are characterised by converging trendlines, forming a triangle form. There are three primary varieties: symmetrical triangles (neither bullish nor bearish), ascending triangles (bullish), and descending triangles (bearish). Breakouts above or beneath the triangle’s boundaries point out the path of the following value motion.

-

Rectangles: These patterns present a interval of consolidation inside a horizontal vary, bounded by assist and resistance ranges. Breakouts above or beneath the rectangle’s boundaries sign the path of the following value motion.

-

Wedges: Wedges are characterised by converging trendlines, much like triangles. Ascending wedges are typically bearish, whereas descending wedges are typically bullish.

V. Necessary Issues and Limitations

Whereas chart patterns might be precious instruments, it is essential to recollect their limitations:

- Affirmation is Key: All the time affirm sample breakouts with elevated quantity. A breakout on low quantity may be a false sign.

- Context Issues: Take into account the broader market context, financial indicators, and company-specific information when deciphering patterns.

- Not a Assure: No chart sample ensures future value motion. Use them as probabilistic instruments, not absolute predictors.

- Subjectivity: Figuring out chart patterns might be subjective. Totally different merchants would possibly interpret the identical value motion in another way.

- False Breakouts: Costs can typically break by assist or resistance ranges solely to reverse path shortly after. All the time use stop-loss orders to handle danger.

VI. Conclusion: Mastering Chart Patterns for Profitable Buying and selling

This cheat sheet offers a complete overview of widespread inventory market chart patterns. By diligently finding out these patterns and practising their identification, you’ll be able to considerably enhance your potential to interpret value motion and make extra knowledgeable buying and selling choices. Do not forget that mastering chart sample evaluation requires constant apply, endurance, and a willingness to study from each successes and failures. Mix your chart sample evaluation with basic evaluation and danger administration methods for a well-rounded and profitable buying and selling method. All the time do not forget that buying and selling entails danger, and no technique ensures income. Thorough analysis and disciplined danger administration are essential for long-term success within the inventory market.

Closure

Thus, we hope this text has offered precious insights into The Final Inventory Market Chart Patterns Cheat Sheet: Decoding Worth Motion for Revenue. We hope you discover this text informative and helpful. See you in our subsequent article!