Buying and selling Choices on Sierra Chart: A Complete Information

Associated Articles: Buying and selling Choices on Sierra Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Buying and selling Choices on Sierra Chart: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Buying and selling Choices on Sierra Chart: A Complete Information

Sierra Chart, a well-liked and highly effective buying and selling platform, presents strong choices buying and selling capabilities, catering to each novice and skilled merchants. Whereas not as visually intuitive as some platforms particularly designed for choices, Sierra Chart’s flexibility and customizability make it a compelling selection for many who worth management and superior analytical instruments. This text delves into the intricacies of choices buying and selling inside Sierra Chart, masking the whole lot from setup and order entry to superior methods and threat administration.

I. Organising Sierra Chart for Choices Buying and selling:

Earlier than you can begin buying and selling choices on Sierra Chart, it is advisable guarantee your dealer helps it and that your Sierra Chart platform is appropriately configured. This includes a number of key steps:

-

Brokerage Account Compatibility: Not all brokers combine seamlessly with Sierra Chart. You have to select a dealer that explicitly helps choices buying and selling and presents a Sierra Chart connection. Verify this immediately along with your dealer earlier than continuing. Many fashionable brokers provide this integration, but it surely’s essential to confirm compatibility earlier than investing time in setup.

-

Downloading and Putting in the Mandatory Knowledge: Sierra Chart requires real-time market knowledge for choices buying and selling. Your dealer will normally present this as a part of your subscription. Make sure you’ve downloaded and configured the right knowledge feeds for the choices contracts you propose to commerce. Incorrect or incomplete knowledge can result in inaccurate calculations and doubtlessly expensive errors.

-

Including Choices Symbols: As soon as the information is put in, it is advisable add the precise choices symbols you want to commerce to your Sierra Chart watchlist. That is normally accomplished by means of an emblem search operate inside the platform. You may must specify the underlying asset, expiration date, and strike worth to find the right choices contracts.

-

Configuring Chart Settings: Sierra Chart permits for intensive chart customization. For choices buying and selling, you would possibly wish to deal with particular indicators and research related to choices pricing, resembling implied volatility, Greeks (Delta, Gamma, Theta, Vega), and choice pricing fashions. Experiment with totally different chart sorts (candlestick, bar, line) to search out what most accurately fits your buying and selling model.

-

Understanding Order Sorts: Sierra Chart helps varied order sorts important for choices buying and selling, together with market orders, restrict orders, cease orders, stop-limit orders, and extra refined order sorts like bracket orders (mechanically setting a revenue goal and stop-loss) and OCO (One Cancels Different) orders. Mastering these order sorts is vital for efficient threat administration.

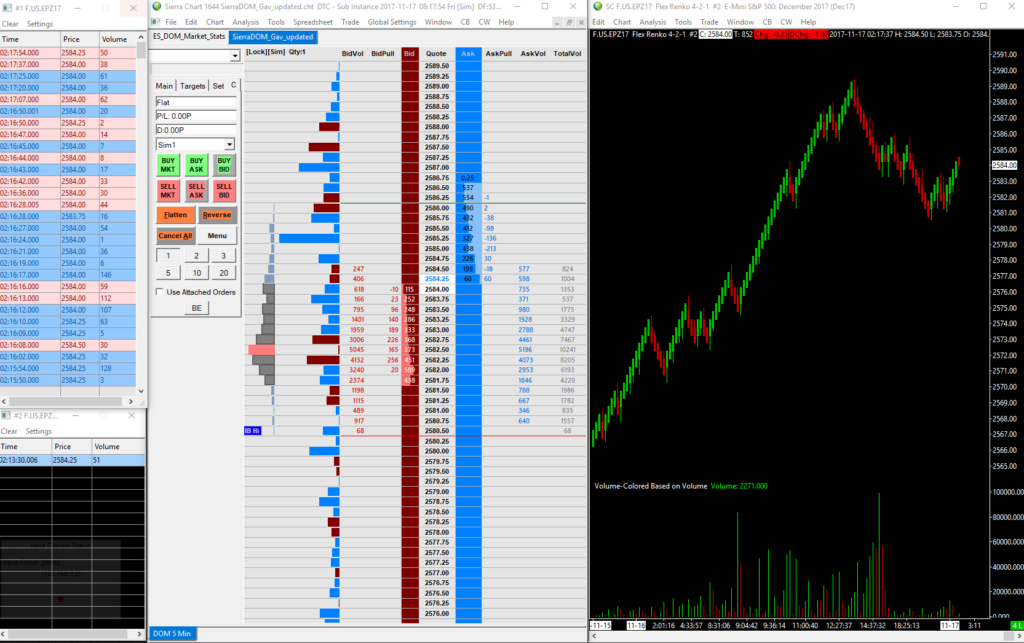

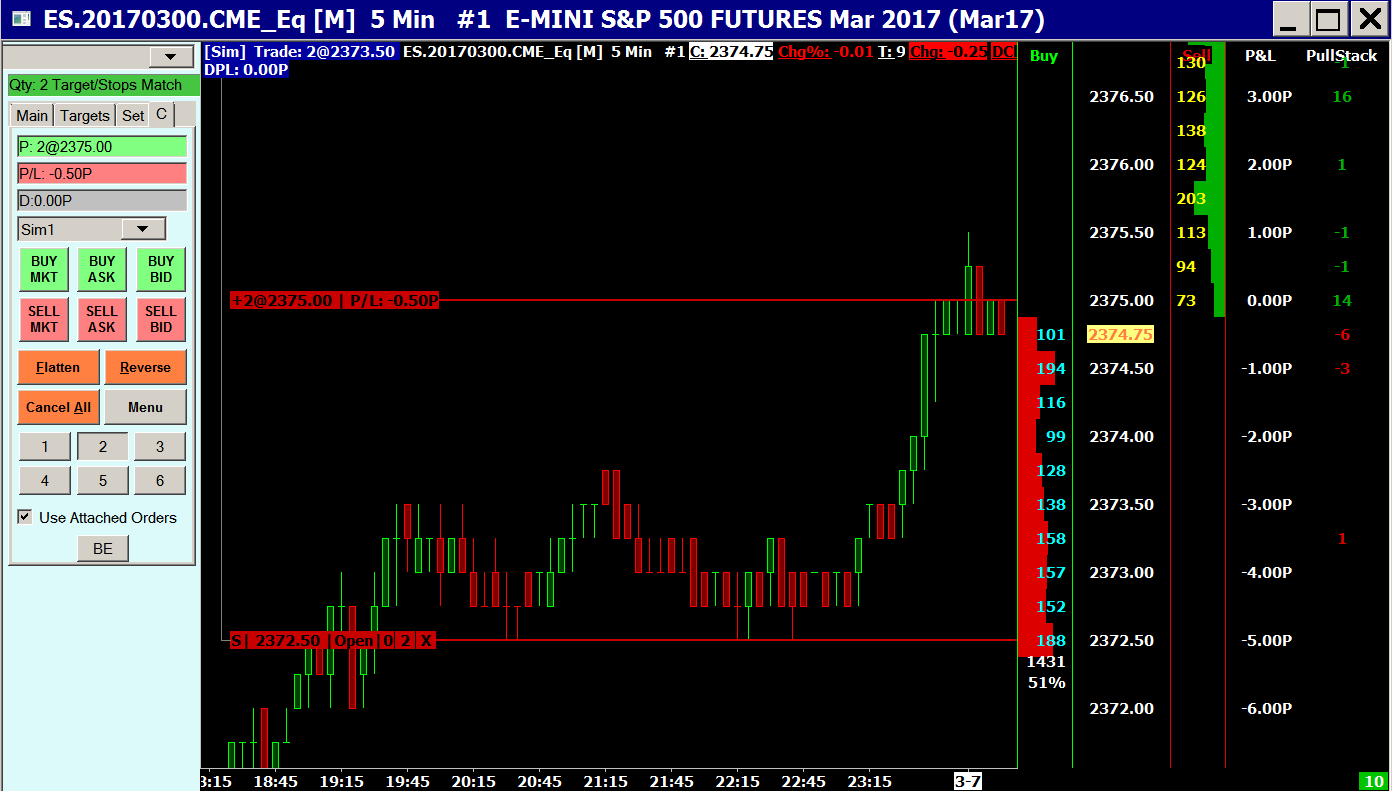

II. Putting and Managing Choices Orders:

As soon as your Sierra Chart is configured, inserting orders is comparatively easy. The method includes:

-

Deciding on the Contract: Select the precise choices contract (underlying asset, expiration date, strike worth, name/put) out of your watchlist.

-

Selecting the Order Kind: Choose the suitable order sort based mostly in your buying and selling technique and threat tolerance.

-

Coming into Order Particulars: Specify the amount (variety of contracts), worth (for restrict orders), and cease worth (for cease orders).

-

Submitting the Order: Evaluate all order particulars fastidiously earlier than submitting. Sierra Chart gives clear affirmation earlier than order execution.

Managing present orders includes monitoring their standing, doubtlessly modifying them (e.g., adjusting the value or cease worth), or canceling them if essential. Sierra Chart presents instruments to simply monitor open positions and handle your total threat publicity.

III. Superior Choices Methods in Sierra Chart:

Sierra Chart’s flexibility extends to implementing complicated choices methods. Whereas the platform would not explicitly label methods, its customization permits for constructing any technique by means of order placement and indicator utilization:

-

Lined Calls: Promoting name choices on an underlying asset you already personal. This generates earnings however limits potential upside.

-

Money-Secured Places: Promoting put choices whereas having sufficient money to purchase the underlying if the choice is exercised. This lets you purchase the underlying at a reduced worth.

-

Spreads (Vertical, Horizontal, Diagonal): Involving concurrently shopping for and promoting choices contracts with totally different strike costs or expiration dates. These methods provide varied threat/reward profiles and can be utilized for hedging or hypothesis. Sierra Chart’s means to position a number of orders concurrently simplifies unfold execution.

-

Straddles and Strangles: Shopping for each a name and a put choice with the identical expiration date (straddle) or totally different strike costs (strangle). These methods revenue from important worth actions in both path.

-

Iron Condors and Iron Butterflies: Extra complicated, defined-risk methods that revenue from restricted worth actions. These require exact order administration, which Sierra Chart facilitates.

To implement these methods successfully, you may must leverage Sierra Chart’s charting capabilities, indicators (like implied volatility and Greeks), and customized research to investigate market situations and handle threat.

IV. Threat Administration in Sierra Chart Choices Buying and selling:

Choices buying and selling carries inherent dangers. Efficient threat administration is essential:

-

Place Sizing: Decide the suitable variety of contracts to commerce based mostly in your account measurement and threat tolerance. By no means threat greater than you may afford to lose.

-

Cease-Loss Orders: Use stop-loss orders to restrict potential losses on particular person trades. Sierra Chart’s order administration instruments make this simple.

-

Monitoring Greeks: Pay shut consideration to the Greeks (Delta, Gamma, Theta, Vega) to know the sensitivity of your choices positions to modifications in underlying worth, volatility, and time decay. Sierra Chart permits for real-time monitoring of those values.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your choices positions throughout totally different underlying property and techniques to scale back total threat.

-

Backtesting: Earlier than implementing any complicated technique, backtest it utilizing historic knowledge inside Sierra Chart or by means of exterior instruments to evaluate its potential profitability and threat profile.

V. Benefits and Disadvantages of Utilizing Sierra Chart for Choices Buying and selling:

Benefits:

- Customization: Sierra Chart’s extremely customizable nature means that you can tailor the platform to your particular buying and selling model and desires.

- Superior Analytical Instruments: Entry to a variety of indicators, research, and charting instruments for in-depth market evaluation.

- Order Administration: Strong order administration capabilities, together with superior order sorts for stylish methods.

- Automation: Potential for automation by means of customized scripting and EasyLanguage programming.

- Price-Efficient: In comparison with some proprietary platforms, Sierra Chart presents a aggressive pricing construction.

Disadvantages:

- Steep Studying Curve: The platform’s intensive options and customization choices will be overwhelming for learners.

- Much less Intuitive Interface: In comparison with user-friendly platforms particularly designed for choices, Sierra Chart’s interface could require extra time to grasp.

- Knowledge Prices: Actual-time market knowledge will be costly, particularly for intensive choices buying and selling.

VI. Conclusion:

Sierra Chart gives a strong and versatile atmosphere for choices buying and selling, but it surely calls for a dedication to studying its options and mastering its functionalities. Its energy lies in its customizability and analytical energy, making it a superb selection for skilled merchants who worth management and superior instruments. Nonetheless, learners needs to be ready for a steeper studying curve in comparison with extra user-friendly platforms. Cautious planning, threat administration, and a radical understanding of choices buying and selling rules are important for achievement, whatever the platform used. Keep in mind to at all times seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered worthwhile insights into Buying and selling Choices on Sierra Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!