Two A long time of Development: A Deep Dive into India’s GDP Chart (2004-2024)

Associated Articles: Two A long time of Development: A Deep Dive into India’s GDP Chart (2004-2024)

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Two A long time of Development: A Deep Dive into India’s GDP Chart (2004-2024). Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Two A long time of Development: A Deep Dive into India’s GDP Chart (2004-2024)

India’s financial journey over the previous 20 years has been nothing in need of transformative. Analyzing its Gross Home Product (GDP) chart from 2004 to 2024 reveals a fancy narrative of spectacular development punctuated by intervals of slowdown, exterior shocks, and coverage shifts. This text delves into this information, exploring the important thing developments, drivers, and challenges which have formed India’s financial trajectory throughout this era. Whereas exact information for 2024 should be preliminary on the time of writing, we’ll make the most of out there projections and information to color a complete image.

The Rise of the "India Development Story": 2004-2012

The interval between 2004 and 2012 witnessed a major surge in India’s GDP development, sometimes called the "India Development Story." This period was characterised by a number of components:

- World Financial Increase: The early 2000s noticed a world financial upswing, offering a positive exterior setting for India’s export-oriented industries. Elevated demand for Indian items and providers contributed considerably to GDP enlargement.

- Providers Sector Dominance: The providers sector, encompassing IT, telecommunications, and monetary providers, skilled phenomenal development. This sector turned the spine of the Indian financial system, driving job creation and attracting international funding.

- Agricultural Reforms: Whereas nonetheless a major a part of the financial system, agriculture’s contribution to GDP development started to say no. Nevertheless, reforms aimed toward enhancing productiveness and market entry for farmers yielded optimistic, albeit slower, outcomes.

- Infrastructure Improvement: Important investments in infrastructure, notably in transportation and communication networks, improved connectivity and facilitated financial exercise. This era noticed the enlargement of highways, telecom networks, and energy era capability.

- Coverage Reforms: Initiatives aimed toward liberalization and deregulation fostered a extra aggressive enterprise setting, attracting each home and international funding. Whereas not all the time seamless, these reforms laid the groundwork for sustained development.

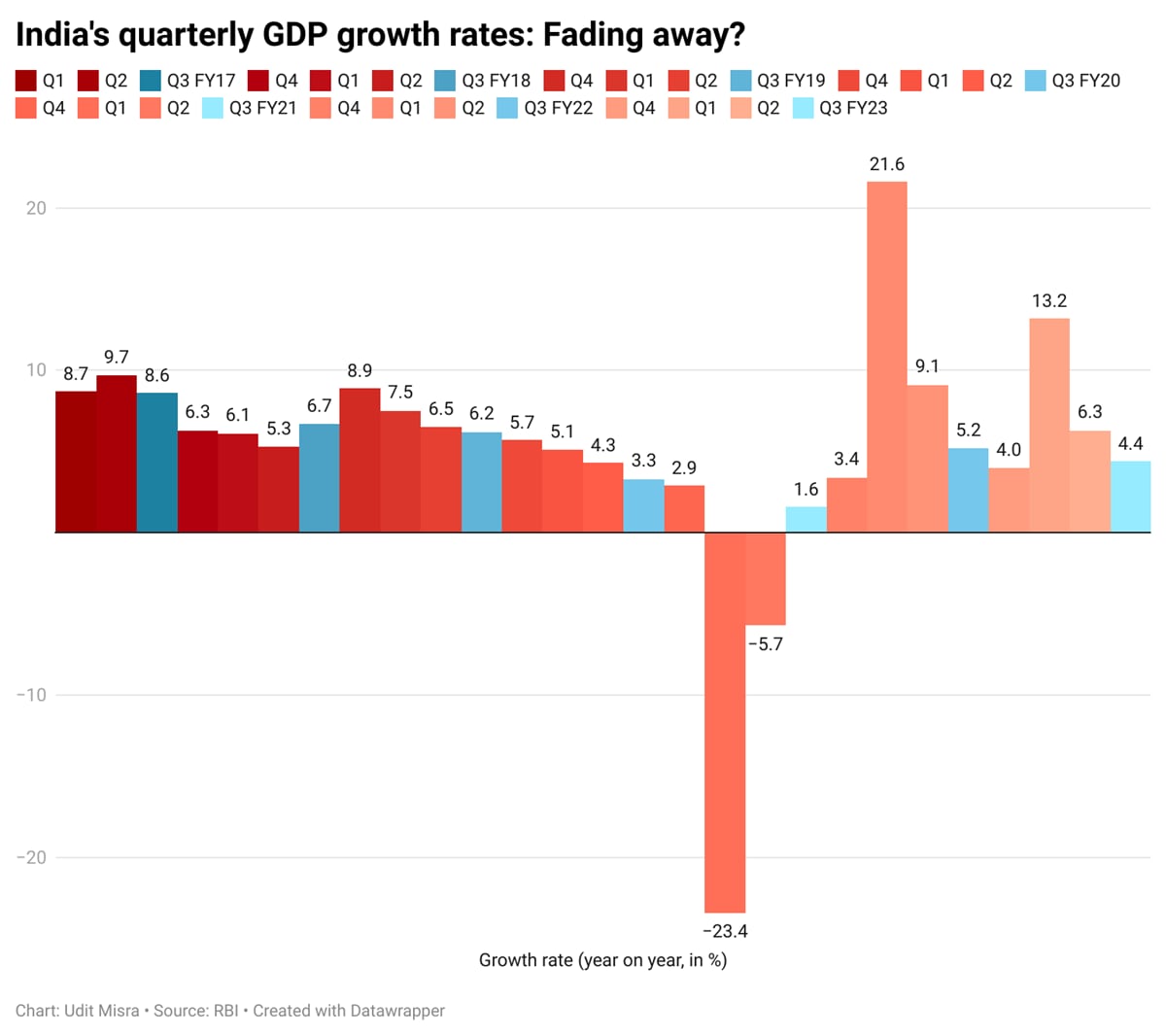

The GDP chart for this era would present a constantly upward trajectory, with development charges usually exceeding 7% yearly. Nevertheless, the worldwide monetary disaster of 2008 brought about a brief dip, highlighting the vulnerability of the Indian financial system to exterior shocks. Regardless of this setback, the restoration was comparatively swift, demonstrating a level of resilience.

Navigating Challenges: 2012-2017

The interval from 2012 to 2017 offered a special image. Whereas development continued, it was considerably slower than the previous decade. A number of components contributed to this deceleration:

- World Financial Slowdown: The lingering results of the 2008 monetary disaster, coupled with slower development in main economies, impacted India’s export efficiency.

- Coverage Paralysis: Issues about coverage uncertainty and bureaucratic hurdles hampered funding and enterprise confidence. This era noticed debates over essential financial reforms, resulting in delays in implementation.

- Inflationary Pressures: Rising inflation eroded buying energy and dampened client spending, impacting general financial exercise. Managing inflation turned a serious problem for the federal government.

- Structural Bottlenecks: Persistent infrastructure gaps, notably in energy and logistics, continued to constrain development. These bottlenecks hindered the environment friendly functioning of companies and hampered productiveness.

The GDP chart for this era would present a much less steep incline, with development charges fluctuating round 5-7%, reflecting the challenges confronted throughout this time. This era underscores the significance of constant coverage implementation and addressing structural bottlenecks for sustained financial development.

Demonetization and GST: A Interval of Transition (2016-2018)

The years 2016 and 2017 witnessed two vital coverage interventions: demonetization and the implementation of the Items and Providers Tax (GST). Whereas aimed toward curbing black cash and streamlining the tax system, respectively, these measures had short-term detrimental impacts on GDP development. The chart would present a brief dip reflecting the disruption attributable to these reforms. Nevertheless, the long-term results are nonetheless being debated and analyzed, with some arguing that these reforms laid the muse for a extra formal and environment friendly financial system.

Renewed Development and the "New India" Narrative (2018-2024)

From 2018 onwards, India’s GDP development began to get better, fueled by a number of components:

- Concentrate on Ease of Doing Enterprise: The federal government carried out numerous reforms to enhance the benefit of doing enterprise, attracting each home and international funding.

- Infrastructure Push: Renewed emphasis on infrastructure growth, together with initiatives just like the Bharatmala venture (highway development) and the Digital India program, boosted financial exercise.

- Fiscal Stimulus: Authorities spending on infrastructure and social welfare packages supplied a fiscal stimulus to the financial system.

- Rising Home Consumption: Growing disposable incomes and a rising center class fueled home consumption, changing into a serious driver of GDP development.

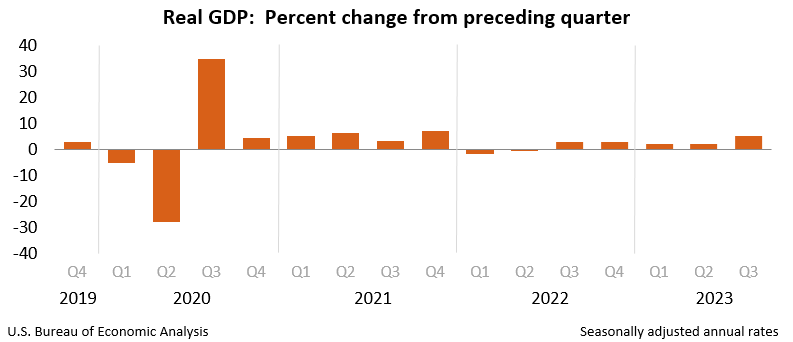

The COVID-19 pandemic in 2020 brought about a major contraction in GDP, representing a pointy downturn on the chart. Nevertheless, the next restoration has been comparatively strong, pushed by a mix of presidency stimulus measures and a resilient providers sector. The GDP chart for this era would present a restoration from the pandemic-induced stoop, with development charges regularly rising, although doubtlessly fluctuating resulting from international uncertainties and home challenges. Projections for 2024 recommend continued, although probably moderated, development.

Challenges and Future Outlook

Regardless of the spectacular development story, a number of challenges stay:

- Job Creation: Whereas the financial system has grown, translating this development into enough job creation stays a serious problem. Addressing unemployment, notably amongst youth, is essential for sustained financial progress.

- Earnings Inequality: The advantages of financial development haven’t been evenly distributed, resulting in widening earnings inequality. Insurance policies aimed toward inclusive development are important to deal with this subject.

- Local weather Change: India’s vulnerability to local weather change poses a major risk to its financial development. Investing in local weather resilience and selling sustainable growth are vital for long-term prosperity.

- World Financial Uncertainty: The worldwide financial panorama stays unsure, with potential dangers from geopolitical tensions, inflation, and provide chain disruptions. India’s means to navigate these exterior shocks might be essential for sustaining its development trajectory.

Conclusion

The GDP chart of India over the previous 20 years tells a narrative of outstanding progress, punctuated by intervals of each speedy development and challenges. Whereas the "India Development Story" has skilled fluctuations, the underlying potential stays immense. Addressing the remaining challenges – creating enough jobs, selling inclusive development, tackling local weather change, and navigating international uncertainties – might be essential for guaranteeing that India continues on its path in the direction of sustained and equitable financial growth within the coming a long time. Additional evaluation, incorporating detailed sectoral information and qualitative components, will present a extra nuanced understanding of this complicated and dynamic financial system. The subsequent 20 years might be vital in figuring out whether or not India can absolutely understand its financial potential and solidify its place as a world financial powerhouse.

Closure

Thus, we hope this text has supplied priceless insights into Two A long time of Development: A Deep Dive into India’s GDP Chart (2004-2024). We hope you discover this text informative and helpful. See you in our subsequent article!