Understanding Share Market Chart Patterns: A Complete Information

Associated Articles: Understanding Share Market Chart Patterns: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Understanding Share Market Chart Patterns: A Complete Information. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Understanding Share Market Chart Patterns: A Complete Information

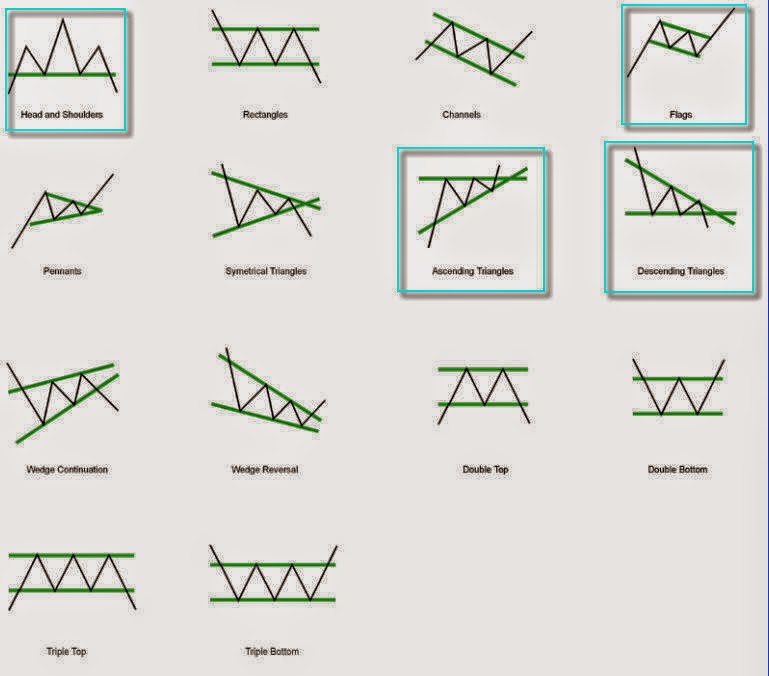

Chart patterns are visible representations of worth actions within the inventory market. They provide invaluable insights into potential future worth motion, serving to merchants and buyers make knowledgeable selections. Whereas not foolproof predictors, understanding and recognizing these patterns can considerably improve your buying and selling technique. This text will delve into varied widespread chart patterns, explaining their traits, implications, and the right way to use them successfully. We are going to cowl each bullish and bearish patterns, emphasizing the significance of context and danger administration.

I. Introduction to Chart Patterns:

Technical evaluation depends closely on chart patterns. These patterns emerge from the interaction of provide and demand, reflecting the collective sentiment of market individuals. By figuring out these patterns, merchants can anticipate potential breakouts, reversals, or continuations of current developments. Bear in mind, patterns are most dependable when thought of inside the broader market context and alongside different technical indicators.

II. Bullish Chart Patterns:

Bullish patterns recommend an upward development is more likely to resume or start. Some distinguished examples embody:

-

Head and Shoulders Backside: This sample resembles an inverted head and shoulders sample. It is characterised by a low level (the "head") flanked by two greater lows ("shoulders"). A breakout above the neckline (a trendline connecting the 2 shoulders) is a bullish sign, suggesting a possible worth improve. The goal worth is commonly estimated by measuring the gap between the top and the neckline and projecting it upwards from the breakout level.

-

Double Backside: This sample reveals two consecutive lows at roughly the identical worth degree, adopted by an increase. The breakout above the neckline (the road connecting the 2 lows) alerts a possible bullish reversal. The goal worth is calculated equally to the top and shoulders backside.

-

Triple Backside: Just like a double backside, however with three consecutive lows. It strengthens the bullish sign because it signifies stronger help.

-

Cup and Deal with: This sample resembles a cup with a small deal with. The "cup" is a rounded U-shaped formation, indicating a interval of consolidation. The "deal with" is a brief, downward correction. A breakout above the deal with’s resistance line is a bullish sign.

-

Ascending Triangle: This sample reveals a sequence of upper highs and persistently flat or barely rising lows. The value is predicted to interrupt out above the higher trendline, confirming the bullish development.

-

Bullish Flag: A brief pause in an uptrend, characterised by an oblong or pennant-shaped consolidation. The breakout above the flag’s higher trendline confirms the continuation of the uptrend.

III. Bearish Chart Patterns:

Bearish patterns recommend a downward development is more likely to resume or start. Key examples embody:

-

Head and Shoulders Prime: That is the inverse of the top and shoulders backside. It incorporates a excessive level ("head") between two decrease highs ("shoulders"). A breakdown under the neckline (connecting the 2 shoulders) alerts a possible bearish reversal. The goal worth is estimated by measuring the gap between the top and the neckline and projecting it downwards from the breakout level.

-

Double Prime: This sample reveals two consecutive highs at roughly the identical worth degree, adopted by a decline. A breakdown under the neckline (connecting the 2 highs) alerts a possible bearish reversal.

-

Triple Prime: Just like a double prime, however with three consecutive highs, strengthening the bearish sign.

-

Cup and Deal with (Inverted): Whereas much less widespread, an inverted cup and deal with sample can recommend a bearish reversal.

-

Descending Triangle: This sample reveals a sequence of decrease lows and persistently flat or barely falling highs. A breakdown under the decrease trendline confirms the bearish development.

-

Bearish Flag: A brief pause in a downtrend, much like the bullish flag however in a downward context. A breakdown under the flag’s decrease trendline confirms the continuation of the downtrend.

IV. Continuation Chart Patterns:

These patterns recommend the prevailing development (bullish or bearish) will proceed. Examples embody:

-

Rectangles: Characterised by horizontal help and resistance traces. Breakouts above the resistance line verify an uptrend, whereas breakouts under the help line verify a downtrend.

-

Triangles (Ascending, Descending, Symmetrical): Triangles signify durations of consolidation earlier than a continuation of the prevailing development. The route of the breakout determines whether or not the development is bullish or bearish.

-

Flags and Pennants: As mentioned earlier, these patterns point out momentary pauses inside a development.

V. Significance of Context and Affirmation:

It is essential to do not forget that chart patterns alone are usually not enough for making buying and selling selections. They need to be used along with different technical indicators (like transferring averages, RSI, MACD) and elementary evaluation. Think about the general market sentiment, financial circumstances, and information occasions earlier than relying solely on chart patterns. Affirmation from a number of indicators will increase the reliability of a sample’s sign.

VI. Threat Administration:

At all times use applicable danger administration strategies. By no means danger greater than you’ll be able to afford to lose. Make use of stop-loss orders to restrict potential losses if the commerce goes in opposition to you. Think about using place sizing to diversify your danger throughout a number of trades.

VII. Limitations of Chart Patterns:

Chart patterns are subjective; totally different merchants might interpret the identical sample in another way. Not all patterns will play out as anticipated. False breakouts are widespread, and it’s important to keep away from emotional buying and selling based mostly solely on sample recognition.

VIII. Conclusion:

Understanding and making use of chart patterns is usually a invaluable instrument for merchants and buyers. Nevertheless, it is essential to method them with warning and use them along with different types of evaluation. By combining chart sample recognition with sound danger administration and a complete buying and selling technique, you’ll be able to considerably enhance your possibilities of success within the share market. Keep in mind that steady studying and adaptation are key to navigating the ever-evolving world of economic markets. Additional analysis and observe are important to mastering the artwork of chart sample evaluation. Think about exploring sources like books, on-line programs, and buying and selling platforms that supply in-depth tutorials and interactive instruments to boost your understanding and ability on this space. Constant observe and a disciplined method are essential to reaching proficiency in using chart patterns for profitable buying and selling.

Closure

Thus, we hope this text has offered invaluable insights into Understanding Share Market Chart Patterns: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!